Answered step by step

Verified Expert Solution

Question

1 Approved Answer

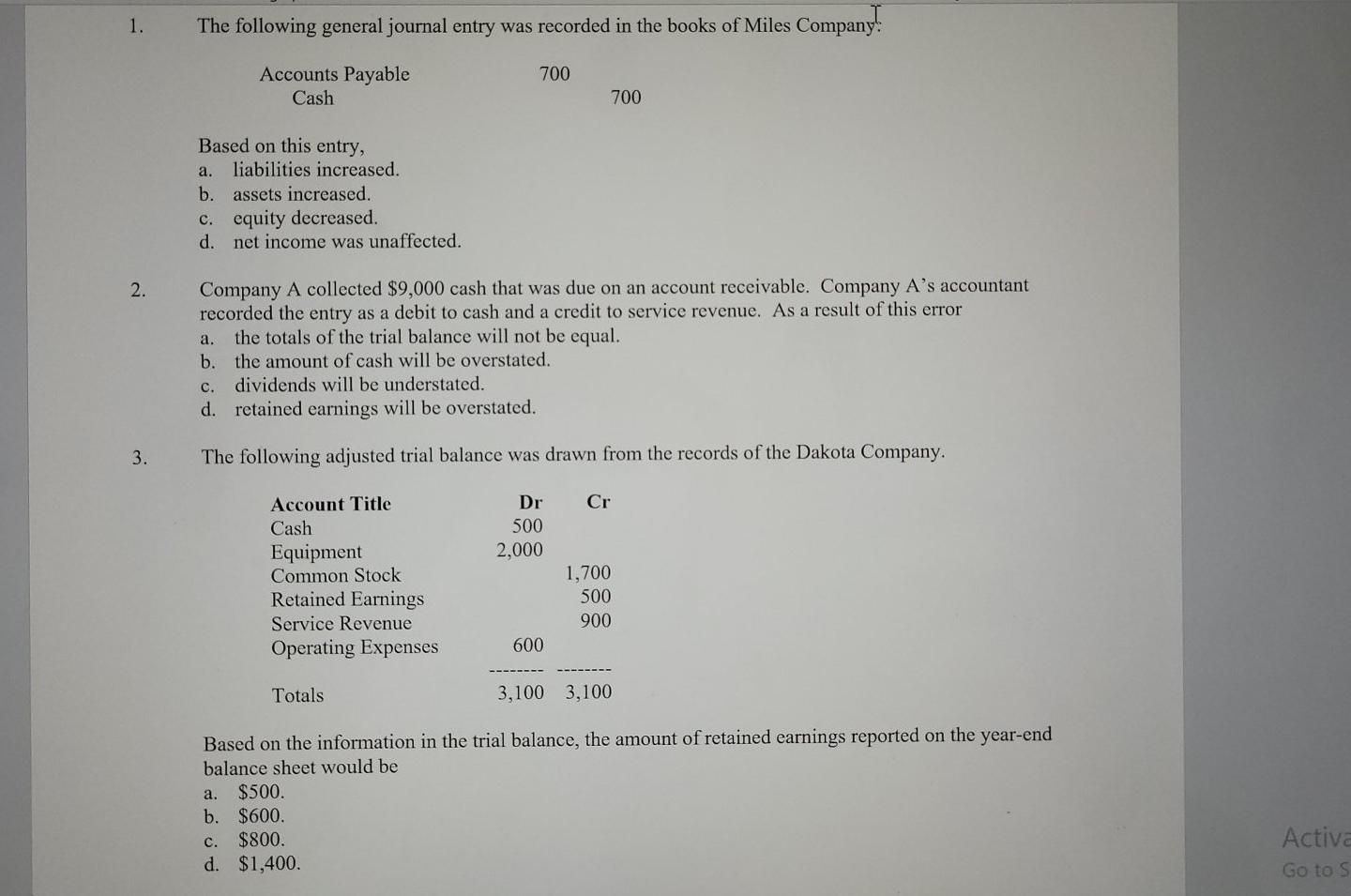

1. The following general journal entry was recorded in the books of Miles Company! 700 Accounts Payable Cash 700 Based on this entry, a. liabilities

