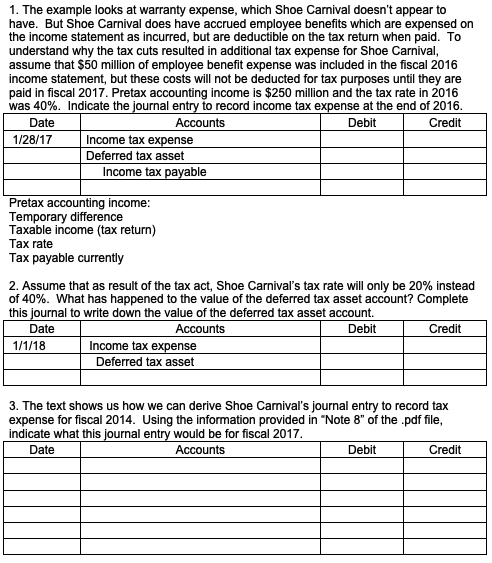

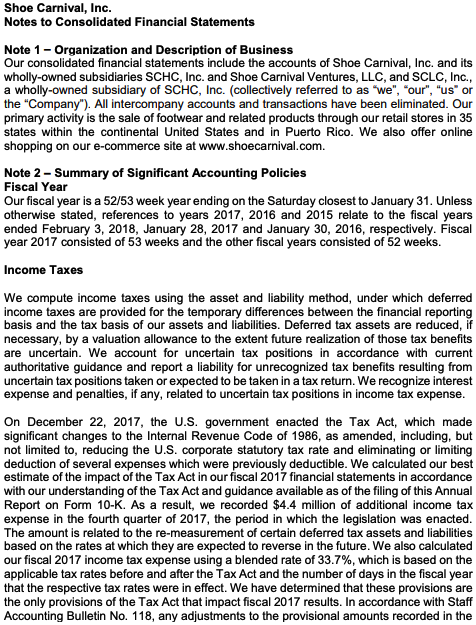

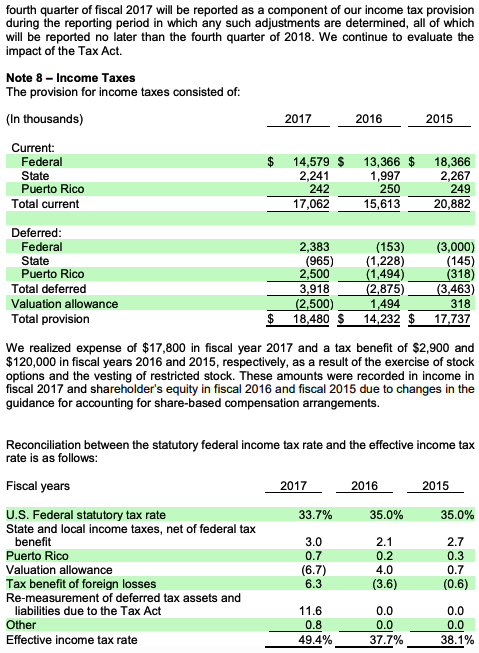

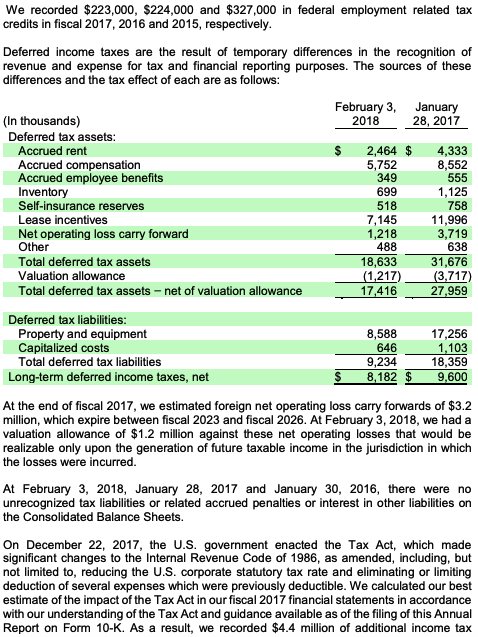

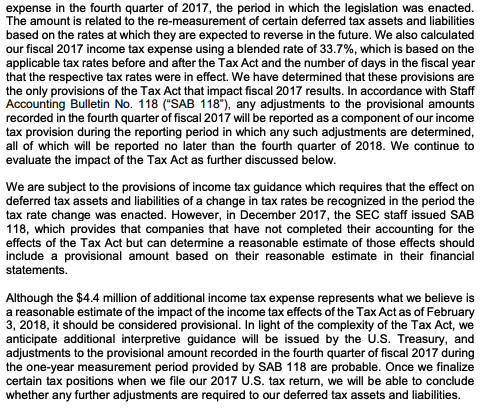

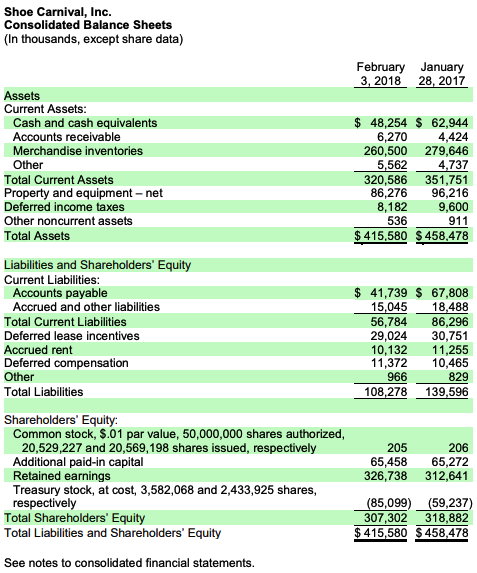

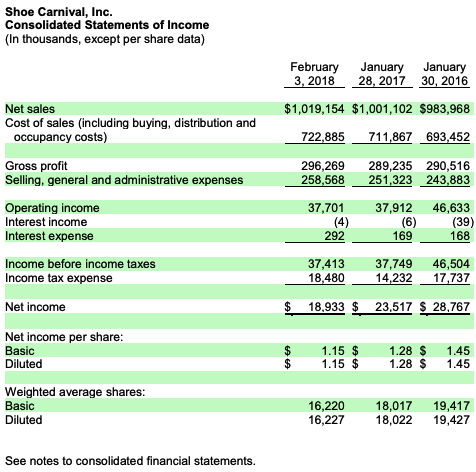

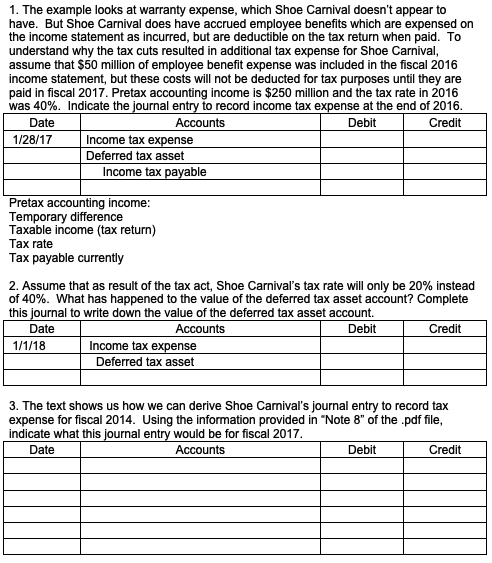

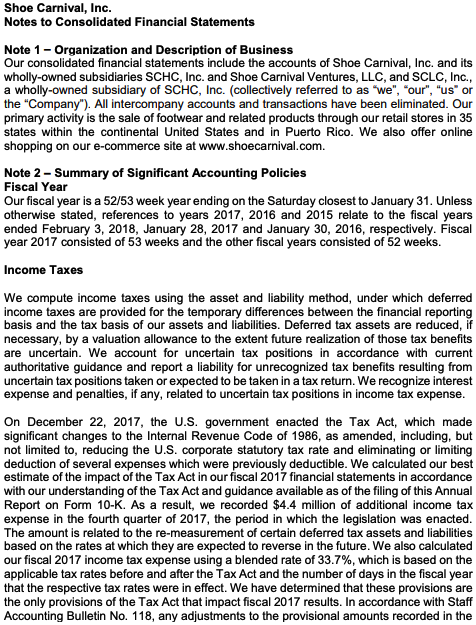

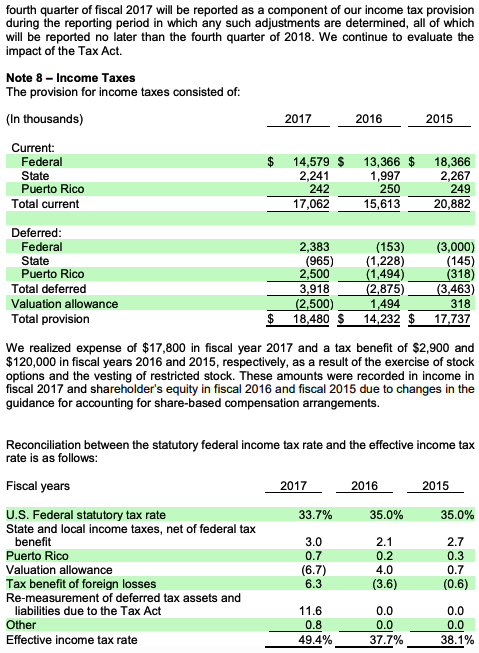

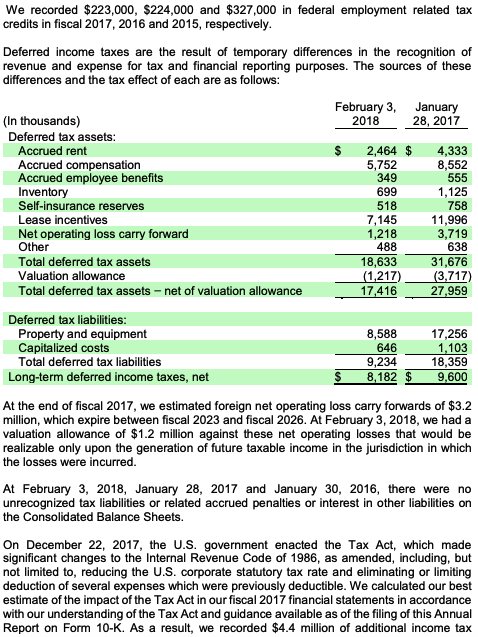

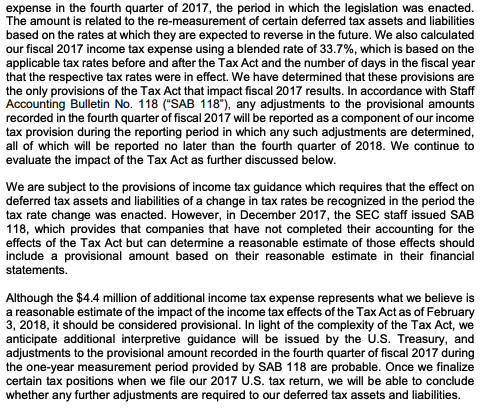

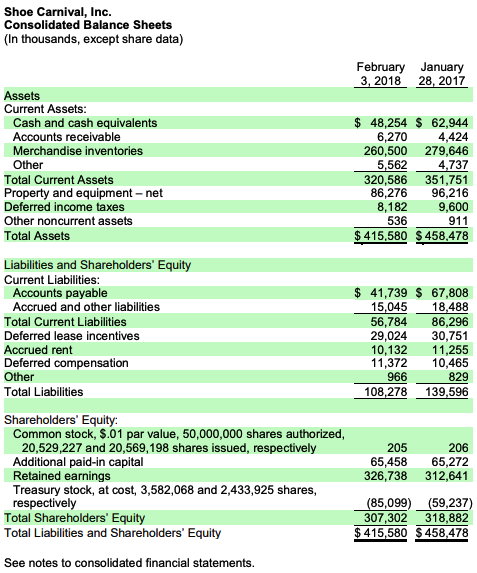

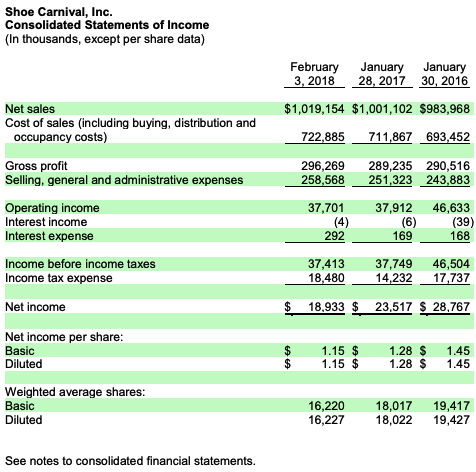

1. The example looks at warranty expense, which Shoe Carnival doesn't appear to have. But Shoe Carnival does have accrued employee benefits which are expensed on the income statement as incurred, but are deductible on the tax return when paid. To understand why the tax cuts resulted in additional tax expense for Shoe Carnival, assume that $50 million of employee benefit expense was included in the fiscal 2016 income statement, but these costs will not be deducted for tax purposes until they are paid in fiscal 2017. Pretax accounting income is $250 million and the tax rate in 2016 was 40%. Indicate the journal entry to record income tax expense at the end of 2016. Date Accounts Debit Credit 1/28/17 Income tax expense Deferred tax asset Income tax payable Pretax accounting income: Temporary difference Taxable income tax return) Tax rate Tax payable currently 2. Assume that as result of the tax act, Shoe Carnival's tax rate will only be 20% instead of 40%. What has happened to the value of the deferred tax asset account? Complete this journal to write down the value of the deferred tax asset account. Date Accounts Debit Credit 1/1/18 Income tax expense Deferred tax asset 3. The text shows us how we can derive Shoe Carnival's journal entry to record tax expense for fiscal 2014. Using the information provided in "Note 8" of the .pdf file, indicate what this journal entry would be for fiscal 2017 Date Accounts 1 Debit Credit Shoe Carnival, Inc. Notes to Consolidated Financial Statements Note 1 - Organization and Description of Business Our consolidated financial statements include the accounts of Shoe Carnival, Inc. and its wholly-owned subsidiaries SCHC, Inc. and Shoe Carnival Ventures, LLC, and SCLC, Inc., a wholly-owned subsidiary of SCHC, Inc. (collectively referred to as "we", "our", "us" or the "Company ). All intercompany accounts and transactions have been eliminated. Our primary activity is the sale of footwear and related products through our retail stores in 35 states within the continental United States and in Puerto Rico. We also offer online shopping on our e-commerce site at www.shoecarnival.com. Note 2 - Summary of Significant Accounting Policies Fiscal Year Our fiscal year is a 52/53 week year ending on the Saturday closest to January 31. Unless otherwise stated, references to years 2017, 2016 and 2015 relate to the fiscal years ended February 3, 2018, January 28, 2017 and January 30, 2016, respectively. Fiscal year 2017 consisted of 53 weeks and the other fiscal years consisted of 52 weeks. Income Taxes We compute income taxes using the asset and liability