1. The industry:

Analyze the Crowdfunding industry - is it a "Winner Take All" market?

2. Competitive advantage:

What are the competitive advantages of Crowd2Fund in the UK?

Which of them do you think are sustainable in the medium term?

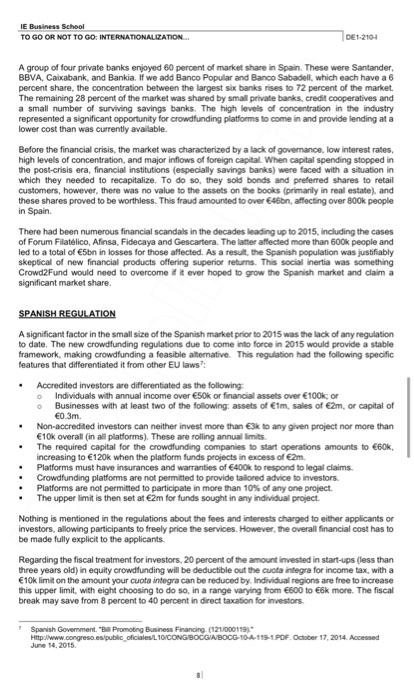

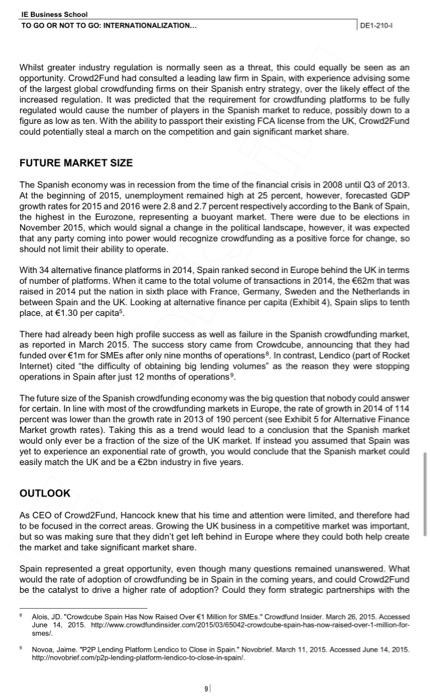

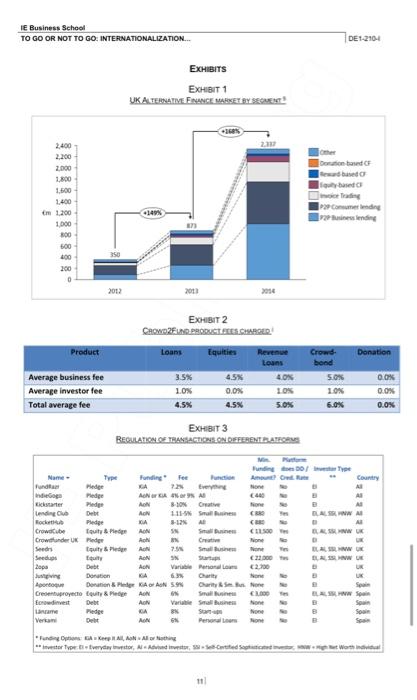

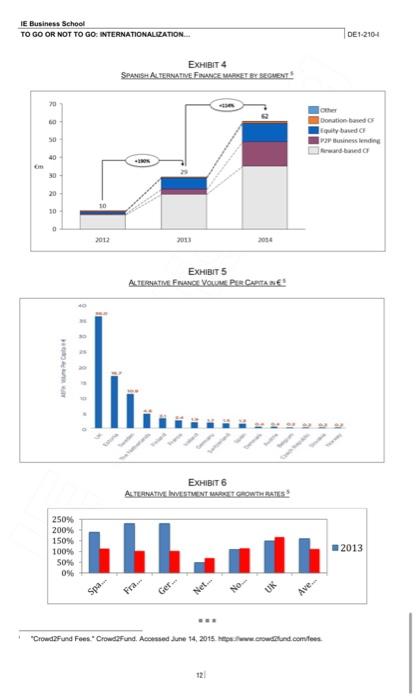

Original written by Prolessor Juan Santalb Mediavila and alumni Jchn Dariel and laac Clemerte Rios, at IE Business School. Original version. September 27. 2015. Last revised. October 21, 2016. Published by IE Business Publshing. Maria de Molina 13, 28006 - Madrid, Spain. 02015 IE. Total or partial publication of this document without the exgress, written consent of IE is prohibied It was spring 2015 and Chris Hancock, the CEO and Founder of crowdfunding platform Crowd2Fund sat in his office in London, deliberating over where best to focus his attention to grow the business. He was sure that consolidation would result in only a handful of players making up the global crowdfunding industry in 10 years, perhaps as soon as 5 years, and needed to position his business to be one of those players. With the City of London as one of the prominent financial capitals of the world, a lending market that was constrained by regulation following the financial crisis of 2008 and a population with a high propensity to commerce over the internet, the UK was one of the largest and most competitive crowdfunding markets worldwide. Crowd2Fund had established itself in this highly competitive market, and while growing UK market share was important, so was establishing a presence in other overseas markets. Crowd2Fund was already considering expansion into the French market but now needed to decide whether to also focus on expanding into the Spanish crowdfunding market. CROWDFUNDING OVERVIEW Crowdfunding is an umbrella term to describe raising money for a venture or project, normally via the use of an online platform. Money is subscribed from a large number of individuals as well as institutions via the platform t. The model requires three types of actors in order to operate: the project initiator who puts forward the venture requiring funding; individuals or institutions who provide the funding for the venture; and a platform to facilitate the transaction between the two aforementioned sets of actors. Crowdfunding can initially be broken down into donations, reward, and investment models. Donations models involve simply donating money to not for profit organizations that have a social or environmental cause. Reward models involve individuals giving money to start-up businesses they want to see get off the ground, receiving a nominal gift in return. Investment models then involve businesses offering equity in their company or taking out various types of loans via a crowdfunding site in return for the receipt of funds. Investment models of crowdfunding replace the role traditionally played by retail banks who would have taken deposits from retail customers, then provided that money in the form of loans to "COMMUNICATION FROM THE COMMISSION TO THE EUROPEAN PARLIAMENT. THE COUNCIL. THE EUROPEAN ECONOMIC AND SOCIAL COMMITTEE AND THE COMMITTEE OF THE REGIONS." Unleashing the Potential of Crowdtunding in the European Union, 2014, 3. IE Business School TO GO OR NOT TO CO: NTEROATIONALIZATON... Det-2194 businesses. Cutting out the institution of the retail banks acting as a middleman reduces the transaction cost in this process and drives cost efficiencies. Even after crowdtunding platforms have taken a fee for faciltating the transaction, they can offer a superior product to both businesses and investors. Businesses gain access to funds without having to give away significant portions of equity to angels or venture capitalists or access loans at lower rates of interest compared to the banks. Investors can then gain access to previously unavailable investment opportunities, often at higher rates of interest than comparable risk options elsewhere. The main risk is an investment target failing or defaulting. If investors are made into a number of opportunities, then it is possible to diversify this risk (which should be associated