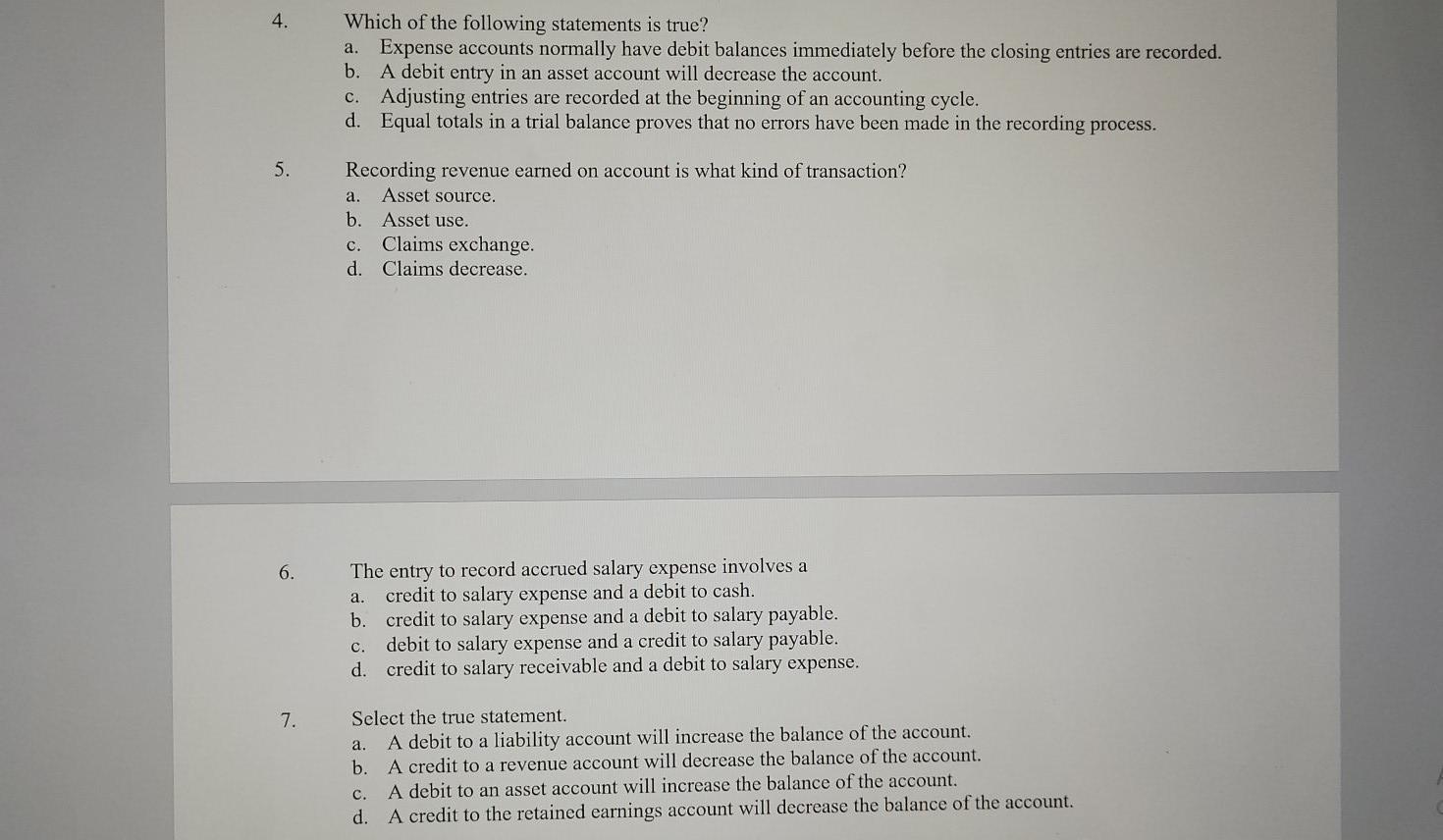

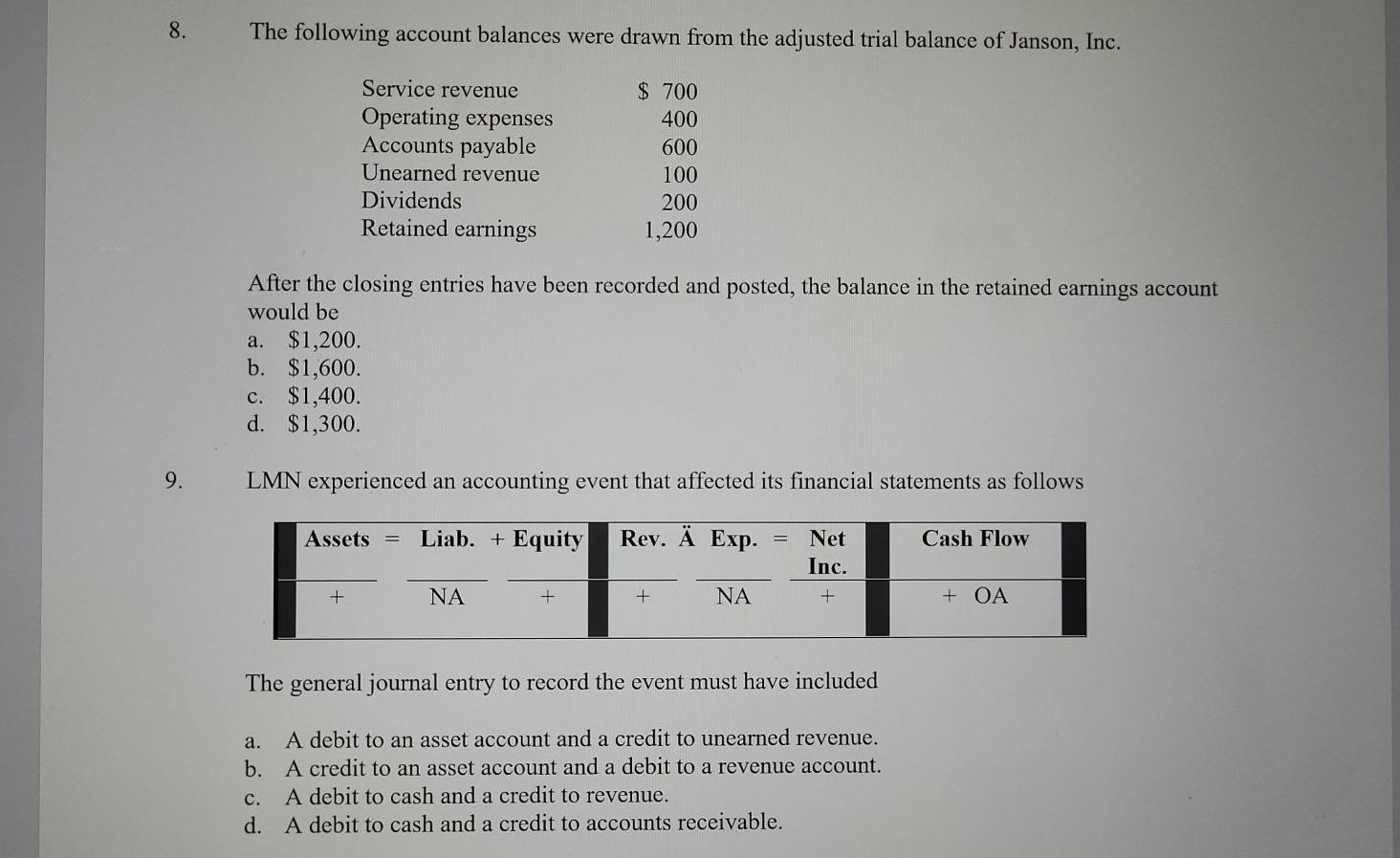

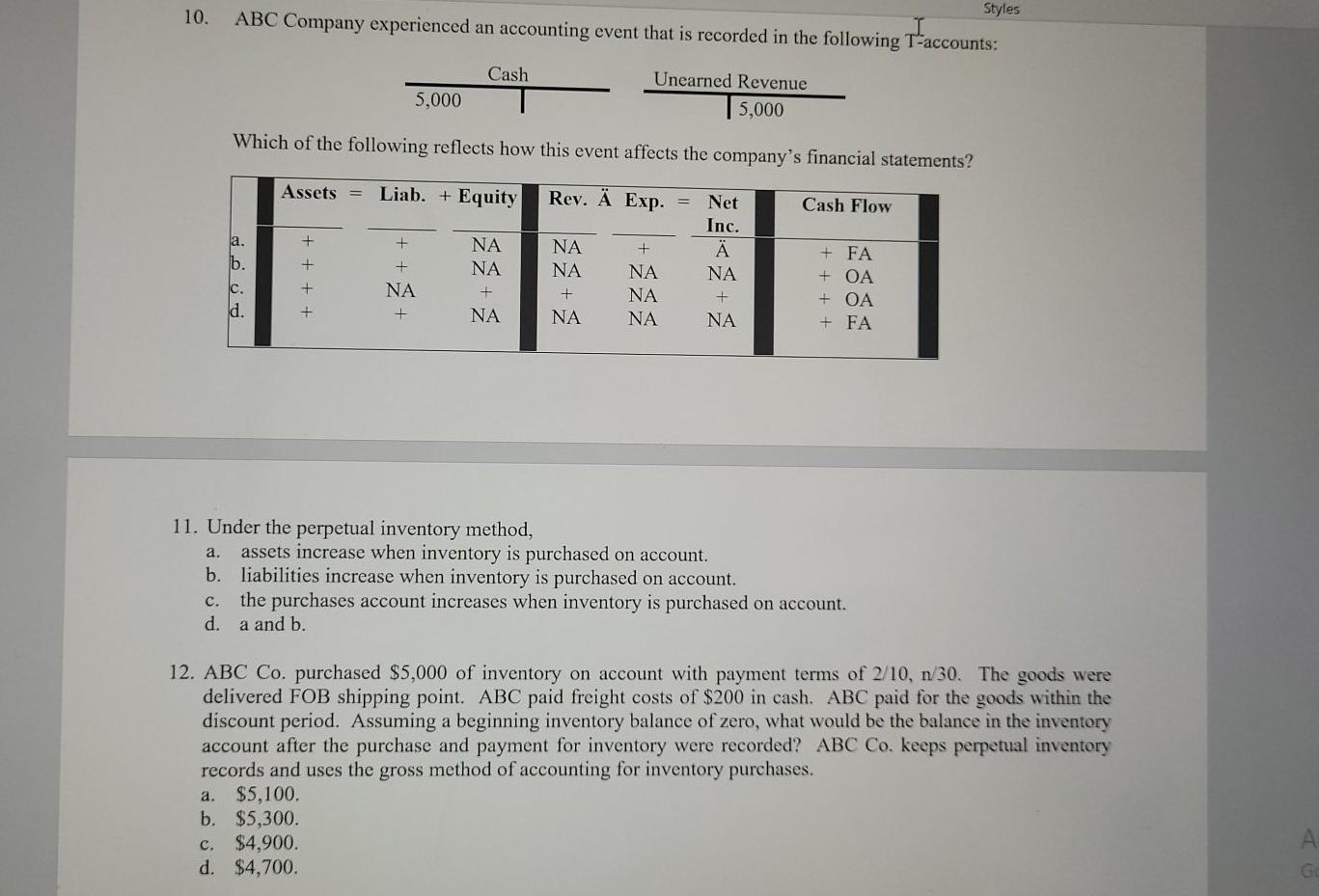

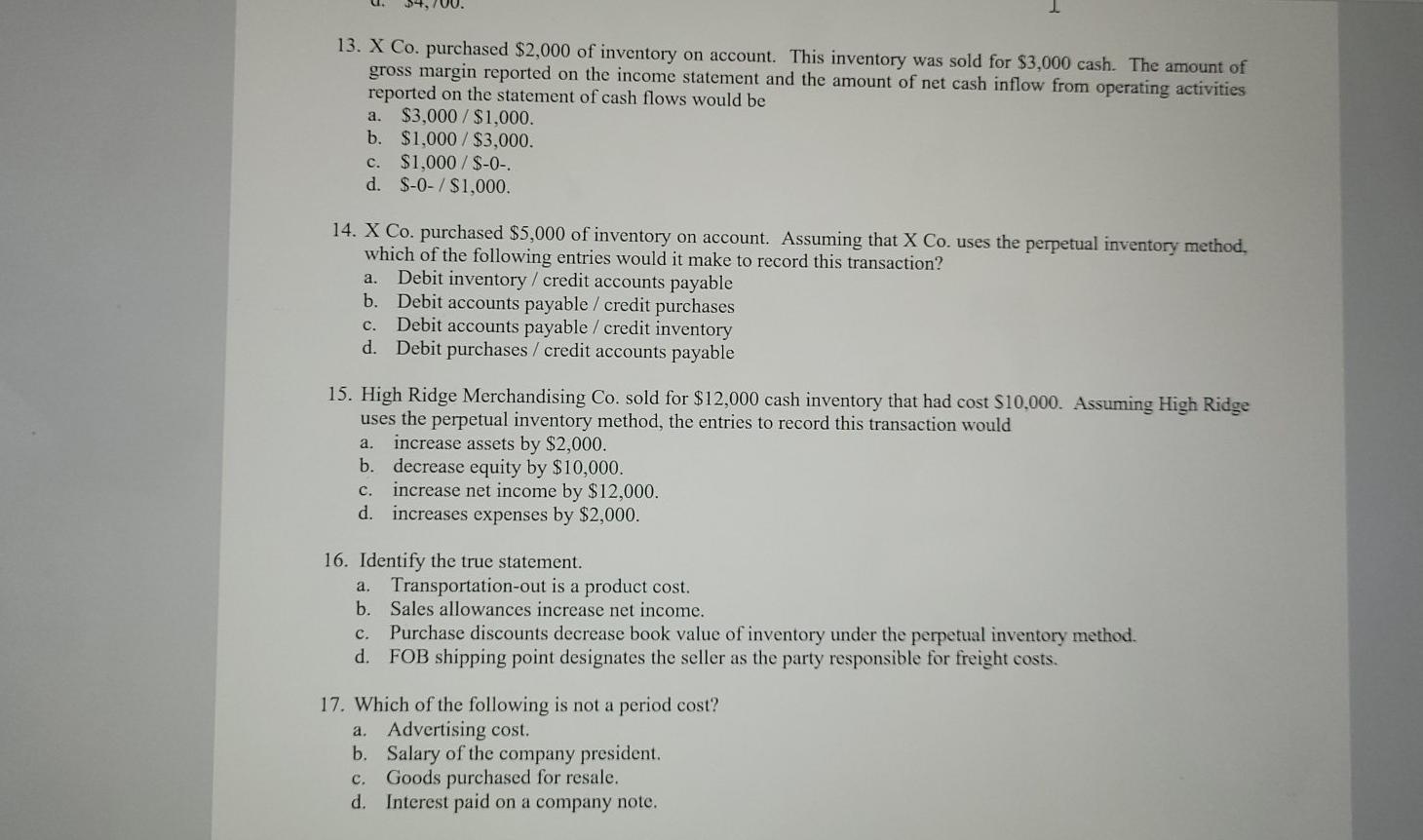

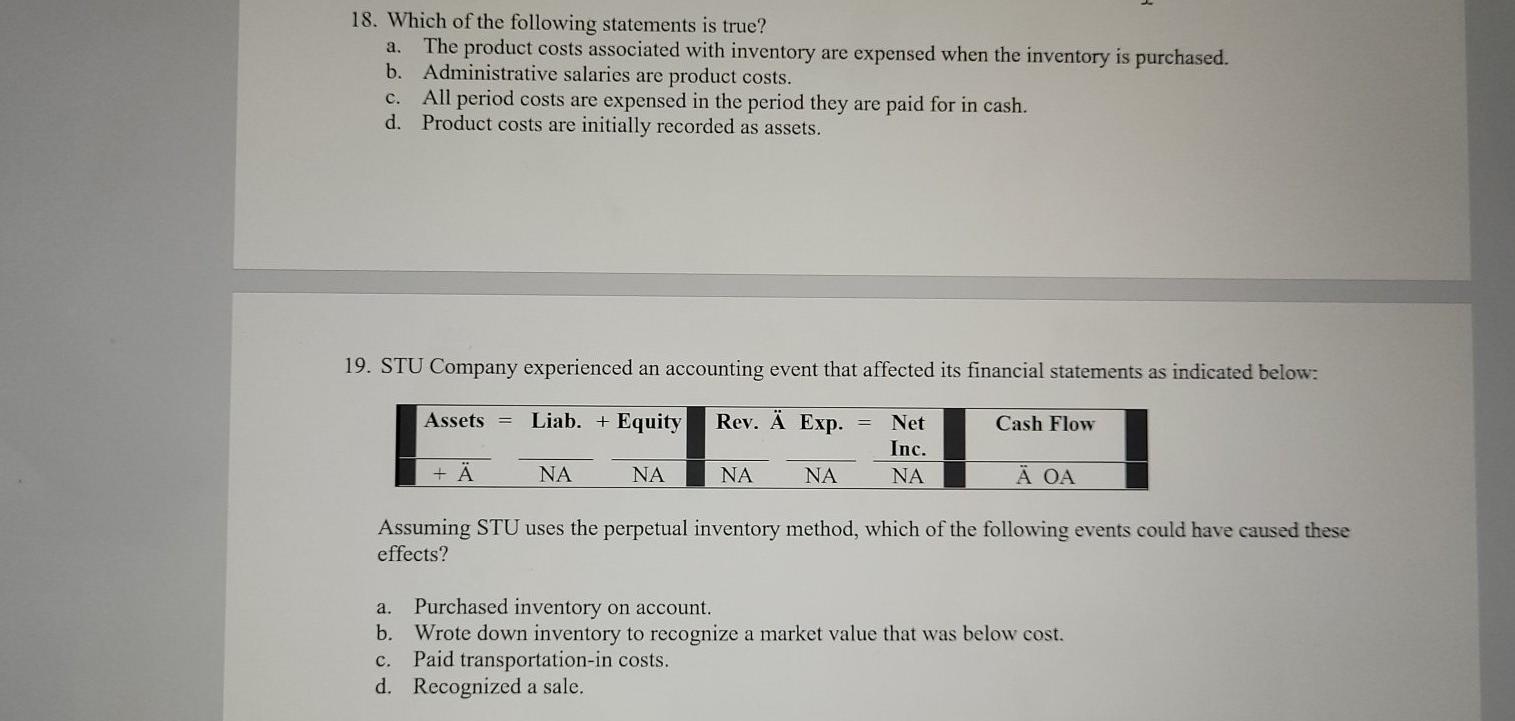

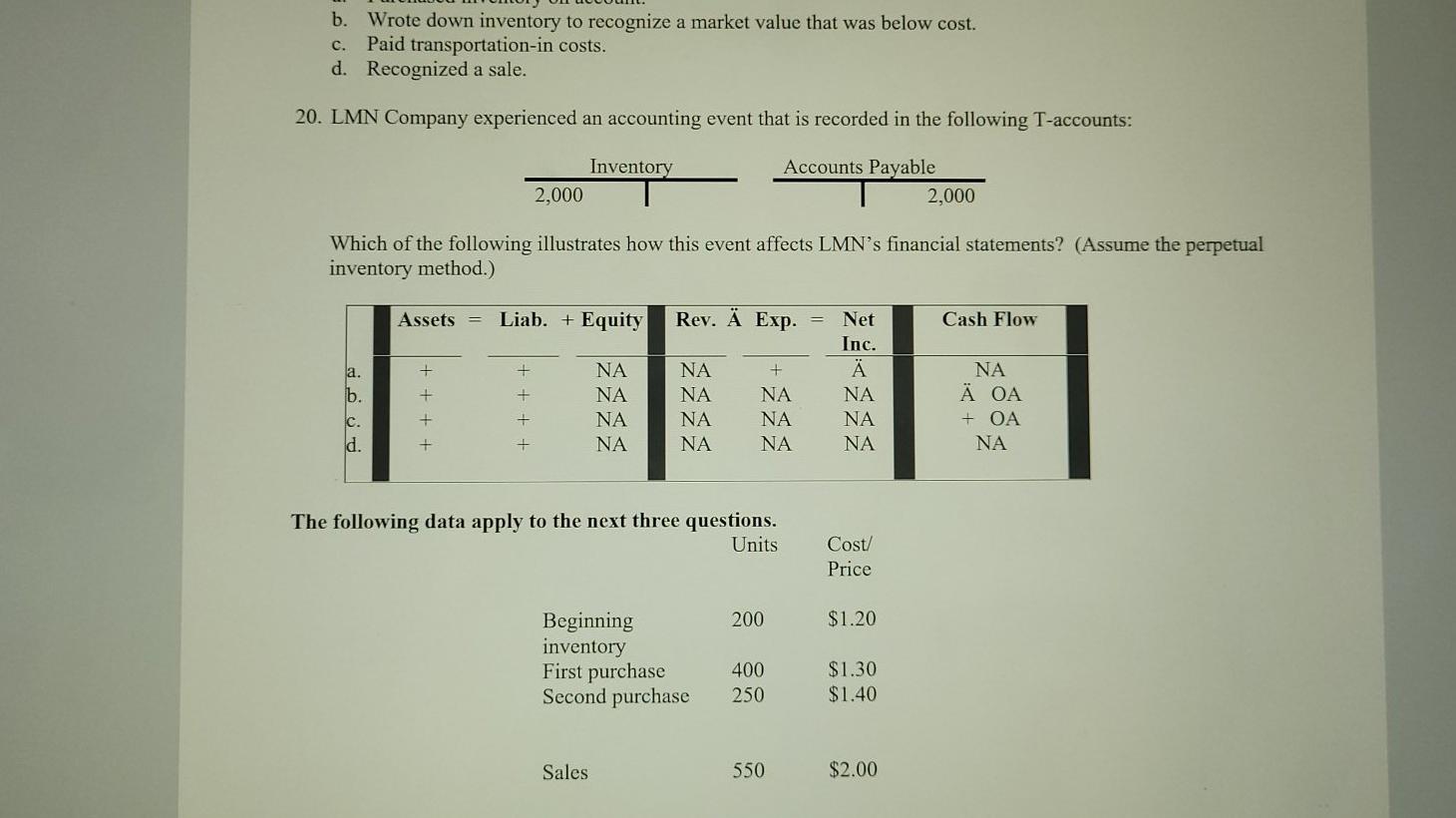

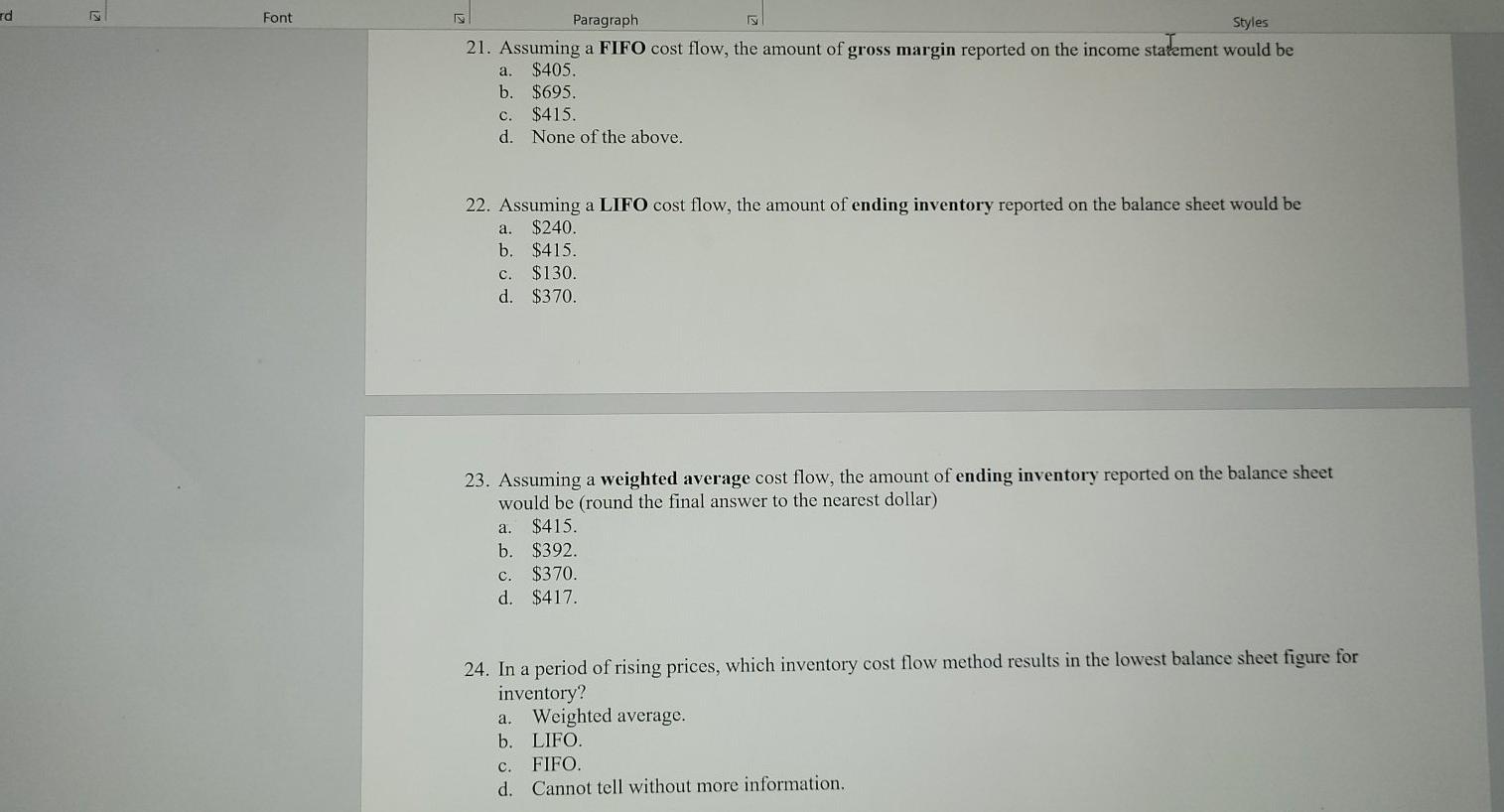

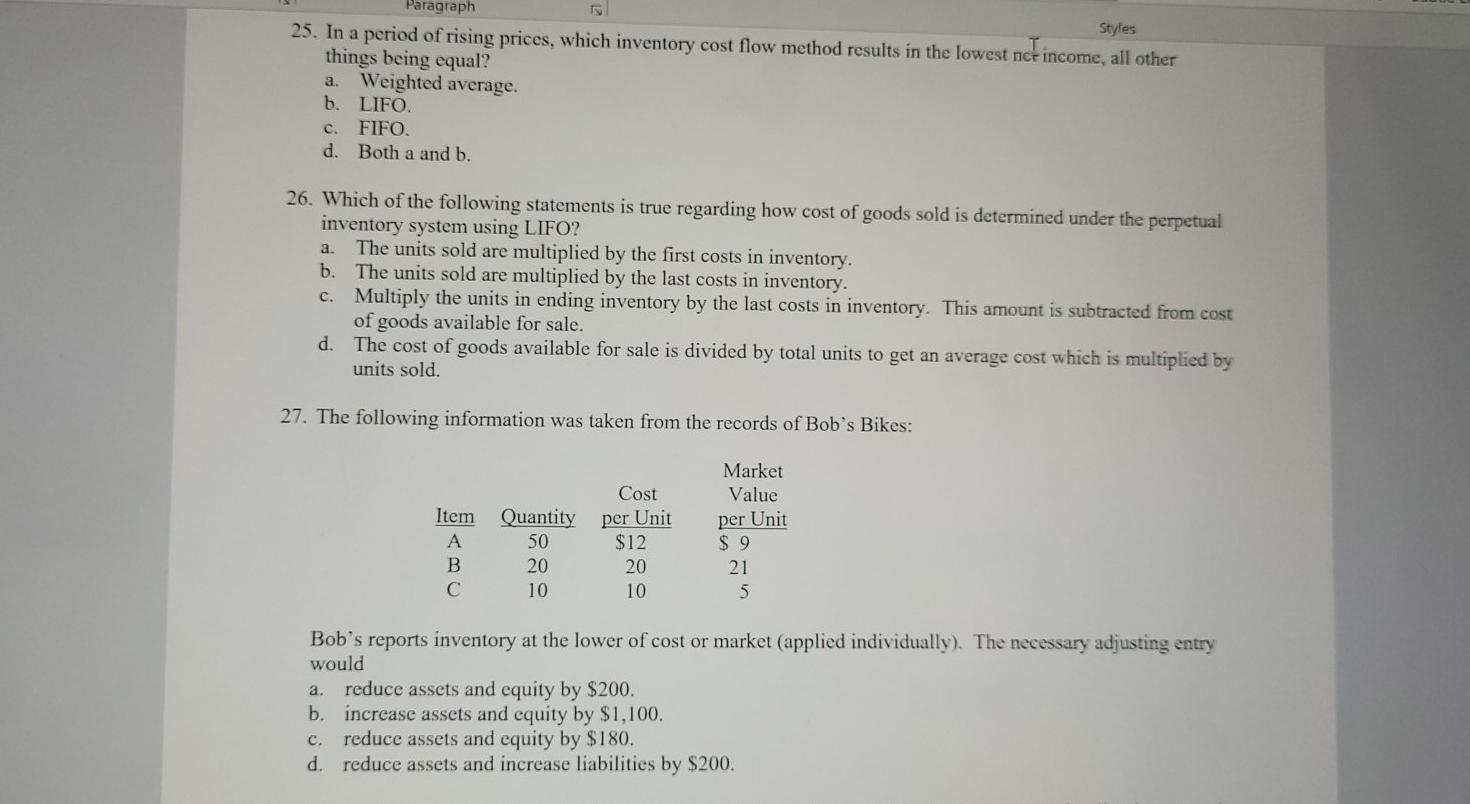

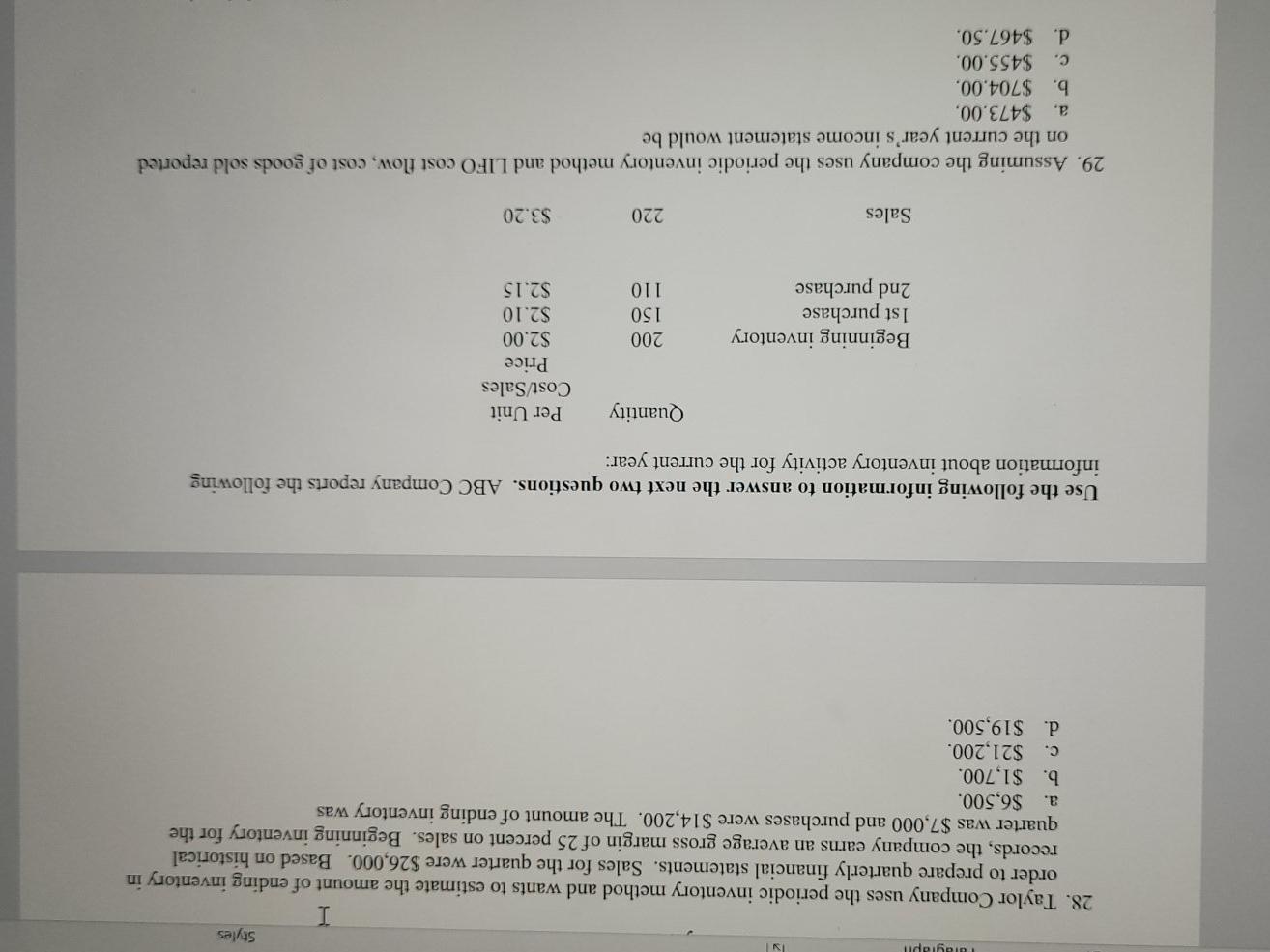

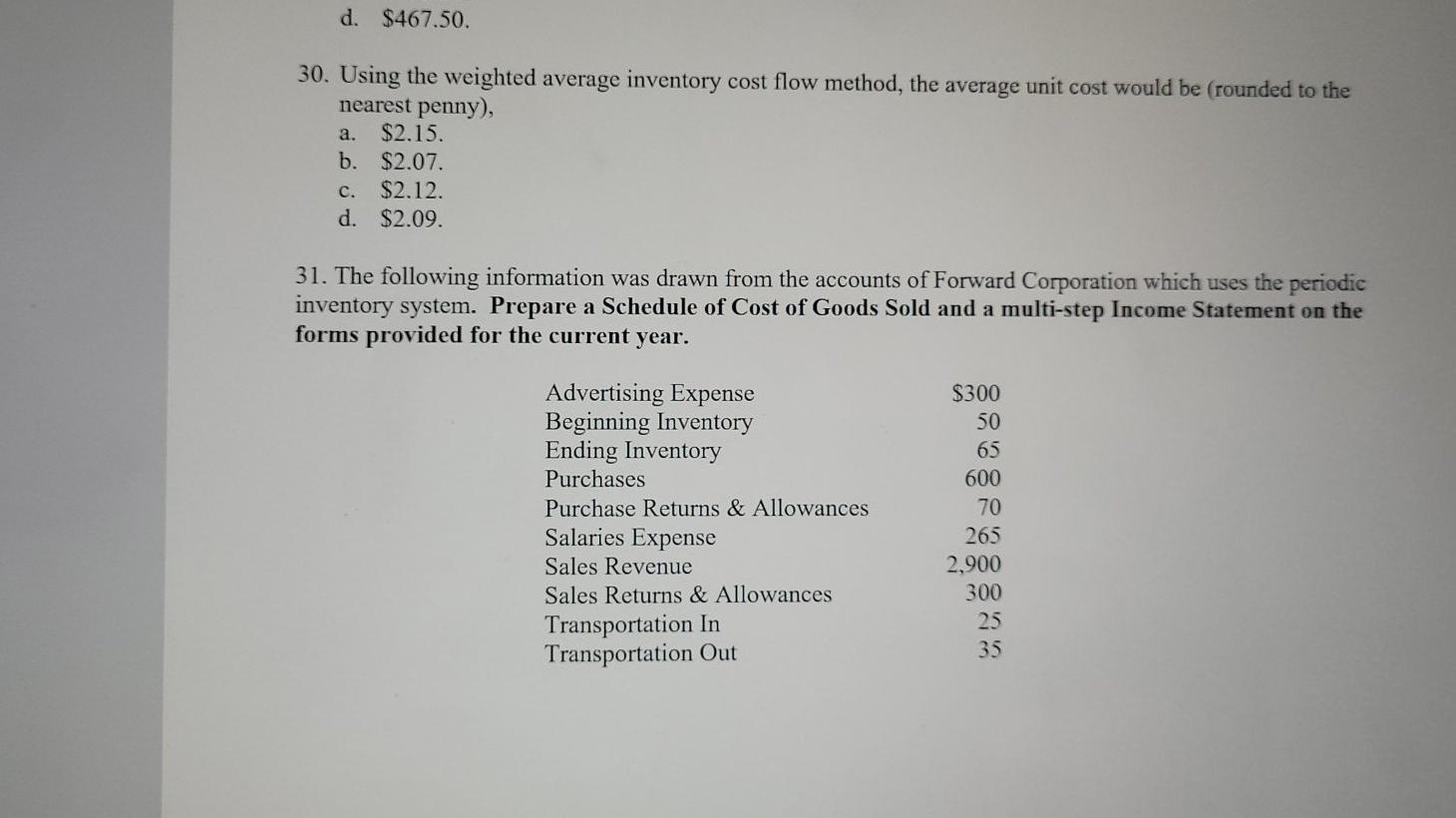

1. The following general journal entry was recorded in the books of Miles Company! 700 Accounts Payable Cash 700 Based on this entry, a. liabilities increased. b. assets increased. c. equity decreased. d. net income was unaffected. 2. a. Company A collected $9,000 cash that was due on an account receivable. Company A's accountant recorded the entry as a debit to cash and a credit to service revenue. As a result of this error the totals of the trial balance will not be equal. b. the amount of cash will be overstated. dividends will be understated. d. retained earnings will be overstated. c. 3. The following adjusted trial balance was drawn from the records of the Dakota Company. Cr Dr 500 2,000 Account Title Cash Equipment Common Stock Retained Earnings Service Revenue Operating Expenses 1,700 500 900 600 Totals 3,100 3,100 Based on the information in the trial balance, the amount of retained earnings reported on the year-end balance sheet would be a. $500. b. $600. $800. d. $1,400. c. Activa Go to S 4. Which of the following statements is true? a. Expense accounts normally have debit balances immediately before the closing entries are