method, under which deferred income taxes are provided for the temporary differences between the financial reporting basis and the tax basis of our assets and liabilities. Deferred tax assets are reduced, If necessary, by a valuation allowance to the extent future realization of those tax benefits are uncertain. We account for uncertain tax positions in accordance with current authoritative guidance and report a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. We recognize interest expense and penalties, if any, related to uncertain tax positions in income tax expense. On December 22, 2017, the U.S. government enacted the Tax Act, which made significant changes to the Internal Revenue Code of 1986, as amended, including, but not limited to, reducing the U.S. corporate statutory tax rate and eliminating or limiting deduction of several expenses which were previously deductible. We calculated our best estimate of the impact of the Tax Act in our fiscal 2017 financial statements in accordance with our understanding of the Tax Act and guidance available as of the filing of this Annual Report on Form 10-K. As a result, we recorded $4.4 million of additional income tax expense in the fourth quarter of 2017, the period in which the legislation was enacted. The amount is related to the re-measurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future. We also calculated our fiscal 2017 income tax expense using a blended rate of 33.7%, which is based on the applicable tax rates before and after the Tax Act and the number of days in the fiscal year that the respective tax rates were in effect. We have determined that these provisions are the only provisions of the Tax Act that impact fiscal 2017 results. In accordance with Staff Accounting Bulletin No. 118, any adjustments to the provisional amounts recorded in the fourth quarter of fiscal 2017 will be reported as a component of our income tax provision during the reporting period in which any such adjustments are determined, all of which will be reported no later than the fourth quarter of 2018. We continue to evaluate the impact of the Tax Act. Note 8-Income Taxes The provision for income taxes consisted of: (In thousands) 2017 2016 2015 $ Current: Federal State Puerto Rico Total current 14,579 $ 13,366 $ 18,366 2.241 1,997 2,267 242250249 17,062 15,613 20,882 Deferred: Federal State Puerto Rico Total deferred Valuation allowance Total provision 2,383 (965) 2,500 3,918 (2,500) 18,480 $ (153) (1,228) (1,494) (2,875) 1,494 14,232 $ (3,000) (145) (318) (3,463) 318 17.737 $ xpense of $17,800 in fiscal year 2017 and a tax benefit of $2,900 and $120,000 in fiscal years 2016 and 2015, respectively, as a result of the exercise of stock options and the vesting of restricted stock. These amounts were recorded in income in fiscal 2017 and shareholder's equity in fiscal 2016 and fiscal 2015 due to changes in the guidance for accounting for share-based compensation arrangements. Reconciliation between the statutory federal income tax rate and the effective income tax rate is as follows: Fiscal years 2016 2015 2017 33.7% 35.0% 35.0% 3.0 2.1 2.7 0.7 U.S. Federal statutory tax rate State and local income taxes, net