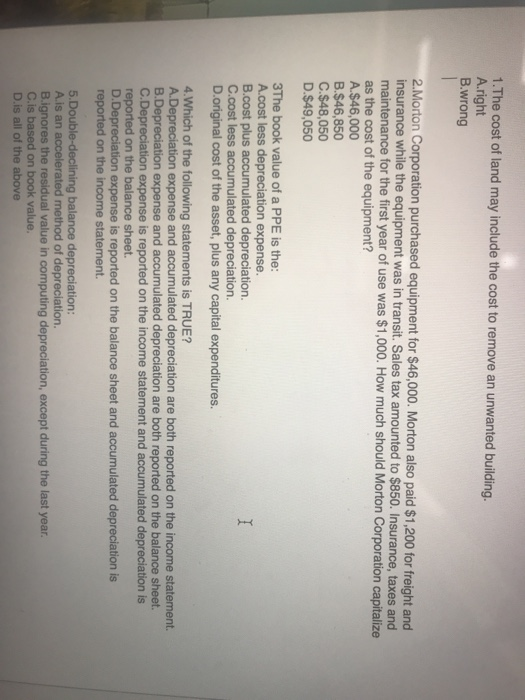

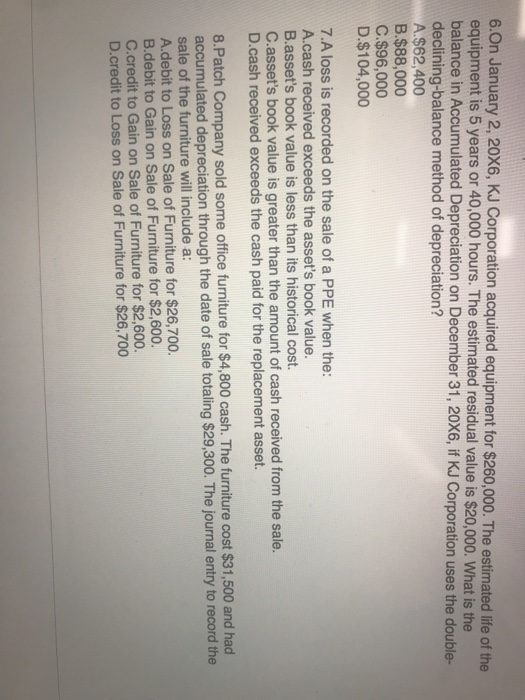

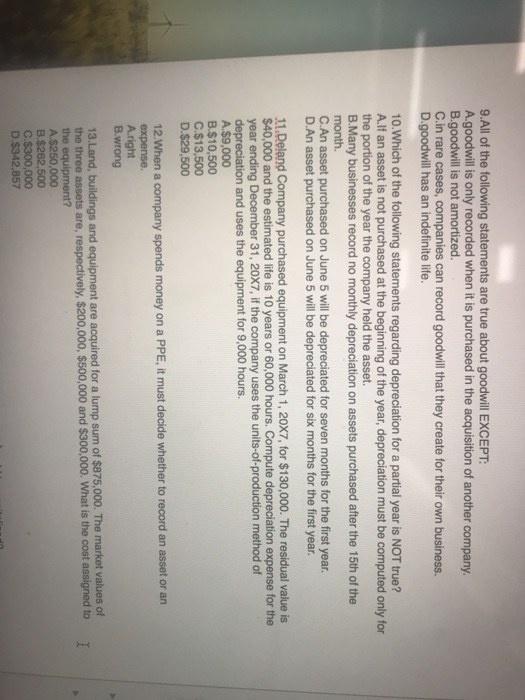

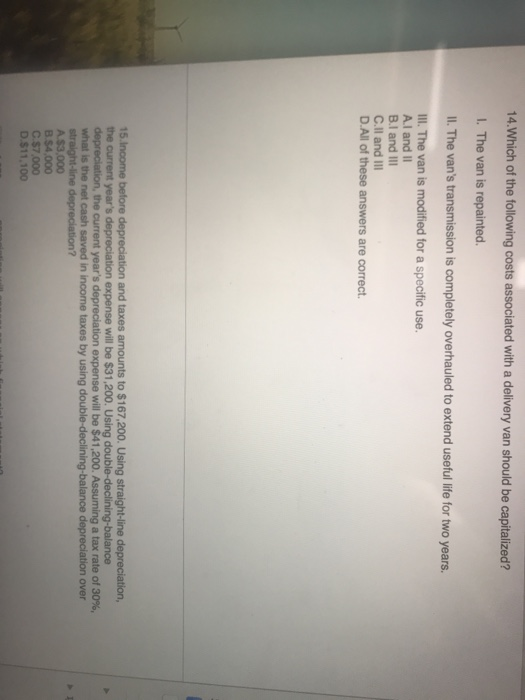

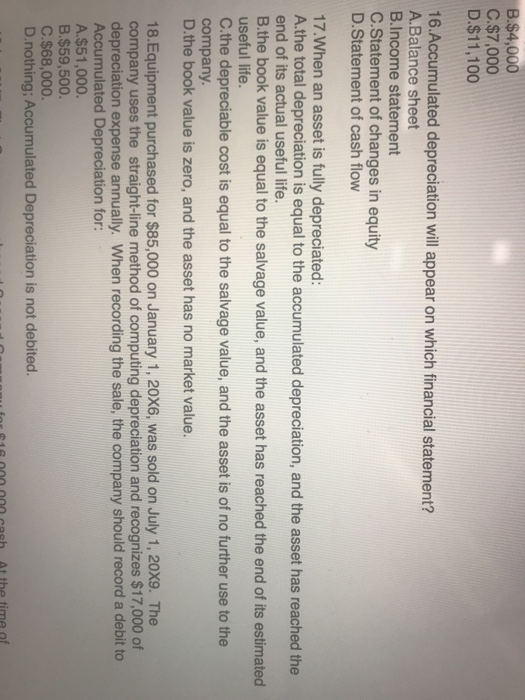

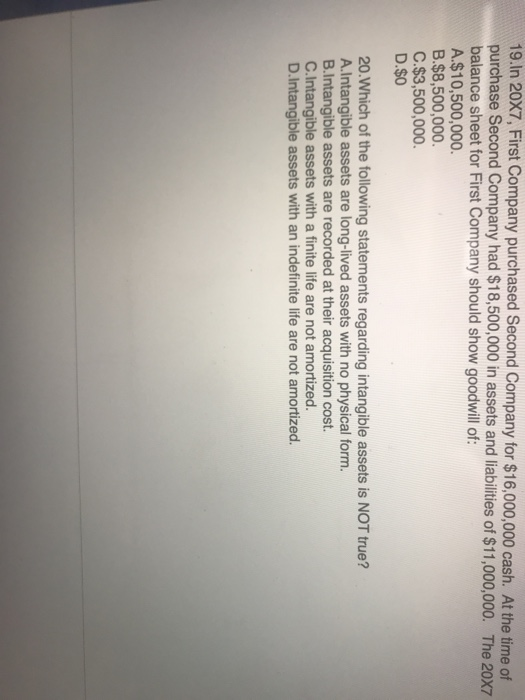

1. The cost of land may include the cost to remove an unwanted building. A.right B.wrong 2.Morton Corporation purchased equipment for $46,000. Morton also paid $1,200 for freight and insurance while the equipment was in transit. Sales tax amounted to $850. Insurance, taxes and maintenance for the first year of use was $1,000. How much should Morton Corporation capitalize as the cost of the equipment? A.$46,000 B.$46,850 C.$48,050 D.$49,050 3The book value of a PPE is the: A.cost less depreciation expense. B.cost plus accumulated depreciation. C.cost less accumulated depreciation. D.original cost of the asset, plus any capital expenditures. 4.Which of the following statements is TRUE? A.Depreciation expense and accumulated depreciation are both reported on the income statement B.Depreciation expense and accumulated depreciation are both reported on the balance sheet C.Depreciation expense is reported on the income statement and accumulated depreciation is reported on the balance sheet. D.Depreciation expense is reported on the balance sheet and accumulated depreciation is reported on the income statement. 5.Double-declining balance depreciation: A.is an accelerated method of depreciation. B.ignores the residual value in computing depreciation, except during the last year. C.is based on book value. D.is all of the above 6.On January 2, 20X6, KJ Corporation acquired equipment for $260,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 20X6, if KJ Corporation uses the double- declining-balance method of depreciation? A.$62,400 B.$88,000 C.$96,000 D.$104,000 7.A loss is recorded on the sale of a PPE when the: A.cash received exceeds the asset's book value. B.asset's book value is less than its historical cost. C.asset's book value is greater than the amount of cash received from the sale. D.cash received exceeds the cash paid for the replacement asset. 8.Patch Company sold some office furniture for $4,800 cash. The furniture cost $31,500 and had accumulated depreciation through the date of sale totaling $29,300. The journal entry to record the sale of the furniture will include a: A.debit to Loss on Sale of Furniture for $26,700. B.debit to Gain on Sale of Furniture for $2,600. C.credit to Gain on Sale of Furniture for $2,600. D.credit to Loss on Sale of Furniture for $26,700 9.All of the following statements are true about goodwill EXCEPT: A.goodwill is only recorded when it is purchased in the acquisition of another company. B.goodwill is not amortized. C.in rare cases, companies can record goodwill that they create for their own business. D.goodwill has an indefinite life. 10. Which of the following statements regarding depreciation for a partial year is NOT true? A.If an asset is not purchased at the beginning of the year, depreciation must be computed only for the portion of the year the company held the asset. B.Many businesses record no monthly depreciation on assets purchased after the 15th