recorded. b. A debit entry in an asset account will decrease the account. c. Adjusting entries are recorded at the beginning of an accounting cycle. d. Equal totals in a trial balance proves that no errors have been made in the recording process. 5. Recording revenue earned on account is what kind of transaction? a. Asset source. b. Asset use. c. Claims exchange. d. Claims decrease. 6. a. The entry to record accrued salary expense involves a credit to salary expense and a debit to cash. b. credit to salary expense and a debit to salary payable. debit to salary expense and a credit to salary payable. d. credit to salary receivable and a debit to salary expense. c. 7. a. Select the true statement. A debit to a liability account will increase the balance of the account. b. A credit to a revenue account will decrease the balance of the account. c. A debit to an asset account will increase the balance of the account. d. A credit to the retained earnings account will decrease the balance of the account. 8. The following account balances were drawn from the adjusted trial balance of Janson, Inc. Service revenue Operating expenses Accounts payable Unearned revenue Dividends Retained earnings $ 700 400 600 100 200 1,200 After the closing entries have been recorded and posted, the balance in the retained earnings account would be a. $1,200. b. $1,600. c. $1,400. d. $1,300. 9. LMN experienced an accounting event that affected its financial statements as follows Assets Liab. + Equity Rev. Exp. Cash Flow Net Inc. + NA + + NA + + OA The general journal entry to record the event must have included a. A debit to an asset account and a credit to unearned revenue. b. A credit to an asset account and a debit to a revenue account. c. A debit to cash and a credit to revenue. d. A debit to cash and a credit to accounts receivable. 10. Styles ABC Company experienced an accounting event that is recorded in the following T-accounts: Cash 5,000 Unearned Revenue 5,000 Which of the following reflects how this event affects the company's financial statements? Assets Liab. + Equity Rev. Exp. Net Cash Flow Inc. + + a. b. NA NA NA NA + + NA + NA NA NA NA + NA + + FA + + OA + FA + NA NA 11. Under the perpetual inventory method, a. assets increase when inventory is purchased on account. b. liabilities increase when inventory is purchased on account. c. the purchases account increases when inventory is purchased on account. d. a and b. 12. ABC Co. purchased $5,000 of inventory on account with payment terms of 2/10, n 30. The goods were delivered FOB shipping point. ABC paid freight costs of $200 in cash. ABC paid for the goods within the discount period. Assuming a beginning inventory balance of zero, what would be the balance in the inventory account after the purchase and payment for inventory were recorded? ABC Co. keeps perpetual inventory records and uses the gross method of accounting for inventory purchases. $5,100. b. $5,300. c. $4,900. d. $4,700. a. 13. X Co. purchased $2,000 of inventory on account. This inventory was sold for $3,000 cash. The amount of gross margin reported on the income statement and the amount of