Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The executor, Kariuki, took an inventory of the assets of the testator and determined their fair value at the time of Dennis's death

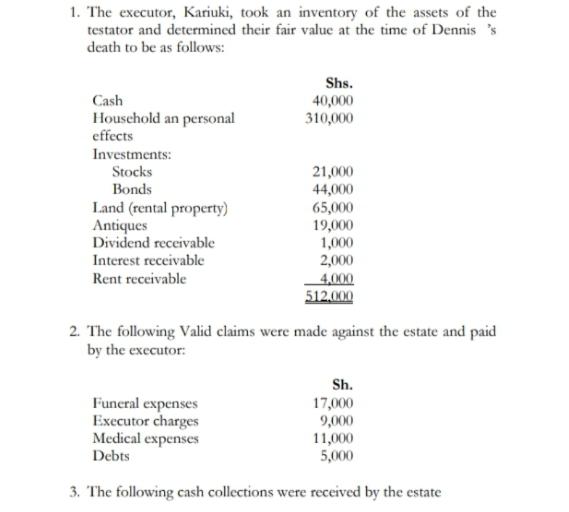

1. The executor, Kariuki, took an inventory of the assets of the testator and determined their fair value at the time of Dennis's death to be as follows: Shs. Cash 40,000 Household an personal 310,000 effects Investments: Stocks 21,000 Bonds 44,000 Land (rental property) 65,000 Antiques 19,000 Dividend receivable 1,000 Interest receivable 2,000 Rent receivable 4,000 512,000 2. The following Valid claims were made against the estate and paid by the executor: Sh. Funeral expenses 17,000 Executor charges 9,000 Medical expenses 11,000 Debts 5,000 3. The following cash collections were received by the estate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the estate accounting we need to determine the total value of the estates assets account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started