of federal tax benefit Puerto Rico Valuation allowance Tax benefit of foreign losses Re-measurement of deferred tax assets and liabilities due to the Tax Act Other Effective income tax rate (6.7) 6.3 0.3 0.7 (0.6) (3.6) 0.0 11.6 0.8 49.4% 0.0 37.7% 38.1% We recorded $223,000, $224,000 and $327,000 in federal employment related tax credits in fiscal 2017, 2016 and 2015, respectively. Deferred income taxes are the result of temporary differences in the recognition of revenue and expense for tax and financial reporting purposes. The sources of these differences and the tax effect of each are as follows: February 3, 2018 January 28, 2017 $ (In thousands) Deferred tax assets: Accrued rent Accrued compensation Accrued employee benefits Inventory Self-insurance reserves Lease incentives Net operating loss carry forward Other Total deferred tax assets Valuation allowance Total deferred tax assets - net of valuation allowance 2,464 $ 5,752 349 699 518 7,145 1,218 488 18,633 (1,217) 17,416 4,333 8,552 555 1,125 758 11.996 3,719 638 31,676 (3,717) 27,959 Deferred tax liabilities: Property and equipment Capitalized costs Total deferred tax liabilities Long-term deferred income taxes, net 8,588 646 9,234 8,182 $ 17,256 1,103 18,359 9,600 $ At the end of fiscal 2017, we estimated foreign net operating loss carry forwards of $3.2 million, which expire between fiscal 2023 and fiscal 2026. At February 3, 2018, we had a valuation allowance of $1.2 million against these net operating losses that would be realizable only upon the generation of future taxable income in the jurisdiction in which the losses were incurred. At February 3, 2018, January 28, 2017 and January 30, 2016, there were no unrecognized tax liabilities or related accrued penalties or interest in other liabilities on the Consolidated Balance Sheets. On December 22, 2017, the U.S. government enacted the Tax Act, which made significant changes to the Internal Revenue Code of 1986, as amended, including, but not limited to, reducing the U.S. corporate statutory tax rate and eliminating or limitir deduction of several expenses which were previously deductible. We calculated our best estimate of the impact of the Tax Act in our fiscal 2017 financial statements in accordance with our understanding of the Tax Act and guidance available as of the filing of this Annual Report on Form 10-K. As a result, we recorded $4.4 million of additional income tax expense in the fourth quarter of 2017, the period in which the legislation was enacted. The amount is related to the re-measurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future. We also calculated our fiscal 2017 income tax expense using a blended rate of 33.7%, which is based on the applicable tax rates before and after the Tax Act and the number of days in the fiscal year that the respective tax rates were in effect. We have determined that these provisions are the only provisions of the Tax Act that impact fiscal 2017 results. In accordance with Staff Accounting Bulletin No. 118 ("SAB 118"), any adjustments to the provisional amounts recorded in the fourth quarter of fiscal 2017 will be reported as a component of our income tax provision during the