Answered step by step

Verified Expert Solution

Question

1 Approved Answer

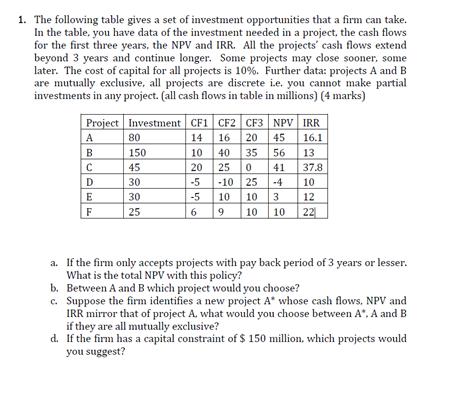

1. The following table gives a set of investment opportunities that a firm can take. In the table, you have data of the investment

1. The following table gives a set of investment opportunities that a firm can take. In the table, you have data of the investment needed in a project, the cash flows for the first three years, the NPV and IRR. All the projects' cash flows extend beyond 3 years and continue longer. Some projects may close sooner, some later. The cost of capital for all projects is 10%. Further data: projects A and B are mutually exclusive, all projects are discrete i.e. you cannot make partial investments in any project. (all cash flows in table in millions) (4 marks) Project A BUDE F Investment CF1 CF2 CF3 NPV IRR 14 16 20 45 16.1 40 35 56 13 25 0 41 37.8 -5 -10 25 -4 10 -5 10 10 3 12 6 9 10 10 22 80 150 45 30 30 25 10 20 a. If the firm only accepts projects with pay back period of 3 years or lesser. What is the total NPV with this policy? b. Between A and B which project would you choose? c. Suppose the firm identifies a new project A* whose cash flows. NPV and IRR mirror that of project A. what would you choose between A*. A and B if they are all mutually exclusive? d. If the firm has a capital constraint of $ 150 million, which projects would you suggest? 1. The following table gives a set of investment opportunities that a firm can take. In the table, you have data of the investment needed in a project, the cash flows for the first three years, the NPV and IRR. All the projects' cash flows extend beyond 3 years and continue longer. Some projects may close sooner, some later. The cost of capital for all projects is 10%. Further data: projects A and B are mutually exclusive, all projects are discrete i.e. you cannot make partial investments in any project. (all cash flows in table in millions) (4 marks) Project A BUDE F Investment CF1 CF2 CF3 NPV IRR 14 16 20 45 16.1 40 35 56 13 25 0 41 37.8 -5 -10 25 -4 10 -5 10 10 3 12 6 9 10 10 22 80 150 45 30 30 25 10 20 a. If the firm only accepts projects with pay back period of 3 years or lesser. What is the total NPV with this policy? b. Between A and B which project would you choose? c. Suppose the firm identifies a new project A* whose cash flows. NPV and IRR mirror that of project A. what would you choose between A*. A and B if they are all mutually exclusive? d. If the firm has a capital constraint of $ 150 million, which projects would you suggest?

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the total NPV with the payback period policy we need to consider the projects that ha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started