net cash inflow from operating activities reported on the statement of cash flows would be $3,000 / $1,000. b. $1,000 / $3,000. $1,000/S-0- d. S-0-/$1,000. a. c. a. 14. X Co. purchased $5,000 of inventory on account. Assuming that X Co. uses the perpetual inventory method, which of the following entries would it make to record this transaction? Debit inventory / credit accounts payable b. Debit accounts payable / credit purchases Debit accounts payable / credit inventory d. Debit purchases / credit accounts payable c. 15. High Ridge Merchandising Co. sold for $12,000 cash inventory that had cost $10,000. Assuming High Ridge uses the perpetual inventory method, the entries to record this transaction would a. increase assets by $2,000. b. decrease equity by $10,000. increase net income by $12,000. d. increases expenses by $2,000. c. a. 16. Identify the true statement. Transportation-out is a product cost. b. Sales allowances increase net income. Purchase discounts decrease book value of inventory under the perpetual inventory method. d. FOB shipping point designates the seller as the party responsible for freight costs. C. 17. Which of the following is not a period cost? a. Advertising cost. b. Salary of the company president c. Goods purchased for resale. d. Interest paid on a company note. 18. Which of the following statements is true? a. The product costs associated with inventory are expensed when the inventory is purchased. b. Administrative salaries are product costs. c. All period costs are expensed in the period they are paid for in cash. d. Product costs are initially recorded as assets. 