reporting period in which any such adjustments are determined, all of which will be reported no later than the fourth quarter of 2018. We continue to evaluate the impact of the Tax Act as further discussed below. We are subject to the provisions of income tax guidance which requires that the effect on deferred tax assets and liabilities of a change in tax rates be recognized in the period the tax rate change was enacted. However, in December 2017, the SEC staff issued SAB 118, which provides that companies that have not completed their accounting for the effects of the Tax Act but can determine a reasonable estimate of those effects should include a provisional amount based on their reasonable estimate in their financial statements. Although the $4.4 million of additional income tax expense represents what we believe is a reasonable estimate of the impact of the income tax effects of the Tax Act as of February 3, 2018, it should be considered provisional. In light of the complexity of the Tax Act, we anticipate additional interpretive guidance will be issued by the U.S. Treasury, and adjustments to the provisional amount recorded in the fourth quarter of fiscal 2017 during the one-year measurement period provided by SAB 118 are probable. Once we finalize certain tax positions when we file our 2017 U.S. tax return, we will be able to conclude whether any further adjustments are required to our deferred tax assets and liabilities. Shoe Carnival, Inc. Consolidated Balance Sheets (In thousands, except share data) February 3, 2018 January 28, 2017 Assets Current Assets: Cash and cash equivalents Accounts receivable Merchandise inventories Other Total Current Assets Property and equipment-net Deferred income taxes Other noncurrent assets Total Assets $ 48,254 $ 62,944 6,270 4,424 260,500 279,646 5,562 4.737 320,586 351,751 86,276 96,216 8,182 9,600 536 911 $ 415,580 $ 458,478 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable Accrued and other liabilities Total Current Liabilities Deferred lease incentives Accrued rent Deferred compensation Other Total Liabilities $ 41,739 $ 67,808 15,045 18,488 56,784 86.296 29,024 30,751 10,132 11.255 11,372 10,465 966 829 108,278 139,596 Shareholders' Equity: Common stock, $.01 par value, 50,000,000 shares authorized, 20,529,227 and 20,569,198 shares issued, respectively Additional paid-in capital Retained earnings Treasury stock, at cost, 3,582,068 and 2,433,925 shares, respectively Total Shareholders' Equity Total Liabilities and Shareholders' Equity 205 65,458 326,738 206 65,272 312,641 (85,099) (59,237) 307,302 318,882 $415,580 $ 458,478 See notes to consolidated financial statements. Shoe Carnival, Inc. Consolidated Statements of Income (In thousands, except per share data) February 3, 2018 January 28, 2017 January 30, 2016 $1,019,154 $1,001,102 $983,968 Net sales Cost of sales (including buying, distribution and occupancy costs) 722,885 711,867 693,452 Gross profit Selling, general and administrative expenses 296,269 258,568 289,235 290,516 251,323 243,883 Operating income Interest income Interest expense 37,701 (4) 292 37,912 (6) 169 46,633 (39) 168 Income before income taxes Income tax expense 37,413 18,480 37,749 14,232 46,504 17,737 Net income $ 18,933 $ 23,517 $ 28,767 Net income per share: Basic Diluted $ $ 1.15 $ 1.15 $ 1.28 $ 1.28 $ 1.45 1.45 Weighted average shares: Basic Diluted 16,220 16,227 18,017 18,022 19,417 19,427 See notes to consolidated financial statements. 