with high retums). however, exposure to individual investments remains. The risk of platform closure is present in the market, which would leave investors with no recourse to recover their investment. Investors also need to consider the possibility of bogus companies using these platforms to simply defraud them of their investment. Taking in the abstract, crowdfunding has been around for centuries, with subscription business models being used in the 17m century to fund publications planned but not yet printed. The cooperative movement of the 19 and 20h century then saw collective groups pooling subscribed funds to develop new concepts and products. One should also note that funding for part of the Statue of Liberty came from as many as 160k donors. Moving closer to the 21te century, it can be noted that in 1997 , British rock group Marilion raised funds for an entire U.S. tour via a fan-based internot campaign, whilst film writer Mark Kines started a successful online campaign to complete his then-unfinished feature film Foreign Correspondents. The site ArtistShare, launched in 2003, then allowed artists to fund their projects directly from the public. sharing the creative process in return. The earliest record of the term "crowdtunding" was then recorded in fundavlog in 2006, which described the concept as it is known today. CROWDFUNDING IN THE UK The alternative financing market in the UK experienced its most significant period of growth in porcentage as well as absolute terms between 2012 and 2014 against a backdrop of bank lending to UK businesses falling by a cumulative f4.3bn, or 9 percent? 2. Starting from a base market size of E267m in 2012, the crowdfunding market grew by 150 peroent in 2013 to a size of 2666m. Growth in 2014 was then 161 percent to reach a total market size of 51.74bn. Of the forms of alternative financing relevant to Crowd2Fund, loan crowdfunding made up the largest category, accounting for 1.30bn, or 70 percent of the total market size in 2014. Other relevant crowdtunding categories in 2014 included equity crowdfunding (84m), rewards crowdtunding (126m). and donation crowdfunding (2m)3. Laan crowdfunding can be split into two subcategories of P2P business lending. and P2P consumer lending (see Exhibit 1 for an illustration of the different models of Aternative Financing in the UK). 250 percent growth between 2012 and 2014 . The average amount borrowed was 573k, and on average it took 796 people in the crowd to fund the loan. Of al businesses surveyed that rose funding in this way, 33 percent believed that they would have been unable to secure the funding they needed elsewhere. The comparatively smaller subcategory, P2P consumer lending had a market size of E547m in 2014, and experienced growth of 108 percent between 2012 and 2014 . The average amount borrowed was just f5k, a much lower figure compared to business lending?" October 1, 2014. Accessed June 14, 2015 ALTERNATNE FINANCE, 2014, 10,11,16,33,37. 2 Drilling down into equity crowdfunding. we note the avorage amount raised was a relatively high figure of 199k. In terms of the use of funds, 54 percent was to fund expansion, whilst 46 percent was seed or start-up capital. Rewards crowdfunding in comparison had an average amount raised of only ~4k, with the majority of funders contributing less than ESO. Turning to donation crowdfunding. we note that the average amount raised was just E6K, with 27 percent of donors going on to help or volunteer with the project they had backed with donations? One of the key barriers to wider adoption of crowdfunding was default risk or perceived defaull risk by potential ifvestors. In P2P lending, default risk reached a high of 30 percent, as experienced by Prosper, in 20094. Subsequent self-imposed restrictions on creditworthiness have reduced default rates dramatically, however, and data compiled from individual platforms shows that Funding Circle had default rates of 1.5 percent, which appears high compared to the rate of 0.3 percent and 0.2 percent for RateSetter and Zopa respectively4. This compares very favorably to average loan default fates in the UK of 0.15 percent to 2.6 percent. The facts, therefore, ride against the assumption that crowdfunding is a risky business. UK