Question

1.) The information below was used to prepare a bank reconciliation for Lorena Company at October 31: According to the bank statement, the bank balance

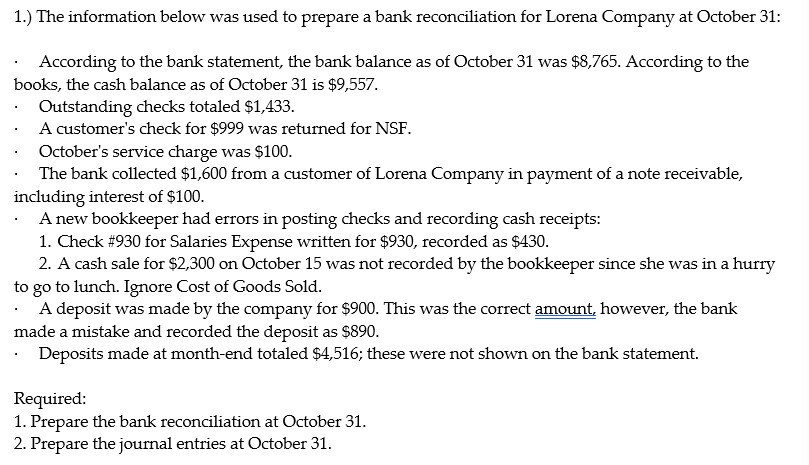

1.) The information below was used to prepare a bank reconciliation for Lorena Company at October 31: According to the bank statement, the bank balance as of October 31 was $8,765. According to the books, the cash balance as of October 31 is $9,557. Outstanding checks totaled $1,433. A customer's check for $999 was returned for NSF. October's service charge was $100. The bank collected $1,600 from a customer of Lorena Company in payment of a note receivable, including interest of $100. A new bookkeeper had errors in posting checks and recording cash receipts: 1. Check #930 for Salaries Expense written for $930, recorded as $430. 2. A cash sale for $2,300 on October 15 was not recorded by the bookkeeper since she was in a hurry to go to lunch. Ignore Cost of Goods Sold. A deposit was made by the company for $900. This was the correct amount, however, the bank made a mistake and recorded the deposit as $890. Deposits made at month-end totaled $4,516; these were not shown on the bank statement. Required: 1. Prepare the bank reconciliation at October 31. 2. Prepare the journal entries at October 31.

1.) The information below was used to prepare a bank reconciliation for Lorena Company at October 31 According to the bank statement, the bank balance as of October 31 was $8,765. According to the books, the cash balance as of October 31 is $9,557. Outstanding checks totaled $1,433 A customer's check for $999 was returned for NSF October's service charge was $100 The bank collected $1,600 from a customer of Lorena Company in payment of a note receivable, including interest of $100 keeper had errors in posting checks and recording cash receipts A new book 1, Check #930 for Salaries Expense written for $930, recorded as $430 2. A cash sale for $2,300 on October 15 was not recorded by the bookkeeper since she was in a hurry to go to lunch. Ignore Cost of Goods Sold. A deposit was made by the company for $900. This was the correct amount, however, the bank made a mistake and recorded the deposit as $890 Deposits made at month-end totaled $4,516; these were not shown on the bank statement. Required 1. Prepare the bank reconciliation at October 31 2. Prepare the journal entries at October 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started