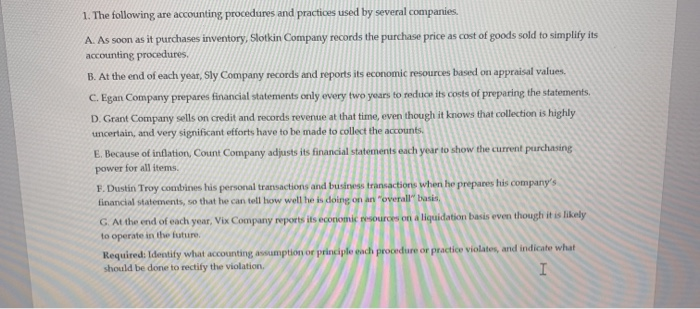

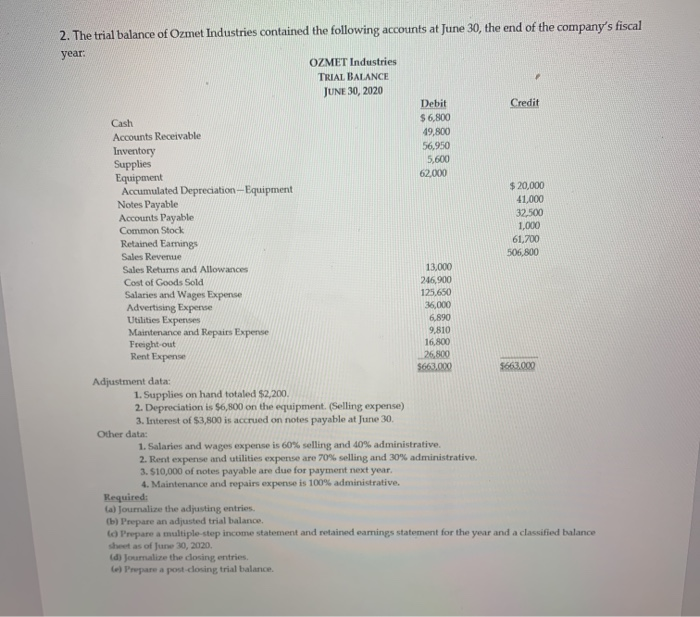

1. The following are accounting procedures and practices used by several companies. A. As soon as it purchases inventory, Slotkin Company records the purchase price as cost of goods sold to simplify its accounting procedures. B. At the end of each year, Sly Company records and reports its economic resources based on appraisal values. C.Egan Company prepares financial statements only every two years to reduce its costs of preparing the statements. D. Grant Company sells on credit and records revenue at that time, even though it knows that collection is highly uncertain, and very significant efforts have to be made to collect the accounts. E. Because of inflation, Count Company adjusts its financial statements each year to show the current purchasing power for all items. F. Dustin Troy combines his personal transactions and business transactions when he prepares his company's financial statements, so that he can tell how well he is doing on an "overall" basis G. At the end of each year, Vix Company reports its economic resources on a liquidation basis even though it is likely to operate in the future. Required: Identity what accounting assumption or principle each procedure or practice violates, and indicate what should be done to rectify the violation I 2. The trial balance of Ozmet Industries contained the following accounts at June 30, the end of the company's fiscal year: OZMET Industries TRIAL BALANCE JUNE 30, 2020 Debit Credit Cash $ 6,800 Accounts Receivable 49,800 Inventory 56,950 Supplies 5,600 Equipment 62000 Accumulated Depreciation--Equipment $ 20,000 Notes Payable 41,000 Accounts Payable 32,500 Common Stock 1,000 Retained Earnings 61.700 Sales Revenue 506,800 Sales Returns and Allowances 13,000 Cost of Goods Sold 246,900 Salaries and Wages Expense 125.650 Advertising Expense 36,000 Utilities Expenses 6.890 Maintenance and Repairs Expense 9,810 Freight-out 16.800 Rent Expense 26.800 $663.000 $663.000 Adjustment data: 1. Supplies on hand totaled $2,200 2. Depreciation is $6,800 on the equipment. (Selling expense) 3. Interest of $3,800 is accrued on notes payable at June 30 Other data: 1. Salaries and wages expense is 60% selling and 40% administrative 2. Rent expense and utilities expense are 70% selling and 30% administrative. 3. $10,000 of notes payable are due for payment next year. 4. Maintenance and repairs expense is 100% administrative, Required: (a) Journalize the adjusting entries. b) Prepare an adjusted trial balance to Prepare a multiple step income statement and retained earnings statement for the year and a classified balance sheet as of June 30, 2020. (d) Joumalize the closing entries 6) Prepare a post-closing trial balance