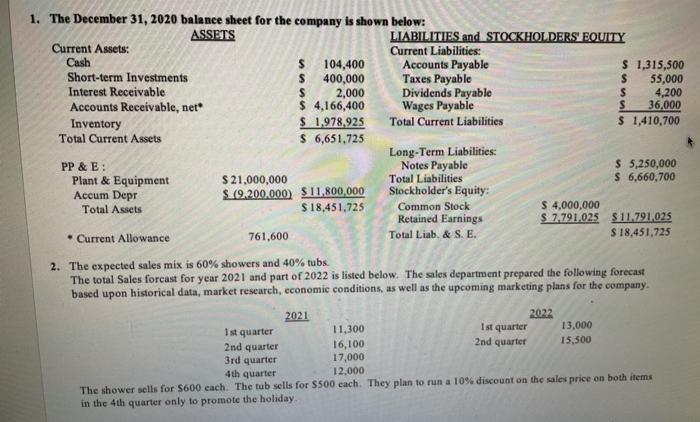

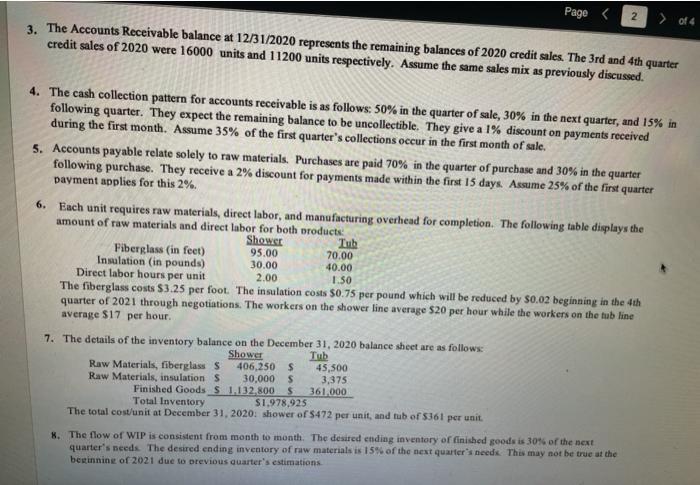

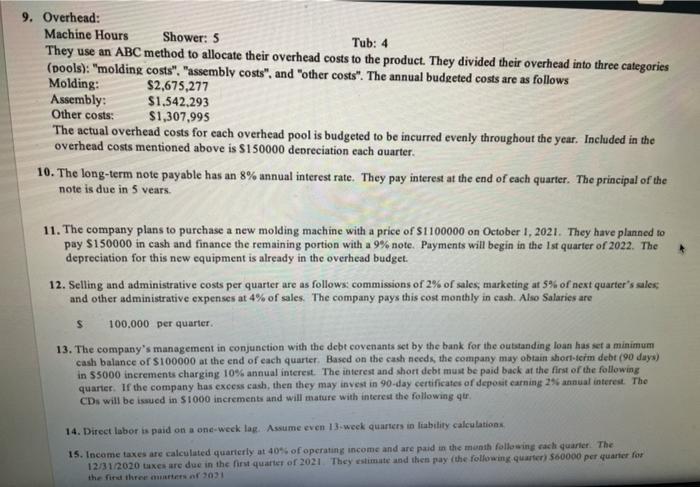

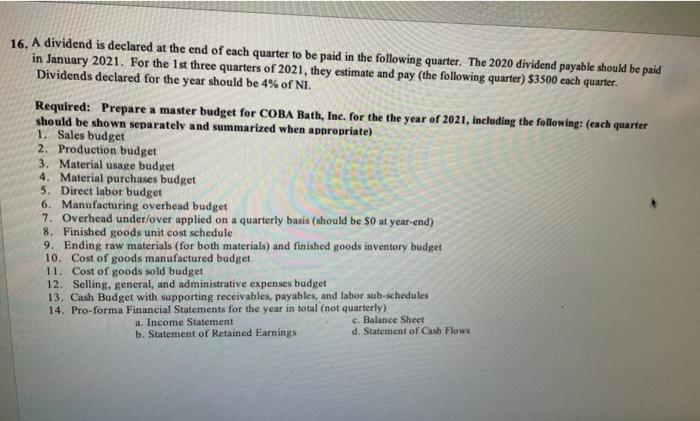

1. The December 31, 2020 balance sheet for the company is shown below: ASSETS LIABILITIES and STOCKHOLDERS' EQUITY Current Assets: Current Liabilities: Cash $ 104,400 Accounts Payable $ 1,315,500 Short-term Investments $ 400,000 Taxes Payable $ 55,000 Interest Receivable $ 2,000 Dividends Payable S 4,200 Accounts Receivable, net $ 4,166,400 Wages Payable s 36,000 Inventory $ 1,978,925 Total Current Liabilities $ 1,410,700 Total Current Assets $ 6,651,725 Long-Term Liabilities: PP & E: Notes Payable $ 5,250,000 Plant & Equipment $ 21,000,000 Total Liabilities $ 6,660,700 Accum Depr S (9.200.000 $11,800,000 Stockholder's Equity: Total Assets $18.451,725 Common Stock $ 4,000,000 Retained Earnings $ 2,791.025 $11.791.025 Current Allowance 761,600 Total Liab. & S.E. $ 18,451,725 2. The expected sales mix is 60% showers and 40% tubs. The total Sales forcast for year 2021 and part of 2022 is listed below. The sales department prepared the following forecast based upon historical data, market research, economic conditions, as well as the upcoming marketing plans for the company. 2021 2022 1st quarter 11,300 1st quarter 13,000 2nd quarter 16,100 2nd quarter 15.500 3rd quarter 17,000 4th quarter 12.000 The shower sells for $600 each. The tub sells for $500 each. They plan to run a 10% discount on the sales price on both items in the 4th quarter only to promote the holiday Pages 2 of 4 3. The Accounts Receivable balance at 12/31/2020 represents the remaining balances of 2020 credit sales. The 3rd and 4th quarter credit sales of 2020 were 16000 units and 11200 units respectively. Assume the same sales mix as previously discussed. 4. The cash collection pattern for accounts receivable is as follows: 50% in the quarter of sale, 30% in the next quarter, and 15% in following quarter. They expect the remaining balance to be uncollectible. They give a 1% discount on payments received during the first month. Assume 35% of the first quarter's collections occur in the first month of sale. 5. Accounts payable relate solely to raw materials. Purchases are paid 70% in the quarter of purchase and 30% in the quarter following purchase. They receive a 2% discount for payments made within the first 15 days. Assume 25% of the first quarter payment applies for this 2%. 6. Each unit requires raw materials, direct labor, and manufacturing overhead for completion. The following table displays the amount of raw materials and direct labor for both products Shower Tube Fiberglass (in feet) 95.00 70.00 Insulation (in pounds) 30.00 40.00 Direct labor hours per unit 2.00 1.50 The fiberglass costs $3.25 per foot. The insulation costs $0.75 per pound which will be reduced by S0.02 beginning in the 4th quarter of 2021 through negotiations. The workers on the shower line average $20 per hour while the workers on the tub line average $17 per hour 7. The details of the inventory balance on the December 31, 2020 balance sheet are as follows: Shower Tub Raw Materials, fiberglass S 406,250 $ 45,500 Raw Materials, insulations 30,000 $ 3,375 Finished Goods S 1.132.800$ 361.000 Total Inventory $1.978,925 The total cost/unit at December 31, 2020: shower of $472 per unit, and tub of $361 per unit *. The flow of WIP is consistent from month to month. The desired ending inventory of finished goods is 30% of the next quarter's needs. The