Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The following are the internal users of an organization, except: A. Owners and managers. B. Securities Commission and potential customers. C. Storekeeper and employee.

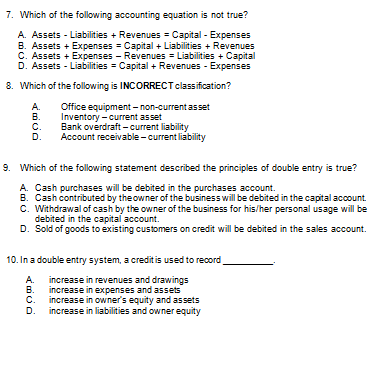

1. The following are the internal users of an organization, except: A. Owners and managers. B. Securities Commission and potential customers. C. Storekeeper and employee. D. Internal auditor and accountant. 2. is the last step in the accounting cycle. A. Preparation of financial statements. B. Postings the transactions from journal to ledgers. C. Recording the accounting adjustments. D. Analysis of financial statements 3. An asset is recorded at its original price This is to fulfil which qualitafivecharacteristic of financial information or accounting concept? A. Completeness B. Economic entity concept C. Historical cost concept D. confirmatory value 4. Which of the following is not true concerning a conceptual framework in accounting concept? A. It allows preparers to solve practical problem more quickly by reference to it. B. To assist MASB in developing MFRS Standards C. It should be a basis on fundamental truths that are derived from the laws of nature. D. None of the above. 5. The fundamental qualitafive characteristic of conceptual framework is A. economic entity B. Going concern C. Truthful representation D. Free from error 6. The depreciation method was used for the last accounting year, and it should be used for the current and future accounting period as to comply with A. Consistency concept B. Going concern concept C. Money measurement concept D. Completeness concept 7. Which of the following accounting equation is not true? A. Assets - Liabilities + Revenues = Capital - Expenses B. Assets + Expenses = Capital + Liabilities + Revenues C. Assets + Expenses - Revenues = Liabilities + Capital D. Assets - Liabilities = Capital + Revenues - Expenses 8. Which of the following is INCORRECT classification? A. Office equipment - non-current asset B. Inventory - current asset C. Bank overdraft - current liability D. Account receivable - current liability 9. Which of the following statement described the principles of double entry is true? A. Cash purchases will be debited in the purchases account. B. Cash contributed by theowner of the business will be debited in the capital account. C. Withdrawal of cash by the owner of the business for his/her personal usage will be debited in the capital account. D. Sold of goods to existing customers on credit will be debited in the sales account. 10. In a double entry system, a credit is used to record A. increase in revenues and drawings B. increase in expenses and assets C. increase in owner's equity and assets D. increase in liabilities and owner equity 1. The following are the internal users of an organization, except: A. Owners and managers. B. Securities Commission and potential customers. C. Storekeeper and employee. D. Internal auditor and accountant. 2. is the last step in the accounting cycle. A. Preparation of financial statements. B. Postings the transactions from journal to ledgers. C. Recording the accounting adjustments. D. Analysis of financial statements 3. An asset is recorded at its original price This is to fulfil which qualitafivecharacteristic of financial information or accounting concept? A. Completeness B. Economic entity concept C. Historical cost concept D. confirmatory value 4. Which of the following is not true concerning a conceptual framework in accounting concept? A. It allows preparers to solve practical problem more quickly by reference to it. B. To assist MASB in developing MFRS Standards C. It should be a basis on fundamental truths that are derived from the laws of nature. D. None of the above. 5. The fundamental qualitafive characteristic of conceptual framework is A. economic entity B. Going concern C. Truthful representation D. Free from error 6. The depreciation method was used for the last accounting year, and it should be used for the current and future accounting period as to comply with A. Consistency concept B. Going concern concept C. Money measurement concept D. Completeness concept 7. Which of the following accounting equation is not true? A. Assets - Liabilities + Revenues = Capital - Expenses B. Assets + Expenses = Capital + Liabilities + Revenues C. Assets + Expenses - Revenues = Liabilities + Capital D. Assets - Liabilities = Capital + Revenues - Expenses 8. Which of the following is INCORRECT classification? A. Office equipment - non-current asset B. Inventory - current asset C. Bank overdraft - current liability D. Account receivable - current liability 9. Which of the following statement described the principles of double entry is true? A. Cash purchases will be debited in the purchases account. B. Cash contributed by theowner of the business will be debited in the capital account. C. Withdrawal of cash by the owner of the business for his/her personal usage will be debited in the capital account. D. Sold of goods to existing customers on credit will be debited in the sales account. 10. In a double entry system, a credit is used to record A. increase in revenues and drawings B. increase in expenses and assets C. increase in owner's equity and assets D. increase in liabilities and owner equity