CROWDFUNDING INDUSTRY Many of the largest crowdfunding (CF) platforms in the UK were part of the wave that began in 2008. including IndieGoGo (2008), FundRazr (2009), and Kickstarter (2009) as follows: - CrowdCube: primarily an equity CF model, and the leading platform worldwide: - Seedrs: an equity-coly CF platform for small and large companies alike; - Kickstarter: the world's largest rewards CF platform for creative projects; - Crowdfunder; a reward-based model offering funding and networking opportunities: - Indiegogo: a reward-based model for ideas, charities or start-ups; - FundRazr: a donations-based model for a variety of philanthropic causes; and - JustGiving: a global donations-based online social platform for charitable causes. More information on these platforms is given in Appendix 3, which looks specifically at how each of the different platforms differentiates themselves in terms of different funding models offered, as well as how they regulate transactions within the platform. More than 350k ventures were launched in the UK thanks to crowdfunding in 20145, In a market where many small businesses were still waiting to see retail banks provide the financing they had been promising since 2008, crowdfunding was becoming an essential source of funding. When small businesses in the UK were surveyed about crowdfunding, it was found that 44 percent were familiar with it, and 9 percent had used or tried to use it 3. UK BANKING SECTOR Consolidation of the retail banking sector throughout the 205 century led to the prevalence of the big five" UK banks. During the sixties and seventies, the banks expanded their branches promoting the high street banking activity, whilst computing and ATMs increased efficiency and competition. After a period of mergers Westminster, National, Provincial, Barclays and Lloyds dominated the financial landscape. The origins of the severe problems faced by UK banks in the financial crisis of 2008 were located in the shift from the traditional business model towards a model focused on buying short-term money to sell long-term low-quality loans and mortgages. By securitizing these and selling them out (after - Kiby. Elesnor, and Shane Womer. "Crowd-tunding. An Intant industry Growing Fast" Staft Working Paper of the 10sco Piesearch Deganmert. 2014, 14, 24. 1 Wartrop. Robet, Bryan Zhang. Raghweendra Rau, and Ma Gray, "MOVING MaiNSTREAM: The European Albernatve Finance Benchmarking Repon." 2015, 40. IE Business Sehool TO GO OR NOT TO GO: INTEREATIONALIZATION.. Det-2104 receiving high credit ratings) the risk was spread out from the banks to the whole financial system. including investment and pension funds, meaning that the failure of any single bank was no longer a palatable option. After increasing concerns about the banks' capital ratios, the UK government approved a protection scheme of E500bn in loans and guarantees. Some of the banks needed this state aid in the form of direct participation in the form of purchasing capital, requiring a total of f50bn. The cost of which was an increased national debt and a devalued currency. If we consider the biggest six retail banks in the UK in 2015, we see paralleis with the Spanish financial system in terms of a concentrated oligopolistic market. Loyds, Barclays, NatWest. HSBC, Halifax, and Santander hold an astonishing 74 percent of the market. The concentration in the sector, capital scarcity, and the insufficient removal of legacy managerial habits, resulted in a lack of sufficient funding for businesses and individuals. All of these factors contributed to the prominence of the UK crowdfunding industry. UK REGULATION UK regulations distinguish betwoen donation, reward, lending and investment models. Accordingly. they have different regulations, with the most restrictive addressing investment modeis, and the least restrictive ones addressing to the donation models. As donation and reward models do not aim to provide a financial reward, this does not constitute a financial instrument and is therefore not subject to securities regulation. As of April 2014, both P2P and B2B lending platforms need to apply for Financial Conduct Authority (FCA) approval to operate in the UK. The platforms operate under the consumer credit