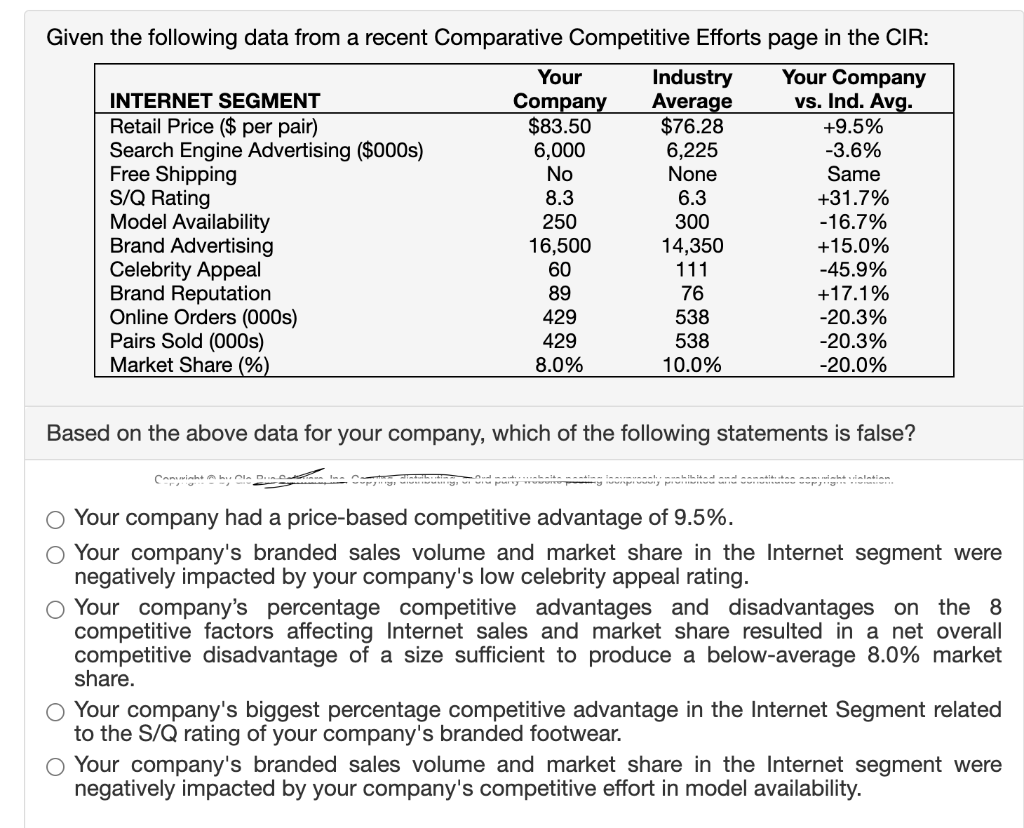

Question

1. The industry-low, industry-average, and industry-high benchmarks on p. 7 of each issue of the Footwear Industry Report a.are of little value to company managers

1. The industry-low, industry-average, and industry-high benchmarks on p. 7 of each issue of the Footwear Industry Report

a.are of little value to company managers in making decisions to improve company performance in the upcoming decision round, although they may have interest to managers who are curious about how their company's prior-year outcomes compared to the various benchmarks on p.7.

b.are of greatest value to the managers of companies whose branded cost benchmarks and operating profit benchmarks are below the industry average.

c.are worth careful scrutiny by the managers of all companies because when a company's costs or operating profits for one or more of the benchmarks are deemed too far out-of-line, managers should consider initiating corrective actions in the next decision round.

d.are only of value to the managers of companies whose operating profits per branded pair sold in the prior-year were negative in one or more geographic regions.

e. are of little value to the managers of companies whose branded cost and operating profit outcomes in the prior year were below the industry-average benchmarks.

2.Which of the following are effective ways to try to boost a company's stock price?

a.Increase the company's retained earnings each year, boost spending for corporate citizenship and social responsibility, pay a dividend each year that equals projected EPS, and offer a wider variety of models/styles of branded footwear

b.Strive to increase earnings per share, boost the company's dividend payout ratio to more than 100%, and increase the company's retained earnings

c.Strive to increase earnings per share each year by amounts that meet or beat investor expectations, raise the company's dividend each year (by at least $0.10 and preferably $0.25 or more for the increase to have much impact on the stock price), and repurchase shares of common stock

d.Pay off all long-term debt as rapidly as possible, strive to achieve a credit rating of at least an A, and try to boost the company's image rating above 75

e.Strive to achieve an ROE above 20%, quickly pay off all long-term debt (preferably by issuing additional shares of common stock and using the proceeds to pay off loans), and keep the company's dividend payout ratio below 50%

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started