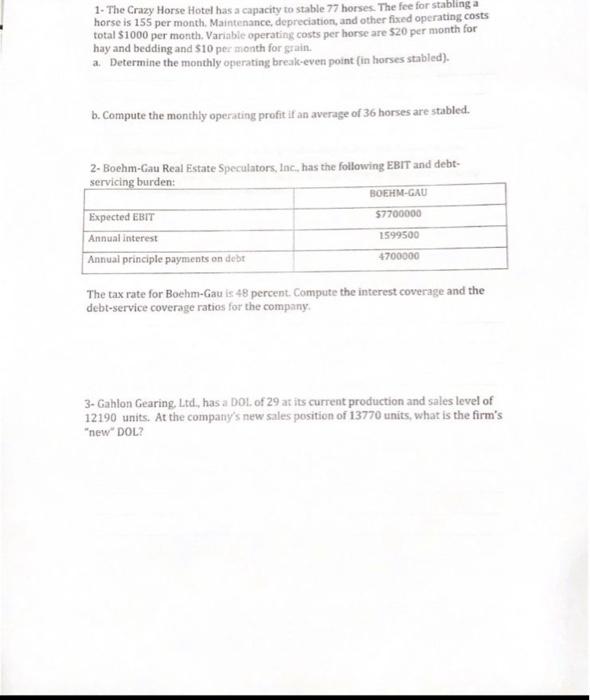

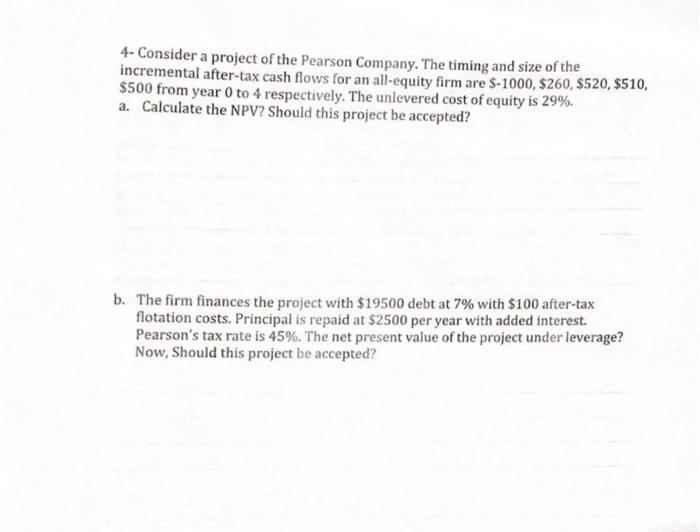

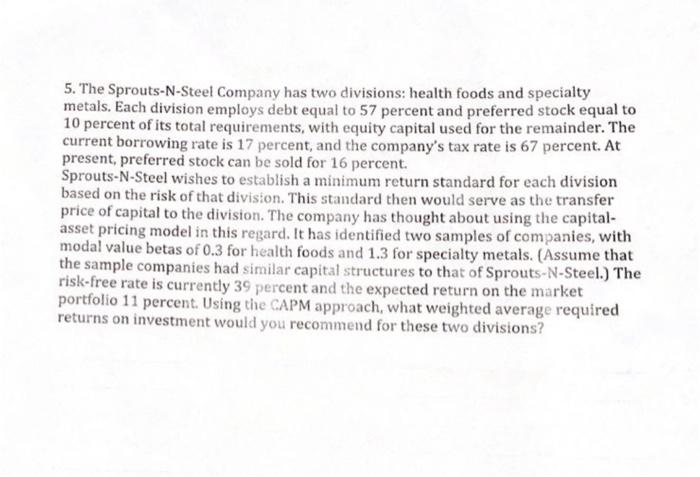

1- The Crazy Horse Hotel has a capacity to stable 77 horses. The fee for stabling a horse is 155 per month. Maintenance, depreciation, and other fixed operating costs total $1000 per month. Variable operating costs per horse are 520 per month for hay and bedding and $10 per month for grain. a. Determine the monthly operating break-even point in horses stabled). b. Compute the monthly operating profit it an average of 36 horses are stabled. 2- Boehm-Gau Real Estate Speculators, Inc. has the following EBIT and debt- servicing burden: BOEHM-GAU Expected EBIT $7700000 Annual interest Annuai principle payments on debt 4700000 1599500 The tax rate for Boehm-Gau is 48 percent. Compute the interest coverage and the debt-service coverage ratios for the company, 3- Gahlon Gearing Ltd, has a Dol. of 29 at its current production and sales level of 12190 units. At the company's new sales position of 13770 units, what is the firm's "new"DOL? 4- Consider a project of the Pearson Company. The timing and size of the incremental after-tax cash flows for an all-equity firm are S-1000, $260, $520, $510, $500 from year 0 to 4 respectively. The unlevered cost of equity is 29%. a. Calculate the NPV? Should this project be accepted? b. The firm finances the project with $19500 debt at 7% with $100 after-tax flotation costs. Principal is repaid at $2500 per year with added interest. Pearson's tax rate is 45%. The net present value of the project under leverage? Now, Should this project be accepted? 5. The Sprouts-N-Steel Company has two divisions: health foods and specialty metals. Each division employs debt equal to 57 percent and preferred stock equal to 10 percent of its total requirements, with equity capital used for the remainder. The current borrowing rate is 17 percent, and the company's tax rate is 67 percent. At present, preferred stock can be sold for 16 percent. Sprouts-N-Steel wishes to establish a minimum return standard for each division based on the risk of that division. This standard then would serve as the transfer price of capital to the division. The company has thought about using the capital- asset pricing model in this regard. It has identified two samples of companies, with modal value betas of 0.3 for health foods and 1.3 for specialty metals. (Assume that the sample companies had similar capital structures to that of Sprouts-N-Steel.) The risk-free rate is currently 39 percent and the expected return on the market portfolio 11 percent. Using the CAPM approach, what weighted average required returns on investment would you recommend for these two divisions? 5. The Sprouts-N-Steel Company has two divisions: health foods and specialty metals. Each division employs debt equal to 57 percent and preferred stock equal to 10 percent of its total requirements, with equity capital used for the remainder. The current borrowing rate is 17 percent, and the company's tax rate is 67 percent. At present, preferred stock can be sold for 16 percent. Sprouts-N-Steel wishes to establish a minimum return standard for each division based on the risk of that division. This standard then would serve as the transfer price of capital to the division. The company has thought about using the capital- asset pricing model in this regard. It has identified two samples of companies, with modal value betas of 0.3 for health foods and 1.3 for specialty metals. (Assume that the sample companies had similar capital structures to that of Sprouts-N-Steel.) The risk-free rate is currently 39 percent and the expected return on the market portfolio 11 percent. Using the CAPM approach, what weighted average required returns on investment would you recommend for these two divisions