act of 1974 and the UK Money Laundering Regulations (S1 2007/2157). The Financial Services and Markets Act (FSMA) 2001 also regulates the P2P activity if either the lender is an individual borrowing less than E25k for personal reasons. The platforms conducting investment-based model are obliged by the FSMA to comply with FCA regulation. Among other requirements, the platforms have to assess investments as non-ready realizable securities, collective investment schemes or atternative investment funds. The FCA issue tougher requirements on the investment based model due to the need to create a common ground for all companies competing in the financial sector. Despite the mandatory complance with regulations, the UK regime is considered light in order to promote the UK as an international center for crowdfunding. CROWD2FUND COMPANY OVERVIEW Crowd2Fund incorporated as a business in April of 2013, then spent the first 12 months working on nothing but the development of the platform in order to go to market with one of the highest quality products on offer. Whilst many peopie view crowdfunding as a finance-led proposition. CrowdzFund instead view it as a technology-led proposition, whereby innovation in platform technology will be the key driver of growth. Quarters two and three of 2014 were spent bulding awareness of the company through marketing and PR campaigns before the platform opened for business in quarter four of 2014. Whist the platform was being developed, an executive team was assembled that could compliment the high-quality technology platform under development. Aware that quality compliance and due diligence was essential to the success of the platform, Hancock employed a chief compliance officer with experience working for leading global investment banks, whilst the head of due dilgence and head of deal fow came across from market leaders at the time. The senior advisory team then had a wealth of experience in private banking, investment banking, media consultancy, and start-ups. CROWD2FUND PRODUCT OFFERING In terms of product, what Crowd2Fund developed was an enterprise class crowdfunding platform, which facilitated all models of crowdfunding avalable in the market at that time. This was to be a point of difference vis-a-vis the competition, where investors and businesses were able to choose the model to fit their needs, as opposed to fitting their needs to a limited choice of crowdfunding options. Beyond the initial split of dividing crowdfunding between investment and donation models, Crowd2Fund divided investing into four specific sub-categories: Laans, Equities, Revenue Loans, and Crowdbonds as follows (see Exhibin 2 for relevant fees): Loans are appropriate for established businesses that are able to demonstrate a track record of profitability as well as the ability to make repayments. Loans are normally required to make capital investments or in order to fund growth. Some form of security is generally required for this option. Investors are able to lend directly to businesses, and enjoy a monthly repayment for the life of the loan. Equities are best suited for early stage businesses that are looking to fund growth. Businesses need to be able to substantiate their current position as much as possible, provide reasonable forecasts for the future, and compensate investors for the greater level of risk they are taking on. For investors, equities are best if you are looking for high returns over the medium to long term. Revenue Loans are an innovative way for new businesses to fund expansion. Monthly repayments are flexible, and linked to revenue, allowing greater control over cash flows. Monthly repayments are the greater of a percentage of revenue or just the monthly interest. Investors then have the potential upside of repayment sooner than expected. Crowdbonds are specifically designed for project funding. They offer the option of covering only the interest while the business gets the project off the ground. Repayments are made for the duration of the loan, before full capital repayment on maturity. Investors are able to enjoy regular repayments. as well as the full loan amount on maturity. Donation crowdlunding is aimed at not-for-profit organizations that are pursuing a social or