Question

1) The euro depreciates 3.00% against the dollar. How much has the dollar appreciated against the euro? 2) The spot rate is 1.5575 $/ and

1) The euro depreciates 3.00% against the dollar. How much has the dollar appreciated against the euro?

2) The spot rate is 1.5575 $/ and the one-month forward rate 1.5655$/. What is the annualized percentage forward premium (or discount) on the dollar?

4) Suppose that you observe the following exchange rates:

10.9500 / 545.7500/ 49.5000/

Check if there is an arbitrage opportunity and calculate the profits if you start with 5,000,000. Show all transactions and calculations involved in one round of transactions.

6) The current spot rate is 7.4500 / (Indian rupee per Salvadoran colon). Six months ago the spot rate was 7.5100 /. Over the last 6 months, inflation in India was 3.50% annually and inflation in Salvador was 1.80% annually. By how much did the colon () appreciate or depreciate in real terms relative to the rupee ()? Show all calculations.

7) Suppose S0$/ = 0.0810 $/, F9months$/ = 0.0790$/, i9month=2.25% annually, and i9month$=4.50% annually. You are to pay 4,000,000 in nine months. You want to fix the amount you are paying in dollars to avoid foreign exchange risk. Form a forward market hedge and a money market hedge. Show all transactions and calculations for each hedge strategy. Which strategy will you follow and why?

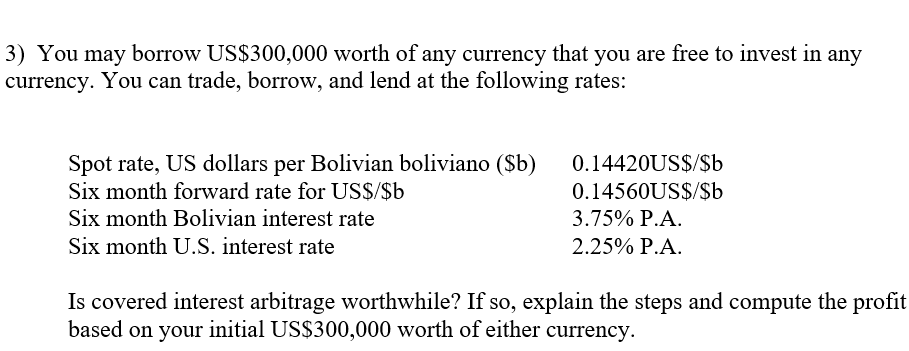

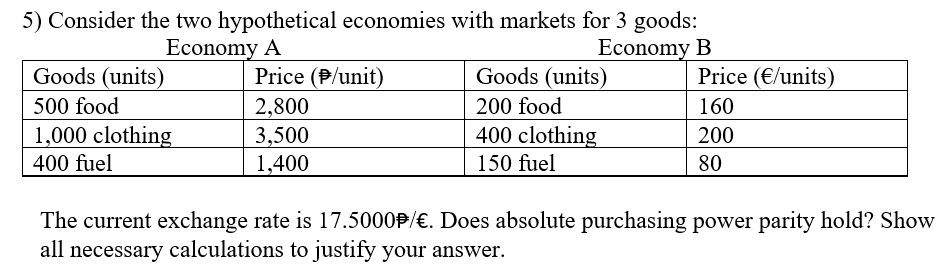

3) You may borrow US$300,000 worth of any currency that you are free to invest in any currency. You can trade, borrow, and lend at the following rates: Spot rate, US dollars per Bolivian boliviano ($b) Six month forward rate for US$/$b Six month Bolivian interest rate Six month U.S. interest rate 0.14420US$/$b 0.14560US$/$b 3.75% P.A. 2.25% P.A. Is covered interest arbitrage worthwhile? If so, explain the steps and compute the profit based on your initial US$300,000 worth of either currency. 5) Consider the two hypothetical economies with markets for 3 goods: Economy A Economy B Goods (units) Price (/unit) Goods (units) Price (/units) 500 food 2,800 200 food 160 1,000 clothing 3,500 400 clothing 200 400 fuel 1,400 150 fuel 80 The current exchange rate is 17.5000P/. Does absolute purchasing power parity hold? Show all necessary calculations to justify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started