Question

1. The direct materials price variance is a.$3,514 favorable b.$3,514 unfavorable c.$8,785 favorable d.$8,785 unfavorable 2. Flapjack Corporation had 7,881 actual direct labor hours at

1.

The direct materials price variance is

a.$3,514 favorable b.$3,514 unfavorable c.$8,785 favorable d.$8,785 unfavorable

2.

Flapjack Corporation had 7,881 actual direct labor hours at an actual rate of $12.30 per hour. Original production had been budgeted for 1,100 units, but only 979 units were actually produced. Labor standards were 7.9 hours per completed unit at a standard rate of $12.85 per hour.

The direct labor rate variance is

a.$4,334.55 unfavorable

b.$4,334.55 favorable

c.$1,573.16 unfavorable

d.$1,573.16 favorable

3.

Myers Corporation has the following data related to direct materials costs for November: actual costs for 4,650 pounds of material at $5.40 and standard costs for 4,460 pounds of material at $6.00 per pound.

The direct materials quantity variance is

a.$2,790 unfavorable

b.$2,790 favorable

c.$1,140 favorable

d.$1,140 unfavorable

4.

The following data relate to direct materials costs for February: Materials cost per yard: standard, $1.97; actual, $2.05 Yards per unit: standard, 4.60 yards; actual, 5.26 yards Units of production: 9,500 The direct materials quantity variance is

a.$12,853.50 favorable

b.$12,853.50 unfavorable

c.$12,351.90 unfavorable

d.$12,351.90 favorable

5.

Dove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $231,000, $319,000, and $413,000, respectively, for September, October, and November. The company expects to sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month of the sale and 30% in the month following the sale.

The cash collections expected in October are

a.$288,640

b.$299,200

c.$271,040

d.$224,840

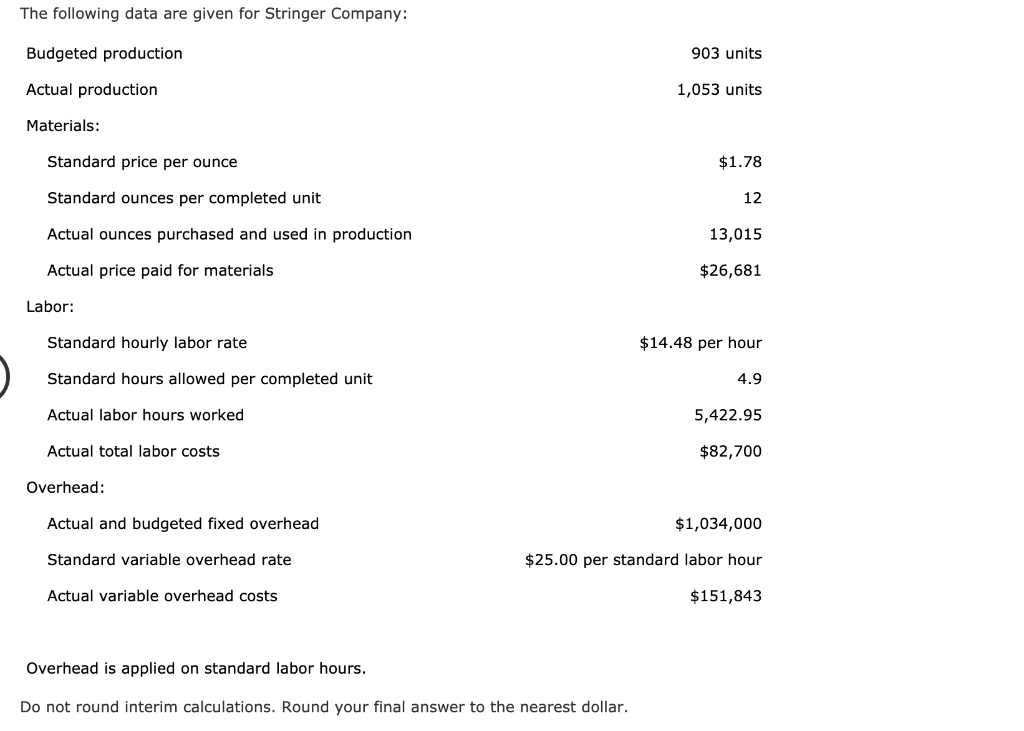

The following data are given for Stringer Company: Budgeted production 903 units Actual production 1,053 units Materials: Standard price per ounce $1.78 Standard ounces per completed unit 12 Actual ounces purchased and used in production 13,015 Actual price paid for materials $26,681 Labor: Standard hourly labor rate $14.48 per hour Standard hours allowed per completed unit 4.9 Actual labor hours worked 5,422.95 Actual total labor costs $82,700 Overhead: Actual and budgeted fixed overhead $1,034,000 Standard variable overhead rate $25.00 per standard labor hour Actual variable overhead costs $151,843 Overhead is applied on standard labor hours. Do not round interim calculations. Round your final answer to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started