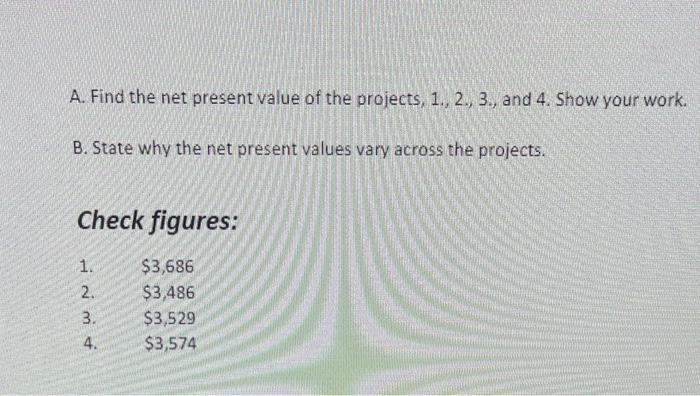

1. The first situation is that the initial investment only requires working capital. Suppose the payments to vendors must be settled 20 days after purchase, and we extend credit to customers so that they can settle in 30 days. That's 10 days where we've made a payment to the vendors and we are waiting to recover the cash from our customers. The cash used as a stockpile to stay current with vendors. When the project is over, the cash can be returned to general use. Working capital cash is not not deductible when the company first sets it aside and it is not taxable when the the cash is returned to general use. 2,3 , and 4. The other situations involve purchases of equipment. The cost of the equipment is depreciable. Following the notion from about page 109 in the text, each year Taxes =( Revenue Other Expenses - Depreciation Expense) "tax rate Cash Flow = Revenue Other Expenses - Taxes The situations, 2.,3, and 4., vary the time over which the cost is depreciated. When there is a timevalue for money, we would expect to see more depreciation save taxes and result in higher net cash earlier. The higher net cash earlier should result in a higher net present value. Able Company has a possible project. It takes an initial investment of $1,000, and will produce ten years of net cash flows of $1,000 each year before taxes. Taxes are assessed at 30 percent. The time value of money is 10 percent. We will compute the present value of the project under a variety of circumstances. 1. Suppose the $1,000 initial investment is money that we put aside for working capital. Working capital includes money we use in a cycle to pay vendors while we wait for collections from customers. At the end of the ten years, we can recover the $1,000. The $1,000 is not deductible for tax purposes and not taxable when we recover it. 2. Suppose the $1,000 initial investment is investment in equipment that will be depreciated for tax purposes. The depreciation is taken straight line. That's $100 of depreciation each year. 3. Suppose the $1,000 initial investment is investment in equipment that will be depreciated for tax purposes. The depreciation is taken as accelerated depreciation of $200 for five years and no depreciation for the second five vears. 4. Suppose the $1,000 initial investment is expensed off entirely in the first year for tax purposes. A. Find the net present value of the projects, 1., 2., 3., and 4. Show your work. B. State why the net present values vary across the projects