1. The following are the internal users of an organization, except: A. Owners and managers. B. Securities Commission and potential customers. C. Storekeeper and employee. D. Internal auditor and accountant. 2. is the last step in the accounting cycle. A. Preparation of financial statements. B. Postings the transactions from journal to ledgers. C. Recording the accounting adjustments. D. Analysis of financial statements 3. An asset is recorded at its original price This is to fulfil which qualitafivecharacteristic of financial information or accounting concept? A. Completeness B. Economic entity concept C. Historical cost concept D. confirmatory value 4. Which of the following is not true concerning a conceptual framework in accounting concept? A. It allows preparers to solve practical problem more quickly by reference to it. B. To assist MASB in developing MFRS Standards C. It should be a basis on fundamental truths that are derived from the laws of nature. D. None of the above. 5. The fundamental qualitafive characteristic of conceptual framework is A. economic entity B. Going concern C. Truthful representation D. Free from error 6. The depreciation method was used for the last accounting year, and it should be used for the current and future accounting period as to comply with A. Consistency concept B. Going concern concept C. Money measurement concept D. Completeness concept 7. Which of the following accounting equation is not true? A. Assets - Liabilities + Revenues = Capital - Expenses B. Assets + Expenses = Capital + Liabilities + Revenues C. Assets + Expenses - Revenues = Liabilities + Capital D. Assets - Liabilities = Capital + Revenues - Expenses 8. Which of the following is INCORRECT classification? A. Office equipment - non-current asset B. Inventory - current asset C. Bank overdraft - current liability D. Account receivable - current liability 9. Which of the following statement described the principles of double entry is true? A. Cash purchases will be debited in the purchases account. B. Cash contributed by theowner of the business will be debited in the capital account. C. Withdrawal of cash by the owner of the business for his/her personal usage will be debited in the capital account. D. Sold of goods to existing customers on credit will be debited in the sales account. 10. In a double entry system, a credit is used to record A. increase in revenues and drawings B. increase in expenses and assets C. increase in owner's equity and assets D. increase in liabilities and owner equity 1. The following are the internal users of an organization, except: A. Owners and managers. B. Securities Commission and potential customers. C. Storekeeper and employee. D. Internal auditor and accountant. 2. is the last step in the accounting cycle. A. Preparation of financial statements. B. Postings the transactions from journal to ledgers. C. Recording the accounting adjustments. D. Analysis of financial statements 3. An asset is recorded at its original price This is to fulfil which qualitafivecharacteristic of financial information or accounting concept? A. Completeness B. Economic entity concept C. Historical cost concept D. confirmatory value 4. Which of the following is not true concerning a conceptual framework in accounting concept? A. It allows preparers to solve practical problem more quickly by reference to it. B. To assist MASB in developing MFRS Standards C. It should be a basis on fundamental truths that are derived from the laws of nature. D. None of the above. 5. The fundamental qualitafive characteristic of conceptual framework is A. economic entity B. Going concern C. Truthful representation D. Free from error 6. The depreciation method was used for the last accounting year, and it should be used for the current and future accounting period as to comply with A. Consistency concept B. Going concern concept C. Money measurement concept D. Completeness concept 7. Which of the following accounting equation is not true? A. Assets - Liabilities + Revenues = Capital - Expenses B. Assets + Expenses = Capital + Liabilities + Revenues C. Assets + Expenses - Revenues = Liabilities + Capital D. Assets - Liabilities = Capital + Revenues - Expenses 8. Which of the following is INCORRECT classification? A. Office equipment - non-current asset B. Inventory - current asset C. Bank overdraft - current liability D. Account receivable - current liability 9. Which of the following statement described the principles of double entry is true? A. Cash purchases will be debited in the purchases account. B. Cash contributed by theowner of the business will be debited in the capital account. C. Withdrawal of cash by the owner of the business for his/her personal usage will be debited in the capital account. D. Sold of goods to existing customers on credit will be debited in the sales account. 10. In a double entry system, a credit is used to record A. increase in revenues and drawings B. increase in expenses and assets C. increase in owner's equity and assets D. increase in liabilities and owner equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started