Answered step by step

Verified Expert Solution

Question

1 Approved Answer

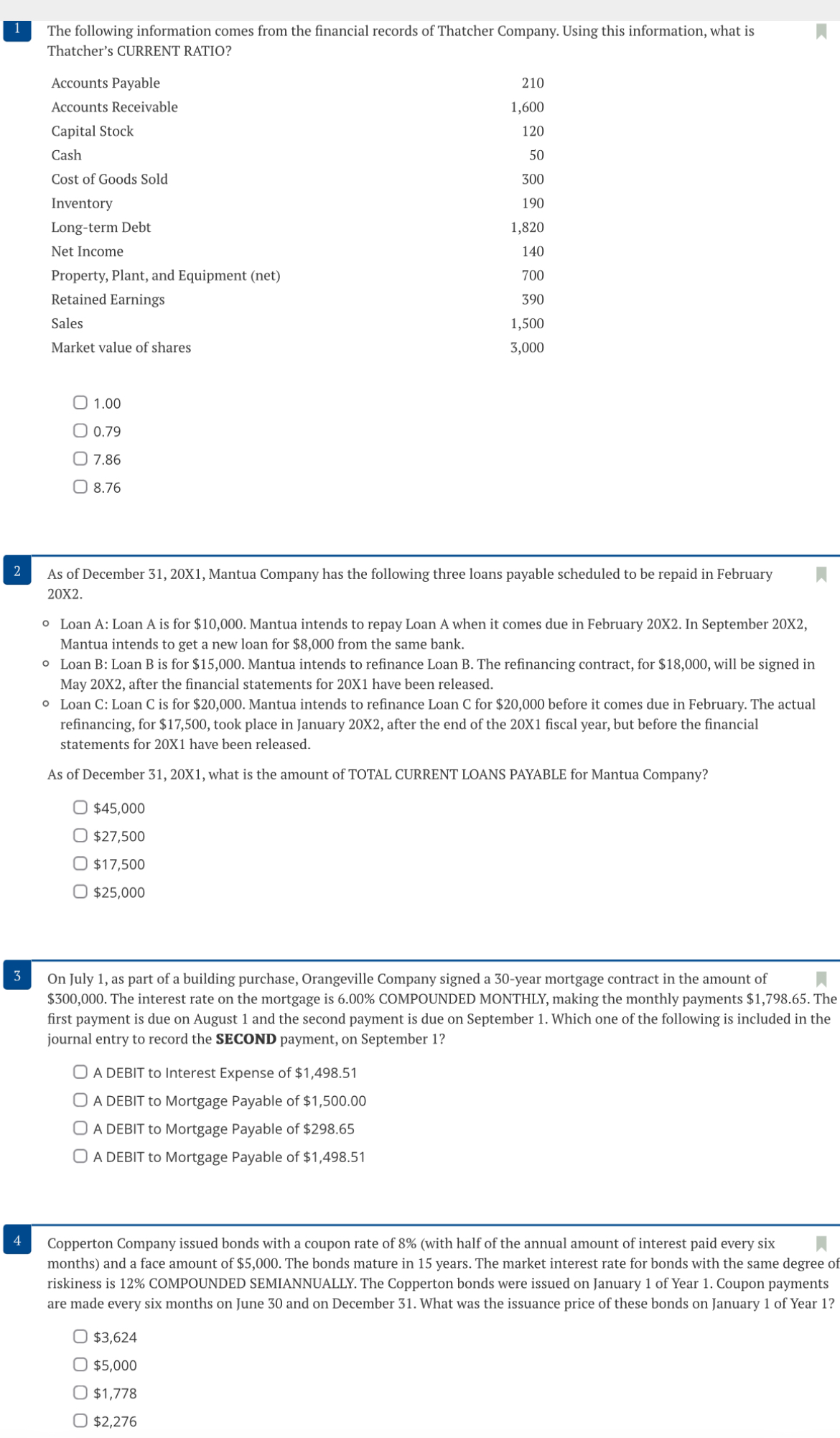

1 The following information comes from the financial records of Thatcher Company. Using this information, what is Thatcher's CURRENT RATIO? table [ [ Accounts

The following information comes from the financial records of Thatcher Company. Using this information, what is Thatcher's CURRENT RATIO?

tableAccounts Payable,Accounts Receivable,Capital Stock,CashCost of Goods Sold,InventoryLongterm Debt,Net Income,Property Plant, and Equipment netRetained Earnings,SalesMarket value of shares,

As of December X Mantua Company has the following three loans payable scheduled to be repaid in February X

Loan A: Loan A is for $ Mantua intends to repay Loan A when it comes due in February X In September X Mantua intends to get a new loan for $ from the same bank.

Loan B: Loan B is for $ Mantua intends to refinance Loan B The refinancing contract, for $ will be signed in May X after the financial statements for X have been released.

Loan C: Loan C is for $ Mantua intends to refinance Loan C for $ before it comes due in February. The actual refinancing, for $ took place in January after the end of the fiscal year, but before the financial statements for X have been released.

As of December X what is the amount of TOTAL CURRENT LOANS PAYABLE for Mantua Company?

$

$

$

$

On July as part of a building purchase, Orangeville Company signed a year mortgage contract in the amount of $ The interest rate on the mortgage is COMPOUNDED MONTHLY, making the monthly payments $ The first payment is due on August and the second payment is due on September Which one of the following is included in the journal entry to record the SECOND payment, on September

A DEBIT to Interest Expense of $

A DEBIT to Mortgage Payable of $

A DEBIT to Mortgage Payable of $

A DEBIT to Mortgage Payable of $

Copperton Company issued bonds with a coupon rate of with half of the annual amount of interest paid every six months and a face amount of $ The bonds mature in years. The market interest rate for bonds with the same degree of riskiness is COMPOUNDED SEMIANNUALLY. The Copperton bonds were issued on January of Year Coupon payments are made every six months on June and on December What was the issuance price of these bonds on January of Year

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started