Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable,

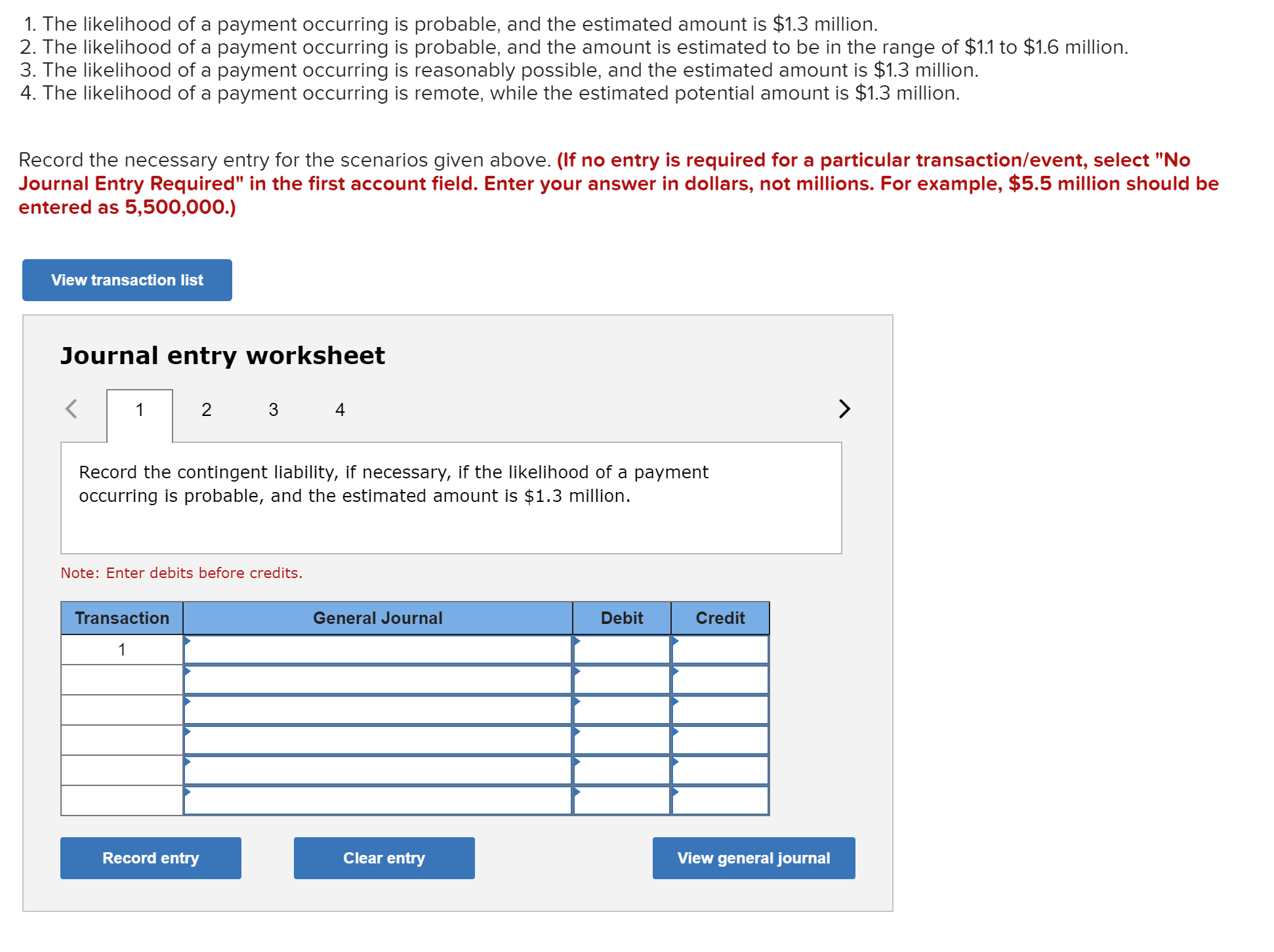

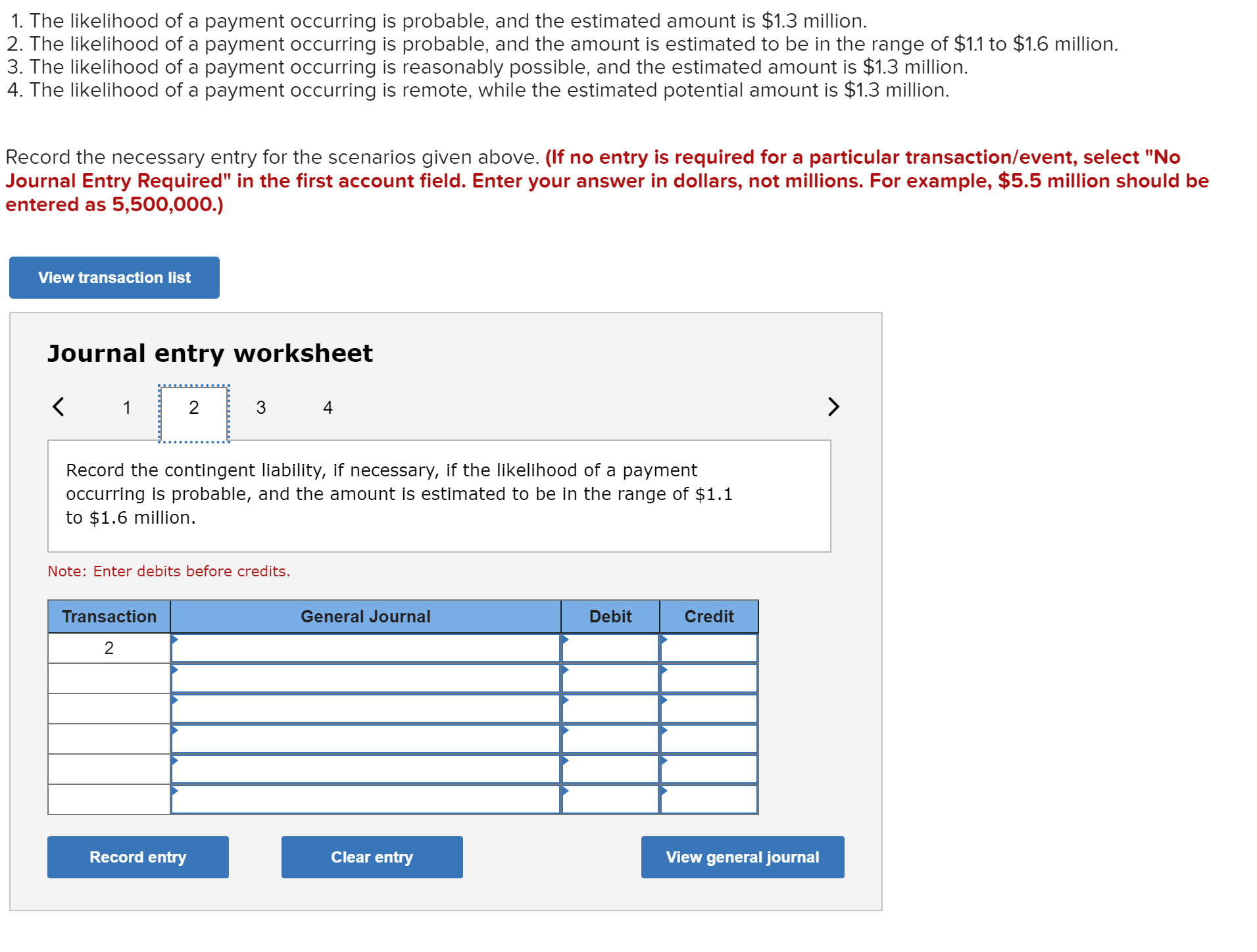

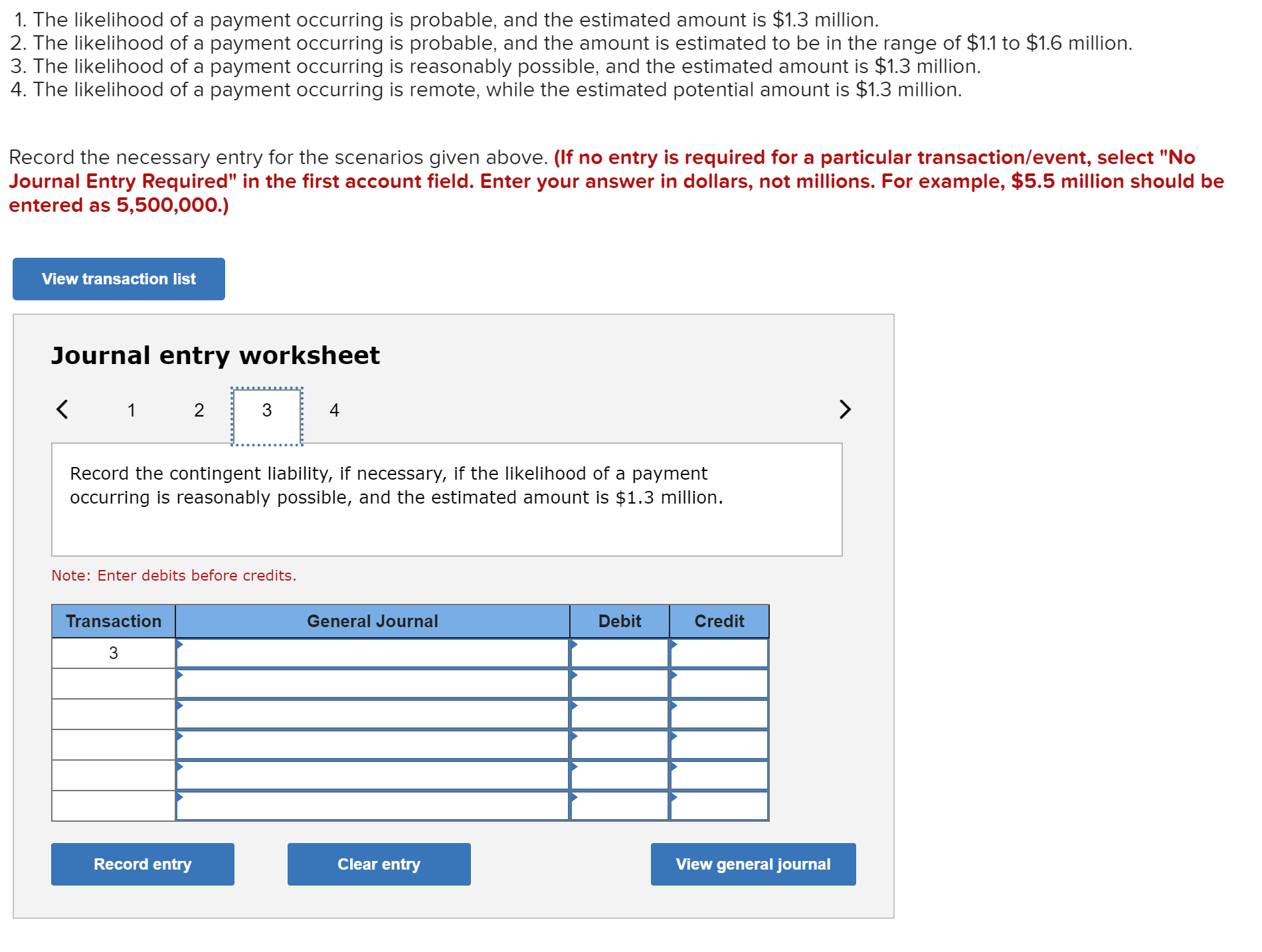

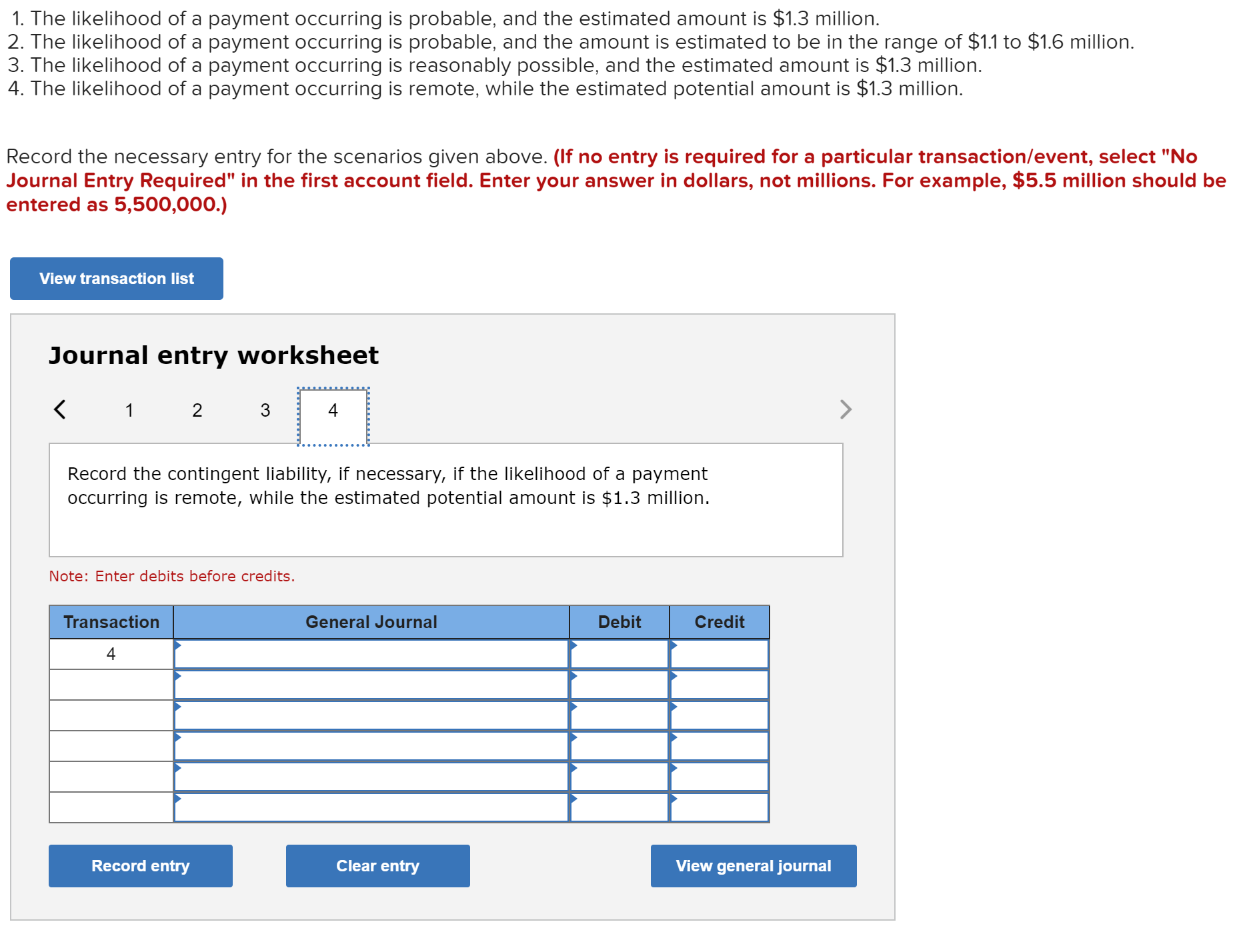

1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Note: Enter debits before credits

1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. Note: Enter debits before credits. 1. The likelihood of a payment occurring is probable, and the estimated amount is $1.3 million. 2. The likelihood of a payment occurring is probable, and the amount is estimated to be in the range of $1.1 to $1.6 million. 3. The likelihood of a payment occurring is reasonably possible, and the estimated amount is $1.3 million. 4. The likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Record the necessary entry for the scenarios given above. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) Journal entry worksheet Record the contingent liability, if necessary, if the likelihood of a payment occurring is remote, while the estimated potential amount is $1.3 million. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started