of the month. C.An asset purchased on June 5 will be depreciated for seven months for the first year. D.An asset purchased on June 5 will be depreciated for six months for the first year. 11.Deland Company purchased equipment on March 1, 20X7, for $130,000. The residual value is $40,000 and the estimated life is 10 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 20X7, if the company uses the units-of-production method of depreciation and uses the equipment for 9,000 hours. A.$9,000 B.$10,500 C.$13,500 D.$29,500 12.When a company spends money on a PPE, it must decide whether to record an asset or an expense. A.right B.wrong 13.Land, buildings and equipment are acquired for a lump sum of $875,000. The market values of the three assets are, respectively, $200,000, $500,000 and $300,000. What is the cost assigned to the equipment? A $250,000 B.$262,500 C.$300,000 D.S342,857 T 14. Which of the following costs associated with a delivery van should be capitalized? 1. The van is repainted. II. The van's transmission is completely overhauled to extend useful life for two years. III. The van is modified for a specific use. A.1 and 11 B.I and III C.ll and III D. All of these answers are correct. 15. Income before depreciation and taxes amounts to $167,200. Using straight-line depreciation. the current year's depreciation expense will be $31,200. Using double-declining balance depreciation, the current yours depreciation expense will be $41,200. Assuming a tax rate of 30% what is the net cash saved in income taxes by using double-declining balance depreciation over straight-line depreciation? A $3,000 B.$4,000 C. $7,000 D.$11.100 B.$4,000 C.$7,000 D.$11,100 16.Accumulated depreciation will appear on which financial statement? A.Balance sheet B.Income statement C.Statement of changes in equity D. Statement of cash flow 17. When an asset is fully depreciated: A.the total depreciation is equal to the accumulated depreciation, and the asset has reached the end of its actual useful life. B.the book value is equal to the salvage value, and the asset has reached the end of its estimated useful life. C.the depreciable cost is equal to the salvage value, and the asset is of no further use to the company D.the book value is zero, and the asset has no market value. 18.Equipment purchased for $85,000 on January 1, 20X6, was sold on July 1, 20X9. The company uses the straight-line method of computing depreciation and recognizes $17,000 of depreciation expense annually. When recording the sale, the company should record a debit to Accumulated Depreciation for: A.$51,000. B.$59,500. C.$68,000 D.nothing; Accumulated Depreciation is not debited. L a for 1600 cash At the time of 19. In 20X7, First Company purchased Second Company for $16,000,000 cash. At the time of purchase Second Company had $18,500,000 in assets and liabilities of $11,000,000. The 20X7 balance sheet for First Company should show goodwill of: A.$10,500,000 B.$8,500,000 C.$3,500,000 D.$0 20.Which of the following statements regarding intangible assets is NOT true? A.Intangible assets are long-lived assets with no physical form. B.Intangible assets are recorded at their acquisition cost. C.Intangible assets with a finite life are not amortized. D.Intangible assets with an indefinite life are not amortized. 