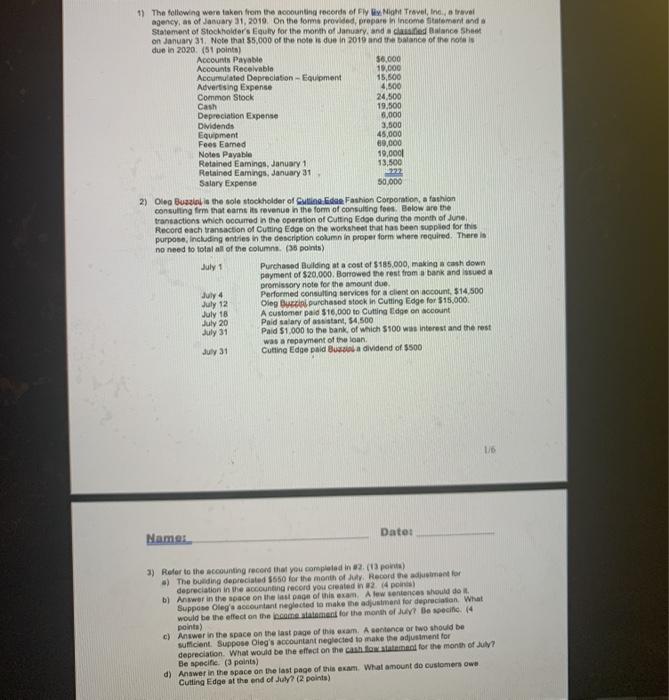

1) The following were taken from the counting records of Fly lay Night Travel, Inc., travel agency, as of January 31, 2019. On the forma provided, prepare in income statement and Statement of Stockholder's Eqully for the month of January, and added Balance She on January 31. Note that 55.000 of the note is due in 2019 and the balance of the notis due in 2020 (51 points) Accounts Payable $6.000 Accounts Receivable 19.000 Accumulated Depreciation - Equipment 15,500 Advertising Expense 4,500 Common Stock 24,500 Cash 19.500 Depreciation Expense 0.000 Dividends 3,000 Equipment 45,000 Fees Eamed 89.000 Notes Payable 10,000 Retained Eamings, January 1 13,500 Retained Eamings, January 31 Salary Expense 50.000 2) Oleg Buail is the sole stockholder of Culing der Fashion Corporation, a fashion consulting firm that ears its revenue in the form of consulting foes Below are the transactions which occurred in the operation of Cutting Edge during the month of June Record each transaction of Cutting Edge on the worksheet that has been supplied for this purpose, including entries in the description column in proper form where required. There is no need to total all of the columns (36 points) July 1 Purchased Building at a cost of $185.000, making a cash down payment of $20,000. Borrowed the rest from a bank and issued a promissory note for the amount due July 4 Performed consulting services for a client on account, $14.500 July 12 Oleg Buzzin purchased stock in Cutting Edge for $15,000 July 18 A customer paid $16,000 to Cutting Edge on count July 20 Paid salary of assistant, 54,500 July 31 Paid $1,000 to the bank, of which $100 was interest and the rest was a repayment of the loan July 31 Cutting Edge paid Busia dividend of $500 16 Date: Name 3) Refer to the accounting record that you completed in 2013 points) .) The bunding depreciated $650 for the month of July. Record the adjustment for depreciation in the accounting record you created 24 points) b) Answer in the space on the last one of this exam. A low sentences should do Suppose Olegs accountant neglected to make the adjustment for depreciation. What would be the effect on the income statement for the month of Jy? Bespecific 14 points) c) Answer in the space on the last page of this exam. A sentence or two should be suficient. Suppose Oleg's accountant neglected to make the adjustment for depreciation. What would be the effect on the cannotamment for the month of July Be specific (3 points) d) Answer in the space on the last page of this exam. What amount do customers own Cutting Edge at the end of Juy (2 points)