19. STU Company experienced an accounting event that affected its financial statements as indicated below: Assets = Liab. + Equity Rev. Exp. Cash Flow Net Inc. NA + NA NA NA NA OA Assuming STU uses the perpetual inventory method, which of the following events could have caused these effects? a. Purchased inventory on account. b. Wrote down inventory to recognize a market value that was below cost. c. Paid transportation in costs. d. Recognized a sale. b. Wrote down inventory to recognize a market value that was below cost. Paid transportation in costs. d. Recognized a sale. c. 20. LMN Company experienced an accounting event that is recorded in the following T-accounts: Inventory 2,000 Accounts Payable 2,000 Which of the following illustrates how this event affects LMN's financial statements? (Assume the perpetual inventory method.) Assets = Liab. + Equity Rev. Exp. Cash Flow a. + b. Net Inc. NA NA NA NA NA NA NA + NA NA NA NA NA OA + OA NA NA NA NA c. d. The following data apply to the next three questions. Units Cost/ Price 200 $1.20 Beginning inventory First purchase Second purchase 400 250 $1.30 $1.40 Sales 550 $2.00 ed Font a. Paragraph Styles 21. Assuming a FIFO cost flow, the amount of gross margin reported on the income statement would be $405. b. $695. $415. d. None of the above. c. a. 22. Assuming a LIFO cost flow, the amount of ending inventory reported on the balance sheet would be $240. b. $415. $130. d. $370. c. 23. Assuming a weighted average cost flow, the amount of ending inventory reported on the balance sheet would be (round the final answer to the nearest dollar) a. $415. b. $392. c. $370. d. $417. 