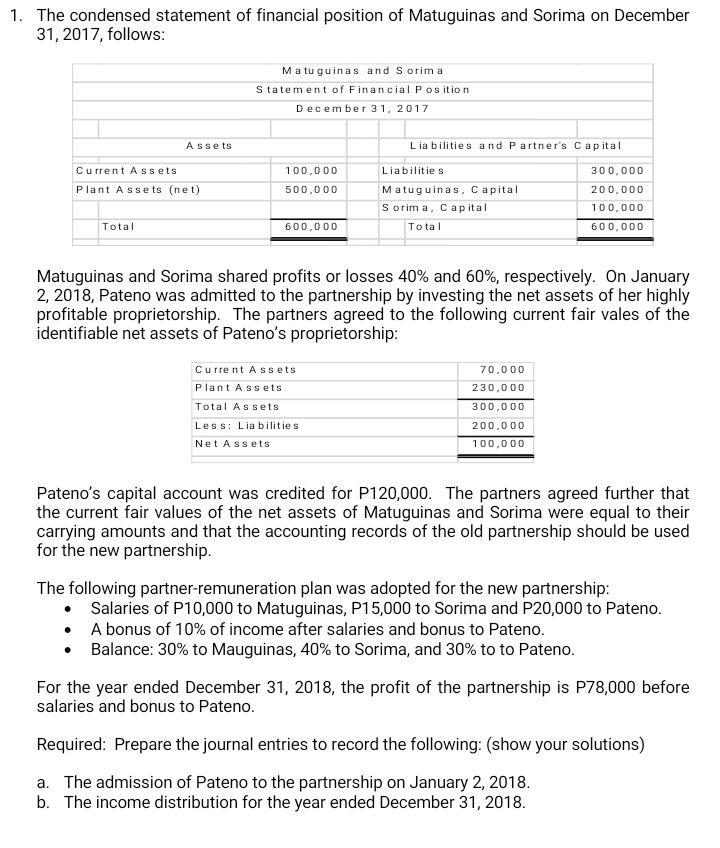

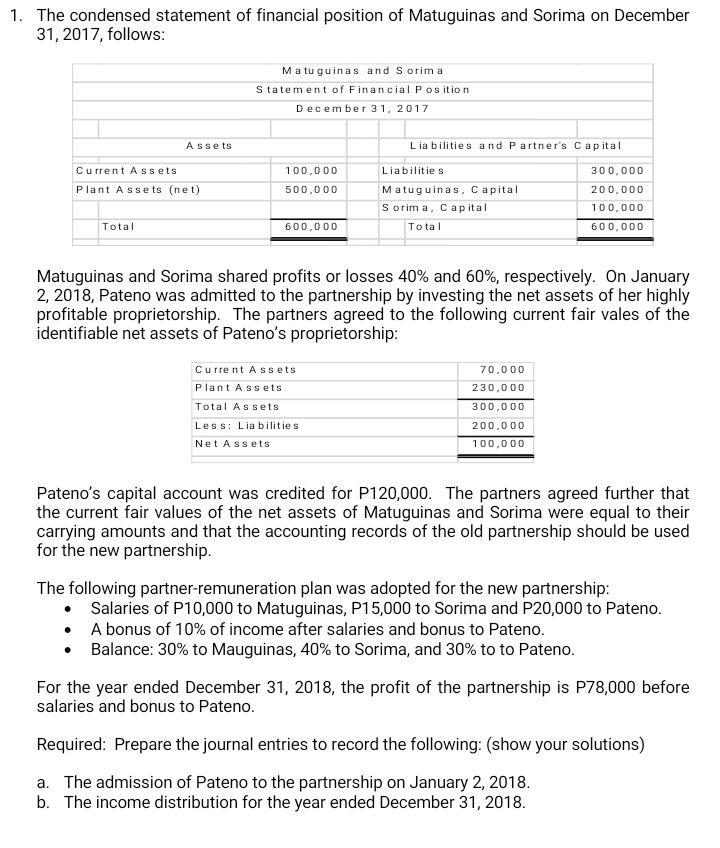

1. The condensed statement of financial position of Matuguinas and Sorima on December 31, 2017, follows: Matu guinas and Sorim a Statement of Financial Position December 31, 2017 Assets Liabilities and Partner's Capital Current Assets 100,000 Liabilities 300,000 Plant Assets (net) 500,000 Matuguinas, Capital 200,000 100,000 Sorima, Capital Total Total 600,000 600,000 Matuguinas and Sorima shared profits or losses 40% and 60%, respectively. On January 2, 2018, Pateno was admitted to the partnership by investing the net assets of her highly profitable proprietorship. The partners agreed to the following current fair vales of the identifiable net assets of Pateno's proprietorship: Current Assets Plant Assets 70,000 230,000 300,000 Total Assets Less: Liabilities Net Assets 200,000 100,000 Pateno's capital account was credited for P120,000. The partners agreed further that the current fair values of the net assets of Matuguinas and Sorima were equal to their carrying amounts and that the accounting records of the old partnership should be used for the new partnership. The following partner-remuneration plan was adopted for the new partnership: Salaries of P10,000 to Matuguinas, P15,000 to Sorima and P20,000 to Pateno. A bonus of 10% of income after salaries and bonus to Pateno. Balance: 30% to Mauguinas, 40% to Sorima, and 30% to to Pateno. For the year ended December 31, 2018, the profit of the partnership is P78,000 before salaries and bonus to Pateno. Required: Prepare the journal entries to record the following: (show your solutions) a. The admission of Pateno to the partnership on January 2, 2018. b. The income distribution for the year ended December 31, 2018. 1. The condensed statement of financial position of Matuguinas and Sorima on December 31, 2017, follows: Matu guinas and Sorim a Statement of Financial Position December 31, 2017 Assets Liabilities and Partner's Capital Current Assets 100,000 Liabilities 300,000 Plant Assets (net) 500,000 Matuguinas, Capital 200,000 100,000 Sorima, Capital Total Total 600,000 600,000 Matuguinas and Sorima shared profits or losses 40% and 60%, respectively. On January 2, 2018, Pateno was admitted to the partnership by investing the net assets of her highly profitable proprietorship. The partners agreed to the following current fair vales of the identifiable net assets of Pateno's proprietorship: Current Assets Plant Assets 70,000 230,000 300,000 Total Assets Less: Liabilities Net Assets 200,000 100,000 Pateno's capital account was credited for P120,000. The partners agreed further that the current fair values of the net assets of Matuguinas and Sorima were equal to their carrying amounts and that the accounting records of the old partnership should be used for the new partnership. The following partner-remuneration plan was adopted for the new partnership: Salaries of P10,000 to Matuguinas, P15,000 to Sorima and P20,000 to Pateno. A bonus of 10% of income after salaries and bonus to Pateno. Balance: 30% to Mauguinas, 40% to Sorima, and 30% to to Pateno. For the year ended December 31, 2018, the profit of the partnership is P78,000 before salaries and bonus to Pateno. Required: Prepare the journal entries to record the following: (show your solutions) a. The admission of Pateno to the partnership on January 2, 2018. b. The income distribution for the year ended December 31, 2018