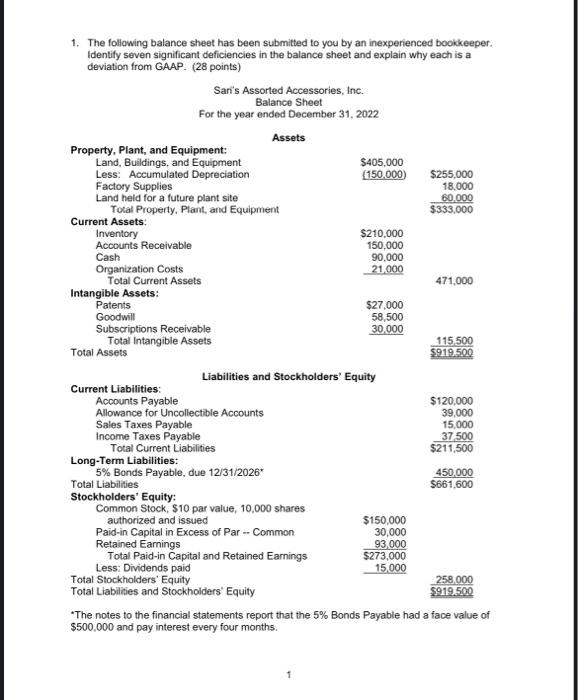

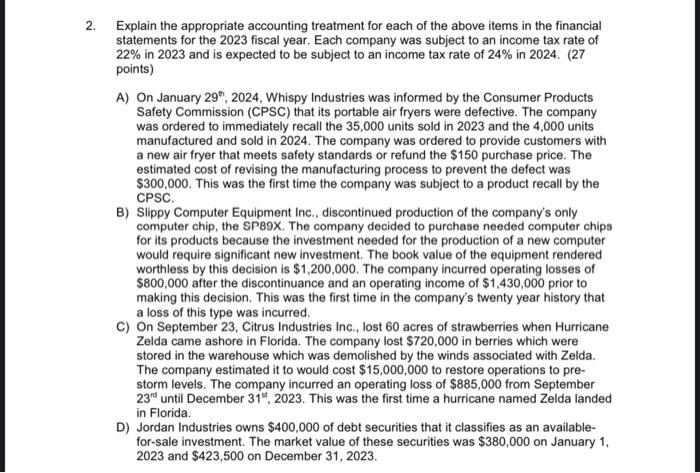

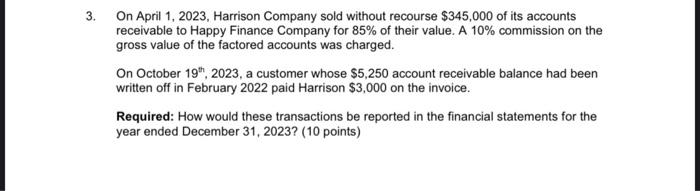

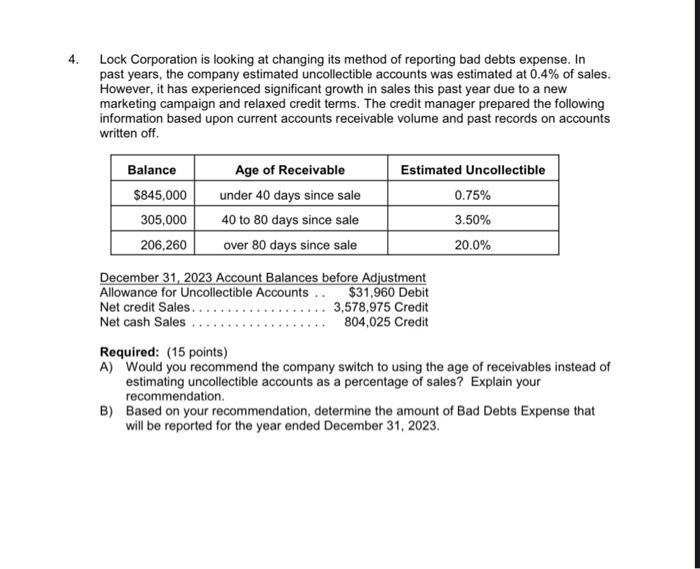

1. The following balance sheet has been submitted to you by an inexperienced bookkeeper. Identify seven significant deficiencies in the balance sheet and explain why each is a deviation from GAAP. (28 points) Lock Corporation is looking at changing its method of reporting bad debts expense. In past years, the company estimated uncollectible accounts was estimated at 0.4% of sales. However, it has experienced significant growth in sales this past year due to a new marketing campaign and relaxed credit terms. The credit manager prepared the following information based upon current accounts receivable volume and past records on accounts written off. Required: (15 points) A) Would you recommend the company switch to using the age of receivables instead of estimating uncollectible accounts as a percentage of sales? Explain your recommendation. B) Based on your recommendation, determine the amount of Bad Debts Expense that will be reported for the year ended December 31, 2023. Explain the appropriate accounting treatment for each of the above items in the financial statements for the 2023 fiscal year. Each company was subject to an income tax rate of 22% in 2023 and is expected to be subject to an income tax rate of 24% in 2024 . (27 points) A) On January 29th,2024, Whispy Industries was informed by the Consumer Products Safety Commission (CPSC) that its portable air fryers were defective. The company was ordered to immediately recall the 35,000 units sold in 2023 and the 4,000 units manufactured and sold in 2024. The company was ordered to provide customers with a new air fryer that meets safety standards or refund the $150 purchase price. The estimated cost of revising the manufacturing process to prevent the defect was $300,000. This was the first time the company was subject to a product recall by the CPSC. B) Slippy Computer Equipment Inc., discontinued production of the company's only computer chip, the SP89X. The company decided to purchase needed computer chips for its products because the investment needed for the production of a new computer would require significant new investment. The book value of the equipment rendered worthless by this decision is $1,200,000. The company incurred operating losses of $800,000 after the discontinuance and an operating income of $1,430,000 prior to making this decision. This was the first time in the company's twenty year history that a loss of this type was incurred. C) On September 23, Citrus Industries Inc., lost 60 acres of strawberries when Hurricane Zelda came ashore in Florida. The company lost $720,000 in berries which were stored in the warehouse which was demolished by the winds associated with Zelda. The company estimated it to would cost $15,000,000 to restore operations to prestorm levels. The company incurred an operating loss of $885,000 from September 23rf until December 31st,2023. This was the first time a hurricane named Zelda landed in Florida. D) Jordan Industries owns $400,000 of debt securities that it classifies as an avilablefor-sale investment. The market value of these securities was $380,000 on January 1 , 2023 and $423,500 on December 31, 2023. On April 1, 2023, Harrison Company sold without recourse $345,000 of its accounts receivable to Happy Finance Company for 85% of their value. A 10% commission on the gross value of the factored accounts was charged. On October 19th,2023, a customer whose $5,250 account receivable balance had been written off in February 2022 paid Harrison $3,000 on the invoice. Required: How would these transactions be reported in the financial statements for the year ended December 31, 2023 ? (10 points)