desired ending inventory of raw materials is 15% of the next quarter's needs. This may not be true at the beginning of 2021 due to previous quarter's estimations 9. Overhead: Machine Hours Shower: 5 Tub: 4 They use an ABC method to allocate their overhead costs to the product. They divided their overhead into three categories (pools): "molding costs", "assembly costs", and other costs". The annual budgeted costs are as follows Molding: $2,675,277 Assembly: $1.542.293 Other costs: $1,307,995 The actual overhead costs for each overhead pool is budgeted to be incurred evenly throughout the year. Included in the overhead costs mentioned above is S150000 depreciation each quarter. 10. The long-term note payable has an 8% annual interest rate. They pay interest at the end of each quarter. The principal of the note is due in 5 vears 11. The company plans to purchase a new molding machine with a price of S1100000 on October 1, 2021. They have planned to pay $150000 in cash and finance the remaining portion with a 9% note. Payments will begin in the Ist quarter of 2022. The depreciation for this new equipment is already in the overhead budget. 12. Selling and administrative costs per quarter are as follows commissions of 2% of sales, marketing at 5% of next quarter's sales, and other administrative expenses at 4% of sales. The company pays this cost monthly in cash. Also Salaries are $ 100.000 per quarter. 13. The company's management in conjunction with the debt covenants set by the bank for the outstanding loan has set a minimum cash balance of $100000 at the end of each quarter. Based on the cash needs the company may obtain short-term debt (90 days) in 55000 increments charging 10% annual interest. The interest and short debt must be paid back at the first of the following quarter. If the company has excess cash, then they may invest in 90-day certificates of deposit earning 25 annual interest. The CDs will be issued in S1000 increments and will mature with interest the following ytr. 14. Direct labor is paid on a one-weck lag. Assume even 13.weck quarters in liability calculations 15. Income taxes are calculated quarterly at 40% of operating income and are paid in the month following each quarter. The 12/31/2020 taxes are due in the first quarter of 2021. They estimate and then pay the following quarter) $60000 per quarter for the first three antes 1031 16. A dividend is declared at the end of each quarter to be paid in the following quarter. The 2020 dividend payable should be paid in January 2021. For the 1st three quarters of 2021, they estimate and pay (the following quarter) $3500 each quarter. Dividends declared for the year should be 4% of NI. Required: Prepare a master budget for COBA Bath, Inc. for the the year of 2021, including the following: (each quarter should be shown separately and summarized when appropriate) 1. Sales budget 2. Production budget 3. Material usage budget 4. Material purchases budget 5. Direct labor budget 6. Manufacturing overhead budget 7. Overhead under/over applied on a quarterly basis (should be so at year-end) 8. Finished goods unit cost schedule 9. Ending raw materials (for both materials) and finished goods inventory budget 10. Cost of goods manufactured budget 11. Cost of goods sold budget 12. Selling, general, and administrative expenses budget 13. Cash Budget with supporting receivables, payables, and labor sub-schedules 14. Pro-forma Financial Statements for the year in total (not quarterly) . Balance