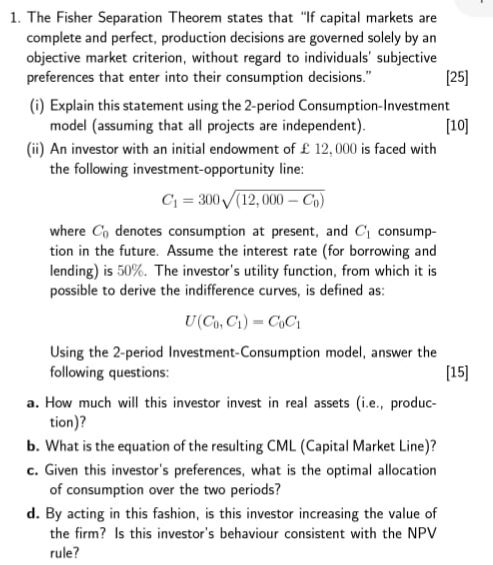

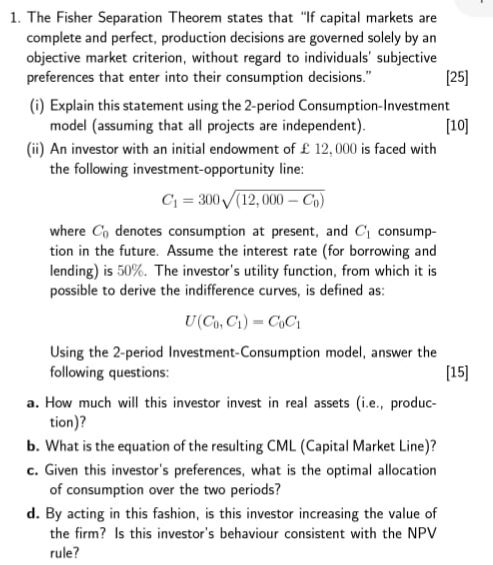

1. The Fisher Separation Theorem states that "If capital markets are complete and perfect, production decisions are governed solely by an objective market criterion, without regard to individuals' subjective preferences that enter into their consumption decisions." (25) (1) Explain this statement using the 2-period Consumption Investment model (assuming that all projects are independent). [10] (ii) An investor with an initial endowment of 12,000 is faced with the following investment opportunity line: G = 300 (12,000 - Co) where Codenotes consumption at present, and consump- tion in the future. Assume the interest rate (for borrowing and lending) is 50%. The investor's utility function, from which it is possible to derive the indifference curves, is defined as: U(Co,C) -CC Using the 2-period Investment Consumption model, answer the following questions: (15) a. How much will this investor invest in real assets (i.e, produc- tion)? b. What is the equation of the resulting CML (Capital Market Line)? c. Given this investor's preferences, what is the optimal allocation of consumption over the two periods? d. By acting in this fashion, is this investor increasing the value of the firm? Is this investor's behaviour consistent with the NPV rule? 1. The Fisher Separation Theorem states that "If capital markets are complete and perfect, production decisions are governed solely by an objective market criterion, without regard to individuals' subjective preferences that enter into their consumption decisions." (25) (1) Explain this statement using the 2-period Consumption Investment model (assuming that all projects are independent). [10] (ii) An investor with an initial endowment of 12,000 is faced with the following investment opportunity line: G = 300 (12,000 - Co) where Codenotes consumption at present, and consump- tion in the future. Assume the interest rate (for borrowing and lending) is 50%. The investor's utility function, from which it is possible to derive the indifference curves, is defined as: U(Co,C) -CC Using the 2-period Investment Consumption model, answer the following questions: (15) a. How much will this investor invest in real assets (i.e, produc- tion)? b. What is the equation of the resulting CML (Capital Market Line)? c. Given this investor's preferences, what is the optimal allocation of consumption over the two periods? d. By acting in this fashion, is this investor increasing the value of the firm? Is this investor's behaviour consistent with the NPV rule