1. The example looks at warranty expense, which Shoe Carnival doesn't appear to have. But Shoe Carnival does have accrued employee benefits which are expensed on the income statement as incurred, but are deductible on the tax return when paid. To understand why the tax cuts resulted in additional tax expense for Shoe Carnival, assume that $50 million of employee benefit expense was included in the fiscal 2016 income statement, but these costs will not be deducted for tax purposes until they are paid in fiscal 2017. Pretax accounting income is $250 million and the tax rate in 2016 was 40%. Indicate the journal entry to record income tax expense at the end of 2016. Date Accounts Debit Credit 1/28/17 Income tax expense Deferred tax asset Income tax payable Pretax accounting income: Temporary difference Taxable income tax return) Tax rate Tax payable currently 2. Assume that as result of the tax act, Shoe Carnival's tax rate will only be 20% instead of 40%. What has happened to the value of the deferred tax asset account? Complete this journal to write down the value of the deferred tax asset account. Date Accounts Debit Credit 1/1/18 Income tax expense Deferred tax asset 3. The text shows us how we can derive Shoe Carnival's journal entry to record tax expense for fiscal 2014. Using the information provided in "Note 8" of the .pdf file, indicate what this journal entry would be for fiscal 2017 Date Accounts 1 Debit Credit Shoe Carnival, Inc. Notes to Consolidated Financial Statements Note 1 - Organization and Description of Business Our consolidated financial statements include the accounts of Shoe Carnival, Inc. and its wholly-owned subsidiaries SCHC, Inc. and Shoe Carnival Ventures, LLC, and SCLC, Inc., a wholly-owned subsidiary of SCHC, Inc. (collectively referred to as "we", "our", "us" or the "Company ). All intercompany accounts and transactions have been eliminated. Our primary activity is the sale of footwear and related products through our retail stores in 35 states within the continental United States and in Puerto Rico. We also offer online shopping on our e-commerce site at www.shoecarnival.com. Note 2 - Summary of Significant Accounting Policies Fiscal Year Our fiscal year is a 52/53 week year ending on the Saturday closest to January 31. Unless otherwise stated, references to years 2017, 2016 and 2015 relate to the fiscal years ended February 3, 2018, January 28, 2017 and January 30, 2016, respectively. Fiscal year 2017 consisted of 53 weeks and the other fiscal years consisted of 52 weeks. Income Taxes We compute income taxes using the asset and liability method, under which deferred income taxes are provided for the temporary differences between the financial reporting basis and the tax basis of our assets and liabilities. Deferred tax assets are reduced, If necessary, by a valuation allowance to the extent future realization of those tax benefits are uncertain. We