environmental cause, with the platform giving greater visibility of these causes. For the investor, these opportunities give the optionalify of including philanthropic projects as part of their wider financial planning portfolio and make a difference where it is needed most. GO TO MARKET STRATEGY Crowd2Fund had obtained direct authorization from the FCA in the UK to operate all five funding models, making in the only fully regulated platform globally with this accreditation. Some crowdfunding platforms were accredited to perform one or two types of crowdfunding whilst others offered al five but did not have FCA authorization. This was a point of difference in the UK that Crowd2Fund hoped to leverage internationally. The platform had been built using three principles of trust: Security (using the strongest security measures possible). Transparency (commitment to transparent, open and responsible practices), and Compliance (ensuring all regulatory requirements were mot). Cross-side network effects exist when users on one side of a platform such as start-ups gain more value from the platform when there are more users on the other side of the plafform such as investors and vice versa 6. Aware of these cross-side network effects, especially when it came to having more investors on the platform, Crowd2Fund had assembled a best in class range of investor services. Investors were assigned a dedicated account manager as soon as they start investing, avallable to answer queries at any time. Further benefits are then offered in the form of a bespoke investor dashboard, as well as alerts on suitable funding campaigns, based on historic investments. A team of accountants and tax specialists was also available to ensure that investors take advantage of all UK government incentives and tax breaks available. Due diligence on all investment opportunities was provided as standard, with the option of enhanced due diligence for those investing large sums of money. Finally, bespoke investment packages could be put together for institutionat investors, and syndicate investing was also available for businesses wishing to invest in multiple projects. On the business side, a dedicated business support manager is allocated to all businesses starting a crowdfunding campaign on the platform. Assistance is provided in creating the initial campaign, managing the business throughout the campaign period, and managing investors through effective reporting. Ancillary services are then provided to enhance technology, brand marketing, and innovation capabilities through consulting services and workshops. Assistance is also provided upon completion of each campaign in order to help businesses maximize their future growth potential. In order to enhance the credibility of the platform and reassure investors that risk presented on the platform were presented as accurately as possible, Crowd2Fund formed strategic partnerships with key stakeholders for the industry. The 'Big Six' accountancy firms, Grant Thornton (GT) provided due diligence advice in return for insights into the workings of the industry (GT have embraced the industry as a whole), BBC Worldwide Labs, a digital media start-up accelerator, provided access to a pool of UK entrepreneurs in retum for funding opportunities on the platform. Deal flow was also enhanced by partnerships with a number of UK retail banks such as HSBC and RBS, who referred some businesses and investors where they were unable to provide a solution themselves. BUSINESS PERFORMANCE In the first four months of the platform being operational, Crowd2Fund saw an exponential rise in all of the key stabisbics for the platform. The number of platform unique visits rose from 2k to almost 13k per month between September and December 2014. The number of monthly investor registrations rose from 116 to 350 over the same period, which corresponded to the value of funds invested rising from 4k in September to 300k by Christmas. Business applications registered were 40 in the first month of operations but had risen to 120 by December 2014. Business continued to grow at a significant rate throughout Q1 of 2015, which meant that at the start of April the total number of registered users was up to 1,300. To date, a total