Sheet a. Income Statement d. Statement of Cash Flows b. Statement of Retained Earnings 1. The December 31, 2020 balance sheet for the company is shown below: ASSETS LIABILITIES and STOCKHOLDERS' EQUITY Current Assets: Current Liabilities: Cash $ 104,400 Accounts Payable $ 1,315,500 Short-term Investments $ 400,000 Taxes Payable $ 55,000 Interest Receivable $ 2,000 Dividends Payable S 4,200 Accounts Receivable, net $ 4,166,400 Wages Payable s 36,000 Inventory $ 1,978,925 Total Current Liabilities $ 1,410,700 Total Current Assets $ 6,651,725 Long-Term Liabilities: PP & E: Notes Payable $ 5,250,000 Plant & Equipment $ 21,000,000 Total Liabilities $ 6,660,700 Accum Depr S (9.200.000 $11,800,000 Stockholder's Equity: Total Assets $18.451,725 Common Stock $ 4,000,000 Retained Earnings $ 2,791.025 $11.791.025 Current Allowance 761,600 Total Liab. & S.E. $ 18,451,725 2. The expected sales mix is 60% showers and 40% tubs. The total Sales forcast for year 2021 and part of 2022 is listed below. The sales department prepared the following forecast based upon historical data, market research, economic conditions, as well as the upcoming marketing plans for the company. 2021 2022 1st quarter 11,300 1st quarter 13,000 2nd quarter 16,100 2nd quarter 15.500 3rd quarter 17,000 4th quarter 12.000 The shower sells for $600 each. The tub sells for $500 each. They plan to run a 10% discount on the sales price on both items in the 4th quarter only to promote the holiday Pages 2 of 4 3. The Accounts Receivable balance at 12/31/2020 represents the remaining balances of 2020 credit sales. The 3rd and 4th quarter credit sales of 2020 were 16000 units and 11200 units respectively. Assume the same sales mix as previously discussed. 4. The cash collection pattern for accounts receivable is as follows: 50% in the quarter of sale, 30% in the next quarter, and 15% in following quarter. They expect the remaining balance to be uncollectible. They give a 1% discount on payments received during the first month. Assume 35% of the first quarter's collections occur in the first month of sale. 5. Accounts payable relate solely to raw materials. Purchases are paid 70% in the quarter of purchase and 30% in the quarter following purchase. They receive a 2% discount for payments made within the first 15 days. Assume 25% of the first quarter payment applies for this 2%. 6. Each unit requires raw materials, direct labor, and manufacturing overhead for completion. The following table displays the amount of raw materials and direct labor for both products Shower Tube Fiberglass (in feet) 95.00 70.00 Insulation (in pounds) 30.00 40.00 Direct labor hours per unit 2.00 1.50 The fiberglass costs $3.25 per foot. The insulation costs $0.75 per pound which will be reduced by S0.02 beginning in the 4th quarter of 2021 through negotiations. The workers on the shower line average $20 per hour while the workers on the tub line average $17 per hour 7. The details of the inventory balance on the December 31, 2020 balance sheet are as follows: Shower Tub Raw Materials, fiberglass S 406,250 $ 45,500 Raw Materials, insulations 30,000 $ 3,375 Finished Goods S 1.132.800$ 361.000 Total Inventory $1.978,925 The total cost/unit at December 31, 2020: shower of $472 per unit, and tub of $361 per unit *. The flow of WIP is consistent from month to month. The desired ending inventory of finished goods is 30% of the next quarter's needs. The desired ending inventory of raw materials is 15% of the next quarter's needs. This