Answered step by step

Verified Expert Solution

Question

1 Approved Answer

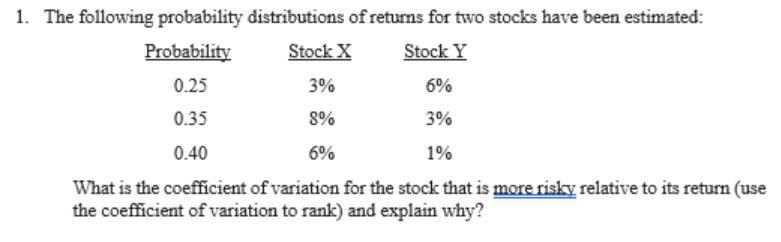

1. The following probability distributions of returns for two stocks have been estimated: Probability 0.25 Stock X Stock Y 3% 6% 0.35 8% 3%

1. The following probability distributions of returns for two stocks have been estimated: Probability 0.25 Stock X Stock Y 3% 6% 0.35 8% 3% 0.40 6% 1% What is the coefficient of variation for the stock that is more risky relative to its return (use the coefficient of variation to rank) and explain why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the coefficient of variation CV we need to first find the standard deviation of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d66e1c699a_967418.pdf

180 KBs PDF File

663d66e1c699a_967418.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started