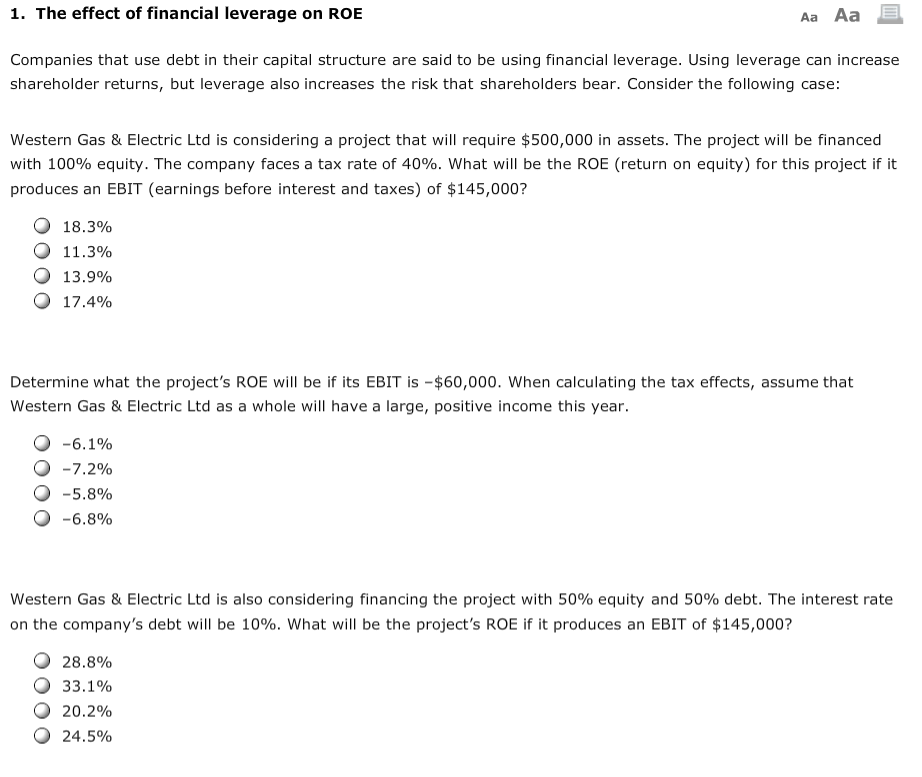

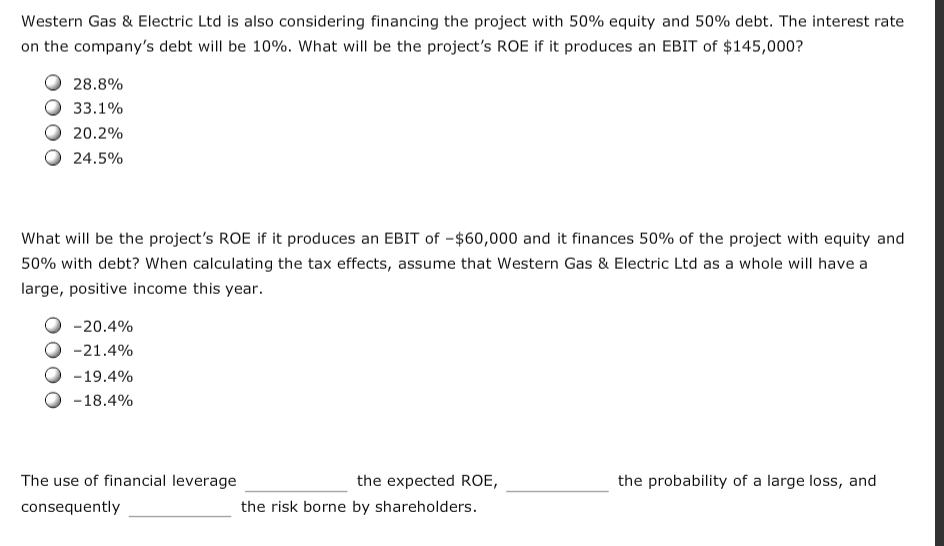

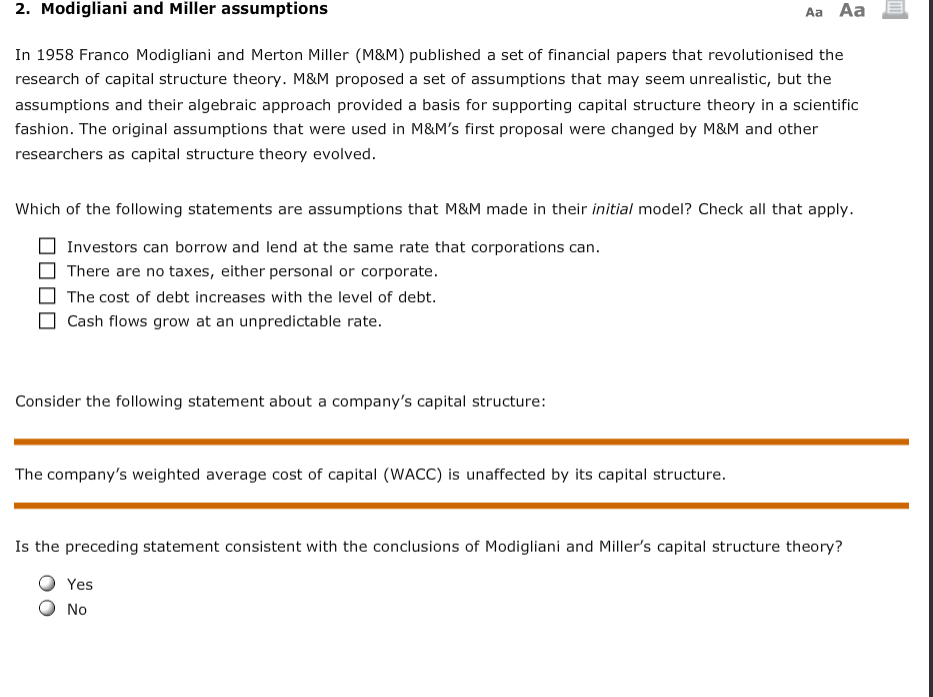

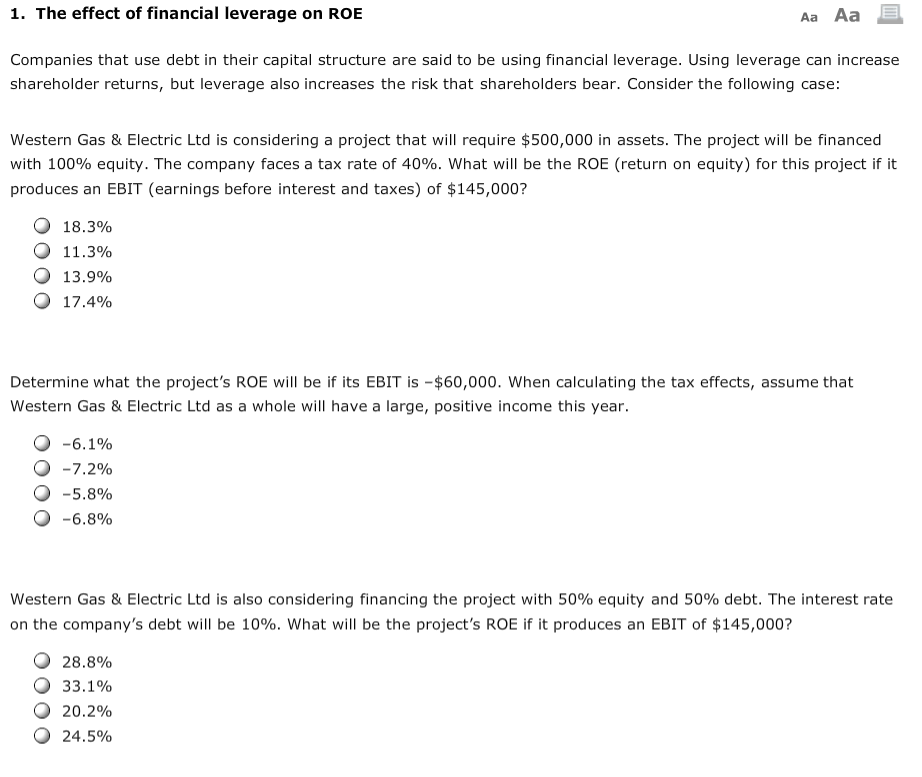

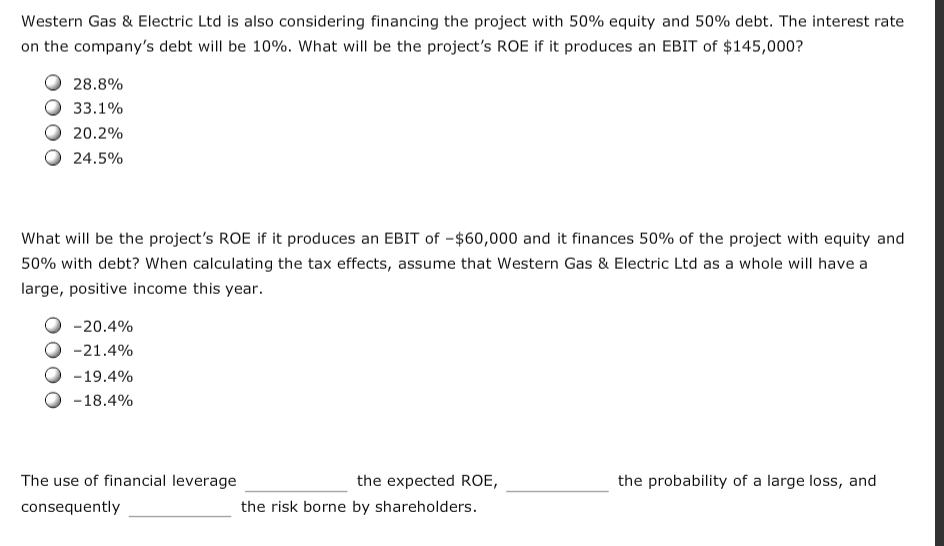

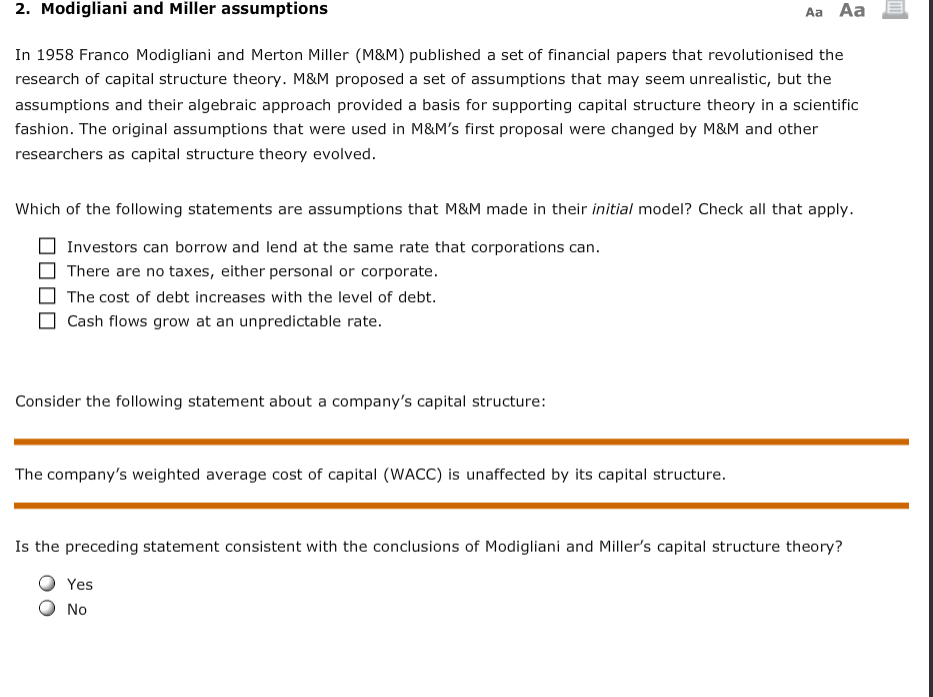

1. The effect of financial leverage on ROE Aa Aa Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear. Consider the following case: Western Gas & Electric Ltd is considering a project that will require $500,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 40%, what will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $145,000? O 18.3% 11.3% O 13.9% O 17.4% Determine what the project's ROE will be if its EBIT is -$60,000. When calculating the tax effects, assume that Western Gas & Electric Ltd as a whole will have a large, positive income this year 0-61% 9-72% 0-58% 0-68% Western Gas & Electric Ltd is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10%, what will be the project's ROE if it produces an EBIT of $145,000? 