may not be true at the beginning of 2021 due to previous quarter's estimations 9. Overhead: Machine Hours Shower: 5 Tub: 4 They use an ABC method to allocate their overhead costs to the product. They divided their overhead into three categories (pools): "molding costs", "assembly costs", and other costs". The annual budgeted costs are as follows Molding: $2,675,277 Assembly: $1.542.293 Other costs: $1,307,995 The actual overhead costs for each overhead pool is budgeted to be incurred evenly throughout the year. Included in the overhead costs mentioned above is S150000 depreciation each quarter. 10. The long-term note payable has an 8% annual interest rate. They pay interest at the end of each quarter. The principal of the note is due in 5 vears 11. The company plans to purchase a new molding machine with a price of S1100000 on October 1, 2021. They have planned to pay $150000 in cash and finance the remaining portion with a 9% note. Payments will begin in the Ist quarter of 2022. The depreciation for this new equipment is already in the overhead budget. 12. Selling and administrative costs per quarter are as follows commissions of 2% of sales, marketing at 5% of next quarter's sales, and other administrative expenses at 4% of sales. The company pays this cost monthly in cash. Also Salaries are $ 100.000 per quarter. 13. The company's management in conjunction with the debt covenants set by the bank for the outstanding loan has set a minimum cash balance of $100000 at the end of each quarter. Based on the cash needs the company may obtain short-term debt (90 days) in 55000 increments charging 10% annual interest. The interest and short debt must be paid back at the first of the following quarter. If the company has excess cash, then they may invest in 90-day certificates of deposit earning 25 annual interest. The CDs will be issued in S1000 increments and will mature with interest the following ytr. 14. Direct labor is paid on a one-weck lag. Assume even 13.weck quarters in liability calculations 15. Income taxes are calculated quarterly at 40% of operating income and are paid in the month following each quarter. The 12/31/2020 taxes are due in the first quarter of 2021. They estimate and then pay the following quarter) $60000 per quarter for the first three antes 1031 16. A dividend is declared at the end of each quarter to be paid in the following quarter. The 2020 dividend payable should be paid in January 2021. For the 1st three quarters of 2021, they estimate and pay (the following quarter) $3500 each quarter. Dividends declared for the year should be 4% of NI. Required: Prepare a master budget for COBA Bath, Inc. for the the year of 2021, including the following: (each quarter should be shown separately and summarized when appropriate) 1. Sales budget 2. Production budget 3. Material usage budget 4. Material purchases budget 5. Direct labor budget 6. Manufacturing overhead budget 7. Overhead under/over applied on a quarterly basis (should be so at year-end) 8. Finished goods unit cost schedule 9. Ending raw materials (for both materials) and finished goods inventory budget 10. Cost of goods manufactured budget 11. Cost of goods sold budget 12. Selling, general, and administrative expenses budget 13. Cash Budget with supporting receivables, payables, and labor sub-schedules 14. Pro-forma Financial Statements for the year in total (not quarterly) . Balance Sheet a. Income Statement d. Statement of Cash Flows b. Statement of Retained Earnings