account for uncertain tax positions in accordance with current authoritative guidance and report a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken in a tax return. We recognize interest expense and penalties, if any, related to uncertain tax positions in income tax expense. On December 22, 2017, the U.S. government enacted the Tax Act, which made significant changes to the Internal Revenue Code of 1986, as amended, including, but not limited to, reducing the U.S. corporate statutory tax rate and eliminating or limiting deduction of several expenses which were previously deductible. We calculated our best estimate of the impact of the Tax Act in our fiscal 2017 financial statements in accordance with our understanding of the Tax Act and guidance available as of the filing of this Annual Report on Form 10-K. As a result, we recorded $4.4 million of additional income tax expense in the fourth quarter of 2017, the period in which the legislation was enacted. The amount is related to the re-measurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future. We also calculated our fiscal 2017 income tax expense using a blended rate of 33.7%, which is based on the applicable tax rates before and after the Tax Act and the number of days in the fiscal year that the respective tax rates were in effect. We have determined that these provisions are the only provisions of the Tax Act that impact fiscal 2017 results. In accordance with Staff Accounting Bulletin No. 118, any adjustments to the provisional amounts recorded in the fourth quarter of fiscal 2017 will be reported as a component of our income tax provision during the reporting period in which any such adjustments are determined, all of which will be reported no later than the fourth quarter of 2018. We continue to evaluate the impact of the Tax Act. Note 8-Income Taxes The provision for income taxes consisted of: (In thousands) 2017 2016 2015 $ Current: Federal State Puerto Rico Total current 14,579 $ 13,366 $ 18,366 2.241 1,997 2,267 242250249 17,062 15,613 20,882 Deferred: Federal State Puerto Rico Total deferred Valuation allowance Total provision 2,383 (965) 2,500 3,918 (2,500) 18,480 $ (153) (1,228) (1,494) (2,875) 1,494 14,232 $ (3,000) (145) (318) (3,463) 318 17.737 $ xpense of $17,800 in fiscal year 2017 and a tax benefit of $2,900 and $120,000 in fiscal years 2016 and 2015, respectively, as a result of the exercise of stock options and the vesting of restricted stock. These amounts were recorded in income in fiscal 2017 and shareholder's equity in fiscal 2016 and fiscal 2015 due to changes in the guidance for accounting for share-based compensation arrangements. Reconciliation between the statutory federal income tax rate and the effective income tax rate is as follows: Fiscal years 2016 2015 2017 33.7% 35.0% 35.0% 3.0 2.1 2.7 0.7 U.S. Federal statutory tax rate State and local income taxes, net of federal tax benefit Puerto Rico Valuation allowance Tax benefit of foreign losses Re-measurement of deferred tax assets and liabilities due to the Tax Act Other Effective income tax rate (6.7) 6.3 0.3 0.7 (0.6) (3.6) 0.0 11.6 0.8 49.4% 0.0 37.7% 38.1% We recorded $223,000, $224,000 and $327,000 in federal employment related tax credits in fiscal 2017, 2016 and 2015, respectively. Deferred income taxes are the result of temporary differences in the recognition of revenue and expense for tax and financial reporting purposes. The sources of these differences and the tax effect of each are as follows: February 3, 2018 January 28, 2017 $ (In thousands) Deferred tax assets: Accrued rent Accrued compensation Accrued employee benefits Inventory Self-insurance reserves Lease incentives Net operating loss carry forward Other Total deferred tax assets Valuation allowance Total deferred tax assets - net of valuation allowance 2,464 $ 5,752 349 699 518 7,145 1,218 488 18,633 (1,217) 17,416 4,333 8,552 555 1,125 758 11.996 3,719 638 31,676 (3,717) 27,959 Deferred tax liabilities: Property and equipment Capitalized costs Total deferred tax liabilities Long-term deferred income taxes, net 8,588 646 9,234 8,182 $ 17,256 1,103 18,359 9,600 $ At the end of fiscal 2017, we estimated foreign net operating loss carry forwards of $3.2 million, which expire between fiscal 2023 and fiscal 2026. At February 3, 2018, we had a valuation allowance of $1.2 million against these net operating losses that would be realizable only upon the generation of future taxable income in the jurisdiction in which the losses were incurred. At February 3, 2018, January 28, 2017 and January 30, 2016, there were no unrecognized tax liabilities or related accrued penalties or interest in other liabilities on the Consolidated Balance Sheets. On December 22, 2017, the U.S. government enacted the Tax Act, which made significant changes to the Internal Revenue Code of 1986, as amended, including, but not limited to, reducing the U.S. corporate statutory tax rate and eliminating or limitir deduction of several expenses which were previously deductible. We calculated our best estimate of the impact of the Tax Act in our fiscal 2017 financial statements in accordance with our understanding of the Tax Act and guidance available as of the filing of this Annual Report on Form 10-K. As a result, we recorded $4.4 million of additional income tax expense in the fourth quarter of 2017, the period in which the legislation was enacted. The amount is related to the re-measurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future. We also calculated our fiscal 2017 income tax expense using a blended rate of 33.7%, which is based on the applicable tax rates before and after the Tax Act and the number of days in the fiscal year that the respective tax rates were in effect. We have determined that these provisions are the only provisions of the Tax Act that impact fiscal 2017 results. In accordance with Staff Accounting Bulletin No. 118 ("SAB 118"), any adjustments to the provisional amounts recorded in the fourth quarter of fiscal 2017 will be reported as a component of our income tax provision during the reporting period in which any such adjustments are determined, all of which will be reported no later than the fourth quarter of 2018. We continue to evaluate the impact of the Tax Act as further discussed below. We are subject to the provisions of income tax guidance which requires that the