1. The cost of land may include the cost to remove an unwanted building. A.right B.wrong 2.Morton Corporation purchased equipment for $46,000. Morton also paid $1,200 for freight and insurance while the equipment was in transit. Sales tax amounted to $850. Insurance, taxes and maintenance for the first year of use was $1,000. How much should Morton Corporation capitalize as the cost of the equipment? A.$46,000 B.$46,850 C.$48,050 D.$49,050 3The book value of a PPE is the: A.cost less depreciation expense. B.cost plus accumulated depreciation. C.cost less accumulated depreciation. D.original cost of the asset, plus any capital expenditures. 4.Which of the following statements is TRUE? A.Depreciation expense and accumulated depreciation are both reported on the income statement B.Depreciation expense and accumulated depreciation are both reported on the balance sheet C.Depreciation expense is reported on the income statement and accumulated depreciation is reported on the balance sheet. D.Depreciation expense is reported on the balance sheet and accumulated depreciation is reported on the income statement. 5.Double-declining balance depreciation: A.is an accelerated method of depreciation. B.ignores the residual value in computing depreciation, except during the last year. C.is based on book value. D.is all of the above 6.On January 2, 20X6, KJ Corporation acquired equipment for $260,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 20X6, if KJ Corporation uses the double- declining-balance method of depreciation? A.$62,400 B.$88,000 C.$96,000 D.$104,000 7.A loss is recorded on the sale of a PPE when the: A.cash received exceeds the asset's book value. B.asset's book value is less than its historical cost. C.asset's book value is greater than the amount of cash received from the sale. D.cash received exceeds the cash paid for the replacement asset. 8.Patch Company sold some office furniture for $4,800 cash. The furniture cost $31,500 and had accumulated depreciation through the date of sale totaling $29,300. The journal entry to record the sale of the furniture will include a: A.debit to Loss on Sale of Furniture for $26,700. B.debit to Gain on Sale of Furniture for $2,600. C.credit to Gain on Sale of Furniture for $2,600. D.credit to Loss on Sale of Furniture for $26,700 9.All of the following statements are true about goodwill EXCEPT: A.goodwill is only recorded when it is purchased in the acquisition of another company. B.goodwill is not amortized. C.in rare cases, companies can record goodwill that they create for their own business. D.goodwill has an indefinite life. 10. Which of the following statements regarding depreciation for a partial year is NOT true? A.If an asset is not purchased at the beginning of the year, depreciation must be computed only for the portion of the year the company held the asset. B.Many businesses record no monthly depreciation on assets purchased after the 15th of the month. C.An asset purchased on June 5 will be depreciated for seven months for the first year. D.An asset purchased on June 5 will be depreciated for six months for the first year. 11.Deland Company purchased equipment on March 1, 20X7, for $130,000. The residual value is $40,000 and the estimated life is 10 years or 60,000 hours. Compute depreciation expense for the year ending December 31, 20X7, if the company uses the units-of-production method of depreciation and uses the equipment for 9,000 hours. A.