of sbx deals had been completed, with a further five on the platform currently raising funds. The total funds invested into businesses stood at almost 5900k, with revenue for Crowd2Fund from investment opportunities averaging at 5 percent of funds invested. Having recently concluded the second round of funding. Hancock was under pressure to ensure that he did not take his eye off the ball in the UK and continue to drive growth in that market. With one eye on the need to have a global footprint in order to be one of the prominent players in the industry, however, he knew that he needed to simultaneously exploce overseas opportunities, such as the one that presented itself in Spain. Entrepreneurinip Theory and Peactice. 2015. INTERNATIONALIZATION IN SPAIN SPANISH CROWDFUNDING INDUSTRY Despite experiencing significant growth between 2012 and 2014 , the market size was still a fraction of the size of the UK market. Starting with a market sice of 610m in 2012, the market grew 190 percent in 2013 to reach a size of 29m. Growth in 2014 was then 114 percent to reach a market size of 662m by the end of 20145. At the beginning of 2015, there were 111 platforms operating in the Spanish crowdfunding industry, a significant number for a market with such a small size. The sector is incredibly fragmented. Some of the platforms are attending minor niches such as weddings, poetry books or fashion designers. The companies try to compete in specific geographies and product lines. As a reference, below are some of the actors in the actual crowdlunding environment in the country: - Apontoque: helps professional sports clubs and individuals to fund sports events: - Creoentuproyecto: an equity-based CF model for start-up or established companies; - Ecrowdinvest crowdfunding for projects with a positive social impact; - Lanzame: a pledge fund platform with the aim of helping start-ups; and - Verkami: a CF site providing ioans for original projects and independent creators. See Appendix 3 for details on how these plafforms differentiate themselves to the competition, as well as specific detals on how they regulate transactions on the platorm. It was crucial for Crowd2Fund to understand the dynamics of the Spanish market since the goal for the company would be to enlarge it and gain significant market share. As the market was still in its infancy, it was envisioned that the P2P business and consumer would represent a larger portion of the market in the future as the market matures. Given the smaller relative size of the market, there were at present insufficiently large revenues to offset the significant marketing spending required to expand the market. This represented both a downside and an opportunity to Crowd2Fund. If effectively execuled, there was an opportunity to grow the market size, create a strong brand image, and take a correspondingly large market share through investment in marketing. Crowd2fund neods to differentiate itself from competitors, but it already had the tools that the company could leverage to achieve this purpose. First. its abilty to offer five different product lines on the same platform. Second, its superior capabilities in both due diligence and risk assessment thanks to compliance with UK FCA rules. Lastly, the focus on technology, which is a central resource for Crowdzfund. The market evolution will beneft companies with operations in multiple countries since it allows economies of scale through centralization of shared resource, as well as greater information inflows. SPANISH BANKING SECTOR Before the financial crisis and the bursting of the real estate bubble in Spain, the sector split was 50/50 between private banks and state-owned regional savings banks. However, the crisis exposed a lack of governance and proper risk assessment (savings banks were managed by political parties and unions), which led to bankruptcy for most of the saving banks. The State provided 67bn and 110bn in subsidies and guarantees respectively to facilitate the absorption of saving banks by private banks. It is remarkable that a special 100 bn line aid was faciltated by EU members to help Spain for this purpose, Of this aid, only 4 percent of subsidies and up to 95 percent of guarantees had been paid back by 