Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The following is information pertaining to a currency Swap for the Indian Rupee (INR) and British Pound (GBP) for a 7%, 10 year

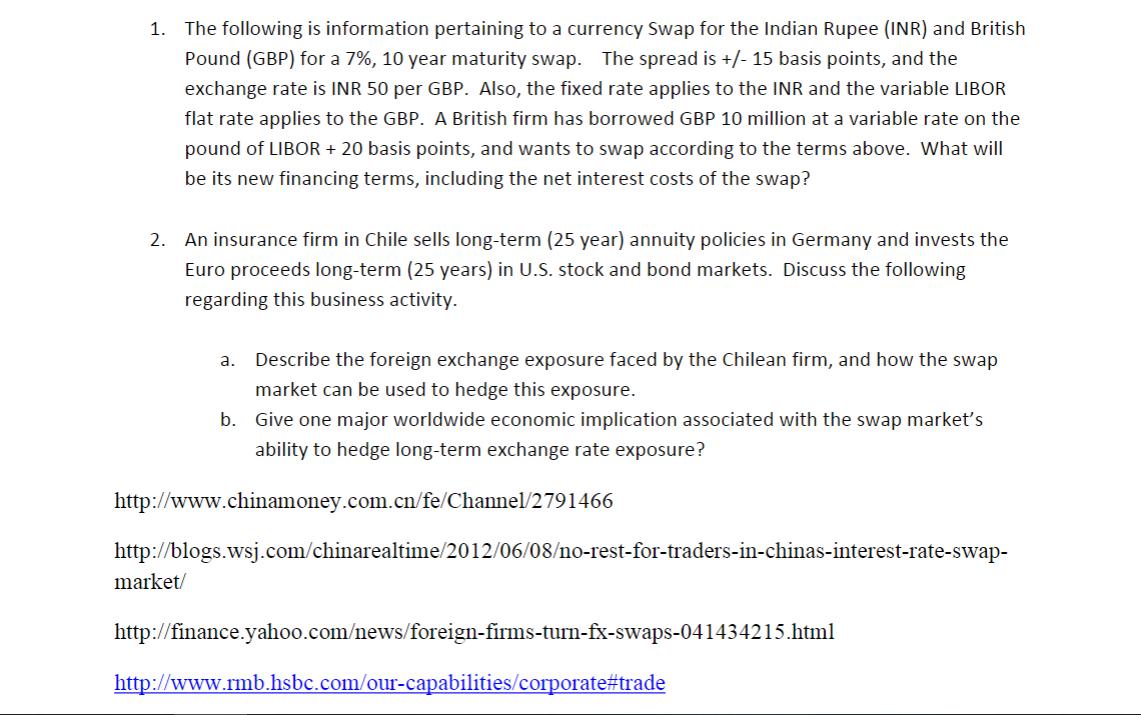

1. The following is information pertaining to a currency Swap for the Indian Rupee (INR) and British Pound (GBP) for a 7%, 10 year maturity swap. The spread is +/- 15 basis points, and the exchange rate is INR 50 per GBP. Also, the fixed rate applies to the INR and the variable LIBOR flat rate applies to the GBP. A British firm has borrowed GBP 10 million at a variable rate on the pound of LIBOR + 20 basis points, and wants to swap according to the terms above. What will be its new financing terms, including the net interest costs of the swap? 2. An insurance firm in Chile sells long-term (25 year) annuity policies in Germany and invests the Euro proceeds long-term (25 years) in U.S. stock and bond markets. Discuss the following regarding this business activity. a. Describe the foreign exchange exposure faced by the Chilean firm, and how the swap market can be used to hedge this exposure. b. Give one major worldwide economic implication associated with the swap market's ability to hedge long-term exchange rate exposure? http://www.chinamoney.com.cn/fe/Channel/2791466 http://blogs.wsj.com/chinarealtime/2012/06/08/no-rest-for-traders-in-chinas-interest-rate-swap- market/ http://finance.yahoo.com/news/foreign-firms-turn-fx-swaps-041434215.html http://www.rmb.hsbc.com/our-capabilities/corporate#trade

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1To begin with lets calculate the fixed and variable rates for the swap using the given information The fixed rate for the INR is 7 and the variable r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started