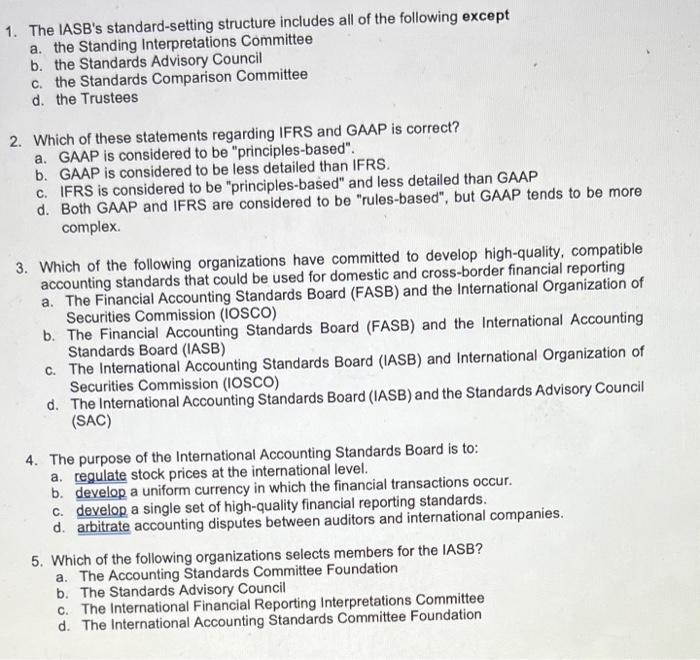

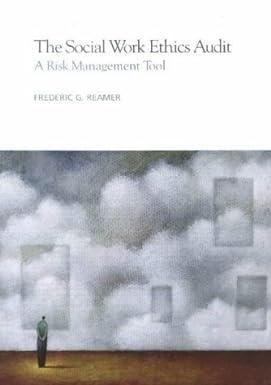

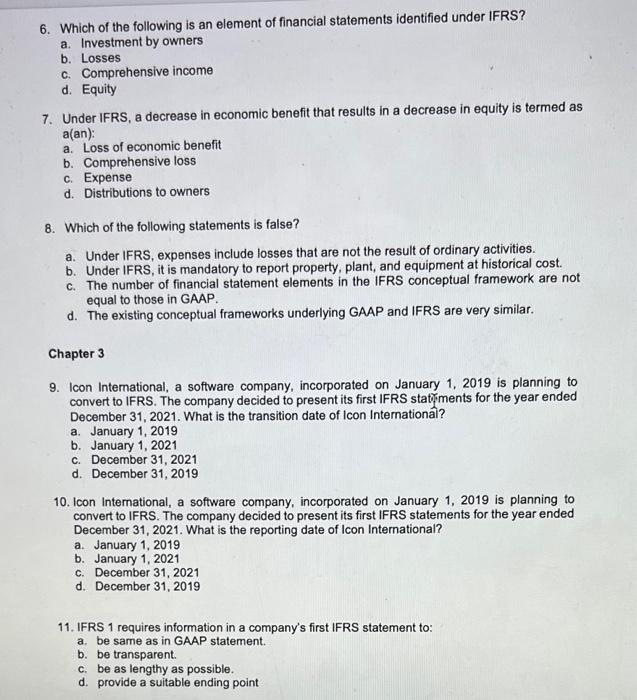

1. The IASB's standard-setting structure includes all of the following except a. the Standing Interpretations Committee b. the Standards Advisory Council c. the Standards Comparison Committee d. the Trustees 2. Which of these statements regarding IFRS and GAAP is correct? a. GAAP is considered to be "principles-based". b. GAAP is considered to be less detailed than IFRS. c. IFRS is considered to be "principles-based" and less detailed than GAAP d. Both GAAP and IFRS are considered to be "rules-based", but GAAP tends to be more complex. 3. Which of the following organizations have committed to develop high-quality, compatible accounting standards that could be used for domestic and cross-border financial reporting a. The Financial Accounting Standards Board (FASB) and the International Organization of Securities Commission (IOSCO) b. The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) c. The International Accounting Standards Board (IASB) and International Organization of Securities Commission (IOSCO) d. The International Accounting Standards Board (IASB) and the Standards Advisory Council (SAC) 4. The purpose of the International Accounting Standards Board is to: a. regulate stock prices at the international level. b. develop a uniform currency in which the financial transactions occur. c. develop a single set of high-quality financial reporting standards. d. arbitrate accounting disputes between auditors and international companies. 5. Which of the following organizations selects members for the IASB? a. The Accounting Standards Committee Foundation b. The Standards Advisory Council c. The International Financial Reporting Interpretations Committee d. The International Accounting Standards Committee Foundation 6. Which of the following is an element of financial statements identified under IFRS? a. Investment by owners b. Losses c. Comprehensive income d. Equity 7. Under IFRS, a decrease in economic benefit that results in a decrease in equity is termed as a(an): a. Loss of economic benefit b. Comprehensive loss c. Expense d. Distributions to owners 8. Which of the following statements is false? a. Under IFRS, expenses include losses that are not the result of ordinary activities. b. Under IFRS, it is mandatory to report property, plant, and equipment at historical cost. c. The number of financial statement elements in the IFRS conceptual framework are not equal to those in GAAP. d. The existing conceptual frameworks underlying GAAP and IFRS are very similar. Chapter 3 9. Icon International, a software company, incorporated on January 1, 2019 is planning to convert to IFRS. The company decided to present its first IFRS statyments for the year ended December 31, 2021. What is the transition date of Icon International? a. January 1, 2019 b. January 1, 2021 c. December 31, 2021 d. December 31, 2019 10. Icon International, a software company, incorporated on January 1, 2019 is planning to convert to IFRS. The company decided to present its first IFRS statements for the year ended December 31, 2021. What is the reporting date of Icon International? a. January 1, 2019 b. January 1, 2021 c. December 31, 2021 d. December 31, 2019 11. IFRS 1 requires information in a company's first IFRS statement to: a. be same as in GAAP statement. b. be transparent. c. be as lengthy as possible. d. provide a suitable ending point