2015 . IE Bunlness Sehool TO GO OR NOT TO GO: INTE POATIONALFATON.. cet12104 A group of four private banks enjoyed 60 percent of market shave in Spain. These were Santander. BBVA, Caixabank, and Bankia. If we add Banco Popular and Banco Sabadell, which each have a 6 percent share, the concentration between the largest six banks rises to 72 percent of the market. The remaining 28 percent of the market was shared by small petvate barks, credit cooperatives and a small number of surviving savings banks. The high levols of concentration in the industry represented a significant opportunity for crowdfunding platforms to come in and provide lending at a lower cost than was currently avalable. Before the financial crisis, the market was characterized by a lack of governance, low interest rates, high levels of concentration, and major inflows of foreign captal. When capital spending stopped in the post-crisis era, financial institutions (especially savings banks) were faced with a situation in which they needed to recapitalize. To d0 so, they sold bonds and preferred shares to retail customers, however, there was no value to the assets on the books (primarly in real estate), and these shares proved to be worthless. This fraud amounted to over 646i, affecting over 800k people in Spain. There had been numerous financial scandals in the decades leading up to 2015, including the cases of Forum Filatelico, Afinsa, Fidecaya and Gescartera. The latter affected more than 600k people and led to a total of 5bn in losses for those affected. As a result, the Spanish population was justifiably skeptical of new financial products offering superior returns. This social inertia was scmething Crowd2Fund would need to overcome if it ever hoped to grow the Spanish market and claim a significant market share. SPANISH REGULATION A significant factor in the small size of the Spanish market prior to 2015 was the lack of any regulation to date. The new crowdfunding regulations due to come into force in 2015 would provide a stable framework, making crowdfunding a feasible alternative. This regulation had the following specific features that differentiated it from other EU laws?: - Accredited investors are differentiated as the following - Individuals with annual income over 650k or financial assets over 100k; or - Businesses with at least two of the following: assets of 1m, sales of 2m, or capital of 0.3m. - Non-accrediled investors can neither invest more than E3k to any given project nor more than 10k overall (in all platforms). These are rolling annual limits. - The required capital for the crowdfunding companies to start operations amounts to 660k. increasing to 6120k when the platform funds peojects in excess of 62m. - Platforms must have insurances and warranties of 6400k to tespond to legal claims. - Crowdfunding platforms are not permitied to provide tallored advice to investors. - Platforms are not permitted to participate in more than 10% of any one project - The upper limit is then set at 62m for funds sought in any individual project. Nothing is mentioned in the regulations about the fees and interests charged to either applicants or investors, allowing participants to freely price the services. However, the overall financial cost has to be made fully explicit to the applicants. Regarding the fiscal treatment for investors, 20 percent of the amount invested in start-ups (less than three years old) in equity crowdfunding will be deductible out the cuota integra for income tax, with a E10k limit on the amount your cuota integra can be reduced by. Individual regions are free to increase this upper limit, whth eight choosing to do so, in a range varying from 6600 to 66k more. The fiscal break may save from 8 percent to 40 percent in direct taxabion for investors. Sparish Government. "Bs Promoting Businesn Financing (121/0001t97." June 14. 