$9,000 B.$10,500 C.$13,500 D.$29,500 12.When a company spends money on a PPE, it must decide whether to record an asset or an expense. A.right B.wrong 13.Land, buildings and equipment are acquired for a lump sum of $875,000. The market values of the three assets are, respectively, $200,000, $500,000 and $300,000. What is the cost assigned to the equipment? A $250,000 B.$262,500 C.$300,000 D.S342,857 T 14. Which of the following costs associated with a delivery van should be capitalized? 1. The van is repainted. II. The van's transmission is completely overhauled to extend useful life for two years. III. The van is modified for a specific use. A.1 and 11 B.I and III C.ll and III D. All of these answers are correct. 15. Income before depreciation and taxes amounts to $167,200. Using straight-line depreciation. the current year's depreciation expense will be $31,200. Using double-declining balance depreciation, the current yours depreciation expense will be $41,200. Assuming a tax rate of 30% what is the net cash saved in income taxes by using double-declining balance depreciation over straight-line depreciation? A $3,000 B.$4,000 C. $7,000 D.$11.100 B.$4,000 C.$7,000 D.$11,100 16.Accumulated depreciation will appear on which financial statement? A.Balance sheet B.Income statement C.Statement of changes in equity D. Statement of cash flow 17. When an asset is fully depreciated: A.the total depreciation is equal to the accumulated depreciation, and the asset has reached the end of its actual useful life. B.the book value is equal to the salvage value, and the asset has reached the end of its estimated useful life. C.the depreciable cost is equal to the salvage value, and the asset is of no further use to the company D.the book value is zero, and the asset has no market value. 18.Equipment purchased for $85,000 on January 1, 20X6, was sold on July 1, 20X9. The company uses the straight-line method of computing depreciation and recognizes $17,000 of depreciation expense annually. When recording the sale, the company should record a debit to Accumulated Depreciation for: A.$51,000. B.$59,500. C.$68,000 D.nothing; Accumulated Depreciation is not debited. L a for 1600 cash At the time of 19. In 20X7, First Company purchased Second Company for $16,000,000 cash. At the time of purchase Second Company had $18,500,000 in assets and liabilities of $11,000,000. The 20X7 balance sheet for First Company should show goodwill of: A.$10,500,000 B.$8,500,000 C.$3,500,000 D.$0 20.Which of the following statements regarding intangible assets is NOT true? A.Intangible assets are long-lived assets with no physical form. B.Intangible assets are recorded at their acquisition cost. C.Intangible assets with a finite life are not amortized. D.Intangible assets with an indefinite life are not amortized