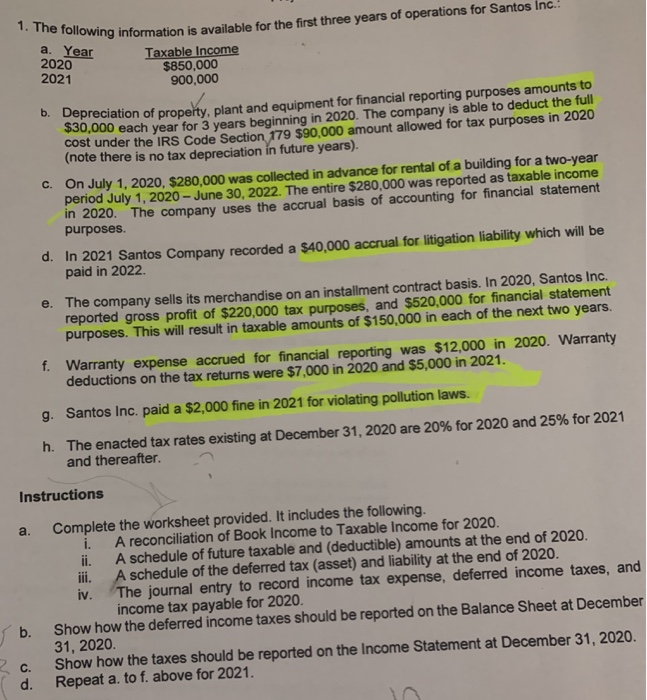

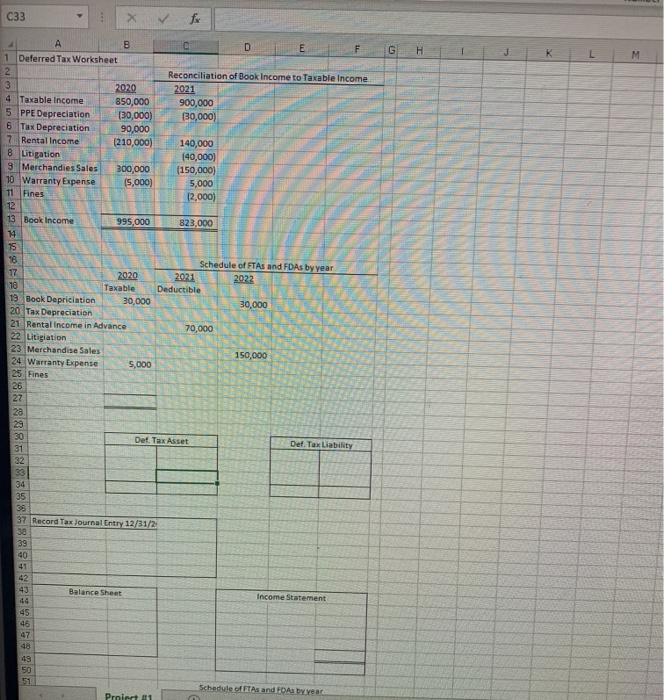

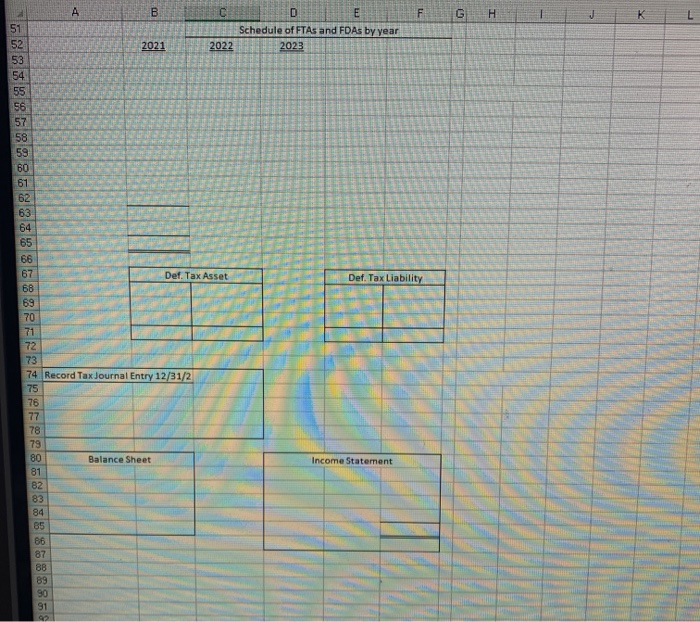

1. The following information is available for the first three years of operations for Santos Inc. Taxable Income 2020 2021 900,000 a. Year $850,000 b. Depreciation of property, plant and equipment for financial reporting purposes amounts to $30,000 each year for 3 years beginning in 2020. The company is able to deduct the full cost under the IRS Code Section 179 $90,000 amount allowed for tax purposes in 2020 (note there is no tax depreciation in future years). C. On July 1, 2020, $280,000 was collected in advance for rental of a building for a two-year period July 1, 2020 - June 30, 2022. The entire $280,000 was reported as taxable income in 2020. The company uses the accrual basis of accounting for financial statement purposes. d. In 2021 Santos Company recorded a $40,000 accrual for litigation liability which will be paid in 2022 e. The company sells its merchandise on an installment contract basis. In 2020, Santos Inc. reported gross profit of $220,000 tax purposes, and $520,000 for financial statement purposes. This will result in taxable amounts of $150,000 in each of the next two years. f. Warranty expense accrued for financial reporting was $12,000 in 2020. Warranty deductions on the tax returns were $7,000 in 2020 and $5,000 in 2021. g. Santos Inc. paid a $2,000 fine in 2021 for violating pollution laws. h. The enacted tax rates existing at December 31, 2020 are 20% for 2020 and 25% for 2021 and thereafter. Instructions a. Complete the worksheet provided. It includes the following. i. A reconciliation of Book