24. In a period of rising prices, which inventory cost flow method results in the lowest balance sheet figure for inventory? a. Weighted average. b. LIFO. c. FIFO. d. Cannot tell without more information. Paragraph Styles 25. In a period of rising prices, which inventory cost flow method results in the lowest nct income, all other things being equal? a. Weighted average. b. LIFO. c. FIFO. d. Both a and 26. Which of the following statements is true regarding how cost of goods sold is determined under the perpetual inventory system using LIFO? a. The units sold are multiplied by the first costs in inventory. b. The units sold are multiplied by the last costs in inventory. c. Multiply the units in ending inventory by the last costs in inventory. This amount is subtracted from cost of goods available for sale. d. The cost of goods available for sale is divided by total units to get an average cost which is multiplied by units sold. 27. The following information was taken from the records of Bob's Bikes: Cost Item A B C Quantity 50 20 10 per Unit $12 20 10 Market Value per Unit $ 9 21 5 a. Bob's reports inventory at the lower of cost or market (applied individually). The necessary adjusting entry would reduce assets and equity by $200. b. increase assets and equity by $1,100. c. reduce assets and equity by $180. d. reduce assets and increase liabilities by $200. udga Styles 28. Taylor Company uses the periodic inventory method and wants to estimate the amount of ending inventory in order to prepare quarterly financial statements. Sales for the quarter were $26,000. Based on historical records, the company earns an average gross margin of 25 percent on sales. Beginning inventory for the quarter was $7,000 and purchases were $14,200. The amount of ending inventory was a. $6,500. b. $1,700. c. $21,200. d. $19,500. Use the following information to answer the next two questions. ABC Company reports the following information about inventory activity for the current year: Quantity Per Unit Cost/Sales Price $2.00 $2.10 $2.15 Beginning inventory 1st purchase 2nd purchase 200 150 110 Sales 220 $3.20 29. Assuming the company uses the periodic inventory method and LIFO cost flow, cost of goods sold reported on the current year's income statement would be $473.00, b. $704.00. c. $455.00 d. $467.50 a. d. $467.50. a. 30. Using the weighted average inventory cost flow method, the average unit cost would be (rounded to the nearest penny), $2.15. b. $2.07. c. $2.12. d. $2.09. 31. The following information was drawn from the accounts of Forward Corporation which uses the periodic inventory system. Prepare a Schedule of Cost of Goods Sold and a multi-step Income Statement on the forms provided for the current year. Advertising Expense Beginning Inventory Ending Inventory Purchases Purchase Returns & Allowances Salaries Expense Sales Revenue Sales Returns & Allowances Transportation In Transportation Out $300 50 65 600 70 265 2,900 300 25 35

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started