Question

(1) The land is not depreciable. On 15 April 2020 a real estate agent revalued the land at 11,000,000. (2) The company depreciates its other

(1) The land is not depreciable. On 15 April 2020 a real estate agent revalued the land at 11,000,000. (2) The company depreciates its other assets to zero residual value as follows: Factory 5% per year straight-line Equipment 20% per year reducing balance The company provides full depreciation in the year of acquisition and none in the year of disposal. The disposal account reflects the sale proceeds of equipment bought on 5 July 2016 for 500,000 and sold on 29 March 2020 for 525,000. No entries have been made in the books for this disposal. (3) The directors have decided that 300,000 of trade receivables are not expected to be collected and should be written off and that the provision for doubtful debts should then be adjusted to 4% of the remaining balance. (4) A stock count was carried out on 31 March 2020 and inventory was valued at normal selling price of 6,000,000. The company marks up the cost of inventory by 20%. Included in this total inventory are items costing 30,000 which were damaged severely in transportation and cannot be sold. (5) Insurance premiums on the factory building are paid three months in advance. The last quarterly payment of 300,000 was made on 1 March 2020. (6) The accrual at 1 April 2019 was for the heat and light expenses. Provision is to be made for the current years remaining heat and light expenses of 19,000. (7) The company issued 60,000 new shares at a premium of 40p per share. No entries have been made relating to this transaction (8) Corporation tax for the year to 31 March 2019 was under-estimated. Corporation tax for the year to 31 March 2020 is estimated to be 145,000. REQUIRED: Prepare the income statement of Rightsize plc for the year ended 31 March 2020 and the statement of financial position at that date in a form suitable for presentation to the directors of the company (i.e. compliance with the accounting requirements of the Companies Act 2006 or with IAS1 Presentation of Financial Statements is not required).

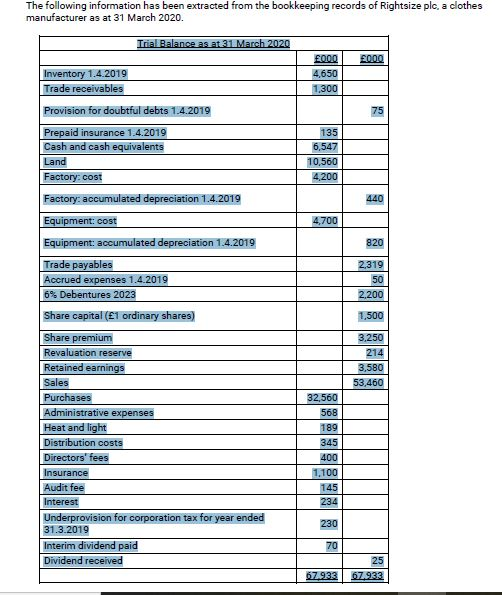

The following information has been extracted from the bookkeeping records of Rightsize plc, a clothes manufacturer as at 31 March 2020. Trial Balance as at 31 March 2020 0.00 Inventory 1.4.2019 Trade receivables 000 4,650 1,300 Provision for doubtful debts 1.4.2019 75 Prepaid insurance 1.4.2019 Cash and cash equivalents Land Factory: cost 135 6,547 10,560 4200 440 Factory: accumulated depreciation 1.4.2019 Equipment: cost 4,700 Equipment: accumulated depreciation 1.4.2019 820 Trade payables Accrued expenses 1.4.2019 6% Debentures 2023 2.319 50 2,200 1.500 3.250 214 3,580 53,460 Share capital (1 ordinary shares) Share premium Revaluation reserve Retained earnings Sales Purchases Administrative expenses Heat and light Distribution costs Directors' fees Insurance Audit fee Interest Underprovision for corporation tax for year ended 31.3.2019 Interim dividend paid Dividend received 32,560 568 189 345 400 1.100 145 234 230 70 25 67.933 67.933 The following information has been extracted from the bookkeeping records of Rightsize plc, a clothes manufacturer as at 31 March 2020. Trial Balance as at 31 March 2020 0.00 Inventory 1.4.2019 Trade receivables 000 4,650 1,300 Provision for doubtful debts 1.4.2019 75 Prepaid insurance 1.4.2019 Cash and cash equivalents Land Factory: cost 135 6,547 10,560 4200 440 Factory: accumulated depreciation 1.4.2019 Equipment: cost 4,700 Equipment: accumulated depreciation 1.4.2019 820 Trade payables Accrued expenses 1.4.2019 6% Debentures 2023 2.319 50 2,200 1.500 3.250 214 3,580 53,460 Share capital (1 ordinary shares) Share premium Revaluation reserve Retained earnings Sales Purchases Administrative expenses Heat and light Distribution costs Directors' fees Insurance Audit fee Interest Underprovision for corporation tax for year ended 31.3.2019 Interim dividend paid Dividend received 32,560 568 189 345 400 1.100 145 234 230 70 25 67.933 67.933Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started