2015. . TO GO OR NOT TO GO: INTERNATIONALIZATION... |DE1-210-1 Whist greater industry regulation is normally seen as a threat, this could equally be seen as an opportunity. Crowd2Fund had consulted a leading law firm in Spain, with experience advising some of the largest global crowdfunding firms on their Spanish entry strategy. over the likely effect of the increased regulation. It was predicted that the requirement for crowdiunding platforms to be fully regulated would cause the number of players in the Spanish market to reduce, possibly down to a figure as low as ten. With the ability to passport their existing FCA license from the UK, Crowd2Fund could potentially steal a march on the competition and gain significant market share. FUTURE MARKET SIZE The Spanish economy was in recession from the time of the financial crisis in 2008 until Q3 of 2013. At the beginning of 2015 , unemployment remained high at 25 percent, however, forecasted GDP growth rates for 2015 and 2016 were 2.8 and 2.7 percent respectively according to the Bank of Spain, the highest in the Eurozone, representing a buoyant market. There were due to be elections in Nowember 2015, which would signal a change in the political landscape, however, it was expected that any party coming into power would recognize crowdfunding as a positive force for change, so should not limit their ability to operate. With 34 alternative finance platforms in 2014, Spain ranked second in Europe behind the UK in terms of number of platforms. When it came to the total volume of transactions in 2014, the 662m that was raised in 2014 put the nation in sixth place with France, Germany, Swoden and the Netherlands in between Spain and the UK. Looking at alternative finance per capita (Exhibit 4). Spain slips to tenth place, at 1.30 per capitas. There had already been high profile success as well as failure in the Spanish crowdfunding market, as reported in March 2015. The success story came from Crowdcube, announcing that they had funded over 1m for SMEs after only nine months of operations 8. In contrast, Lendico (part of Rocket Internet) cited "the difficulty of obtaining big lending volumes" as the reason they were stopping operations in Spain after just 12 months of operations? The future size of the Spanish crowdfunding economy was the big question that nobody could answer for certain. In line with most of the crowdfunding markets in Europe, the rate of growth in 2014 of 114 percent was lower than the growth rate in 2013 of 190 percent (see Exhibit 5 for Alternative Finance Market growth rates). Taking this as a trend would lead to a conclusion that the Spanish market would only ever be a fraction of the size of the UK market. If instead you assumed that Spain was yet to experience an exponential rate of growth, you would conclude that the Spanish market could easily match the UK and be a E2bn industry in five years. OUTLOOK As CEO of Crowd2Fund, Hancock knew that his time and attention were limited, and therefore had to be focused in the correct areas. Growing the UK business in a competfive market was important, but so was making sure that they didn't get left behind in Europe where they could both help create the market and take significant market share. Spain represented a great opportunity, even though many questions remained unanswered. What would the rate of adoption of crowdfunding be in Spain in the coming years, and could Crowd2Fund be the catalyst to drive a higher rate of adoption? Could they form strategic partnerships with the imes. - Novoa, Jame. P2P Lending Platiom Lendico to Close in Spain *Novobriet. Maych 11, 2015, Acoessed June 14, 2015 tetpolhovoberied com/p2p-lending-platform-lendico-to-close-inspain! IE Business School TO GO OR NOT TO GO: INTERNATIONALRZATION... Det.210-1 Spanish banks in the same way they had done in the UK in order to provide essential deal flow, or would the banks see them as direct competition? If Hancock did decide to enter the market, should he offer all five of the business modeis they offered in the UK or select those most appropriate for the Spanish market? He also needed to decide on a strategy to attract both businesses and investors alike to the platform. The opportunity to become a key player in the Spanish market was certainly great, but the business model and entry strategy would have to be executed to with great precision if Crowd2Fund were to overcome the obstacies that lay in their path. IE Business School TO GO OR NOT TO GO: INTERNATIONALIZATION. Exhibits EXHIBIT 1 Exonsit 2 CAOwa 2f ung pacovcterts caunce? IE Business School TO GO OR NOT TO GO: INTERNATIONALIZATION. EXHIBT 5