28.8% O 33.190 o 20.2% 24.5% Western Gas & Electric Ltd is also considering financing the project with 50% equity and 50% debt. The interest rate on the company's debt will be 10%, what will be the project's ROE if it produces an EBIT of $145,000? 28.8% O 33.190 o 20.2% 24.5% What will be the project's ROE if it produces an EBIT of-$60,000 and it finances 50% of the project with equity and 50% with debt? when calculating the tax effects, assume that western Gas & Electric Ltd as a whole will have a arge, positive income this year. O O O O -20.4% -21.4% -19.4% -18.4% The use of financial leverage the expected ROE, the probability of a large loss, and the risk borne by shareholders. consequently 2. Modigliani and Miller assumptions In 1958 Franco Modigliani and Merton Miller (M&M) published a set of financial papers that revolutionised the research of capital structure theory. M&M proposed a set of assumptions that may seem unrealistic, but the assumptions and their algebraic approach provided a basis for supporting capital structure theory in a scientific fashion. The original assumptions that were used in M&M's first proposal were changed by M&M and other researchers as capital structure theory evolved. Which of the following statements are assumptions that M&M made in their initial model? Check all that apply Investors can borrow and lend at the same rate that corporations can There are no taxes, either personal or corporate. The cost of debt increases with the level of debt Cash flows grow at an unpredictable rate. Consider the following statement about a company's capital structure The company's weighted average cost of capital (WACC) is unaffected by its capital structure. Is the preceding statement consistent with the conclusions of Modigliani and Miller's capital structure theory? Yes No