Income to Taxable income for 2020. ii. A schedule of future taxable and (deductible) amounts at the end of 2020. iii. A schedule of the deferred tax (asset) and liability at the end of 2020. iv. The journal entry to record income tax expense, deferred income taxes, and income tax payable for 2020. Show how the deferred income taxes should be reported on the Balance Sheet at December 31, 2020. Show how the taxes should be reported on the Income Statement at December 31, 2020. Repeat a. to f. above for 2021. b. 2 c. d. C33 face G H M A B D 1 Deferred Tax Worksheet 2 Reconciliation of Book Income to Taxable income 3 2020 2021 4 Taxable income 850,000 900,000 5 PPE Depreciation (30,000) (30,000 6 Tax Depreciation 90,000 7 Rental Income (210,000) 140,000 8 Litigation (40,000) 9 Merchandies Sales 300,000 (150,000) 10 Warranty Expense 15,000) 5,000 11 Fines 12,000 12 13 Book Income 995,000 823,000 14 15 16 Schedule of FTAs and FDAs by year 17 2020 2021 2022 18 Taxable Deductible 19 Book Depriciation 30,000 30,000 20 Tax Depreciation 21 Rental income in Advance 70,000 22 Litigation 23 Merchandise Sales 150,000 24 Warranty Expense 5,000 25 Fines 26 27 28 29 30 Def. Tax Asset Def. Tax Liability 31 32 33 34 35 36 37 Record Tax Journal Entry 12/31/2 39 40 41 42 43 44 45 46 Balance Sheet Income Statement 48 50 51 Schedule of ETAs and FDAs by year Proiect 1 00 F G T K D E Schedule of FTAs and FDAs by year 2023 Def. Tax Liability A C 51 52 2021 2022 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 Def. Tax Asset 68 69 70 71 72 73 74 Record Tax Journal Entry 12/31/2 75 76 77 78 79 80 Balance Sheet 81 82 83 84 85 86 87 88 89 90 91 92 Income Statement