effect on deferred tax assets and liabilities of a change in tax rates be recognized in the period the tax rate change was enacted. However, in December 2017, the SEC staff issued SAB 118, which provides that companies that have not completed their accounting for the effects of the Tax Act but can determine a reasonable estimate of those effects should include a provisional amount based on their reasonable estimate in their financial statements. Although the $4.4 million of additional income tax expense represents what we believe is a reasonable estimate of the impact of the income tax effects of the Tax Act as of February 3, 2018, it should be considered provisional. In light of the complexity of the Tax Act, we anticipate additional interpretive guidance will be issued by the U.S. Treasury, and adjustments to the provisional amount recorded in the fourth quarter of fiscal 2017 during the one-year measurement period provided by SAB 118 are probable. Once we finalize certain tax positions when we file our 2017 U.S. tax return, we will be able to conclude whether any further adjustments are required to our deferred tax assets and liabilities. Shoe Carnival, Inc. Consolidated Balance Sheets (In thousands, except share data) February 3, 2018 January 28, 2017 Assets Current Assets: Cash and cash equivalents Accounts receivable Merchandise inventories Other Total Current Assets Property and equipment-net Deferred income taxes Other noncurrent assets Total Assets $ 48,254 $ 62,944 6,270 4,424 260,500 279,646 5,562 4.737 320,586 351,751 86,276 96,216 8,182 9,600 536 911 $ 415,580 $ 458,478 Liabilities and Shareholders' Equity Current Liabilities: Accounts payable Accrued and other liabilities Total Current Liabilities Deferred lease incentives Accrued rent Deferred compensation Other Total Liabilities $ 41,739 $ 67,808 15,045 18,488 56,784 86.296 29,024 30,751 10,132 11.255 11,372 10,465 966 829 108,278 139,596 Shareholders' Equity: Common stock, $.01 par value, 50,000,000 shares authorized, 20,529,227 and 20,569,198 shares issued, respectively Additional paid-in capital Retained earnings Treasury stock, at cost, 3,582,068 and 2,433,925 shares, respectively Total Shareholders' Equity Total Liabilities and Shareholders' Equity 205 65,458 326,738 206 65,272 312,641 (85,099) (59,237) 307,302 318,882 $415,580 $ 458,478 See notes to consolidated financial statements. Shoe Carnival, Inc. Consolidated Statements of Income (In thousands, except per share data) February 3, 2018 January 28, 2017 January 30, 2016 $1,019,154 $1,001,102 $983,968 Net sales Cost of sales (including buying, distribution and occupancy costs) 722,885 711,867 693,452 Gross profit Selling, general and administrative expenses 296,269 258,568 289,235 290,516 251,323 243,883 Operating income Interest income Interest expense 37,701 (4) 292 37,912 (6) 169 46,633 (39) 168 Income before income taxes Income tax expense 37,413 18,480 37,749 14,232 46,504 17,737 Net income $ 18,933 $ 23,517 $ 28,767 Net income per share: Basic Diluted $ $ 1.15 $ 1.15 $ 1.28 $ 1.28 $ 1.45 1.45 Weighted average shares: Basic Diluted 16,220 16,227 18,017 18,022 19,417 19,427 See notes to consolidated financial statements