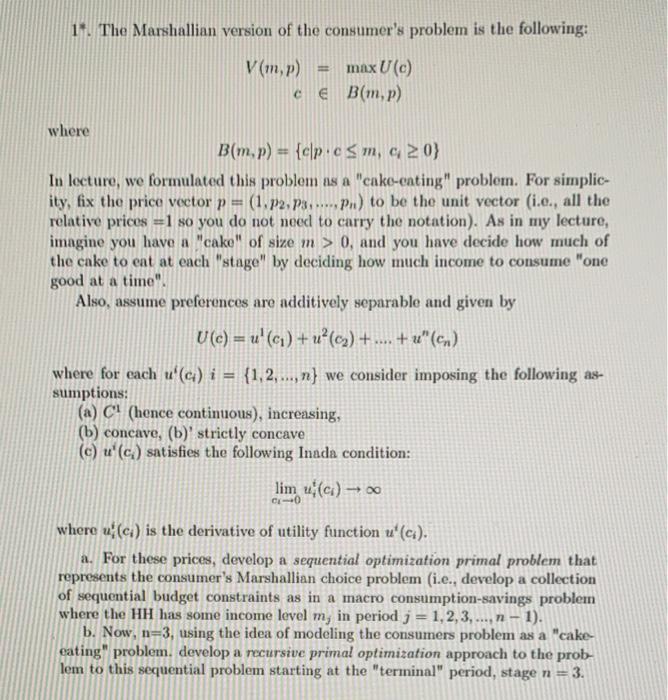

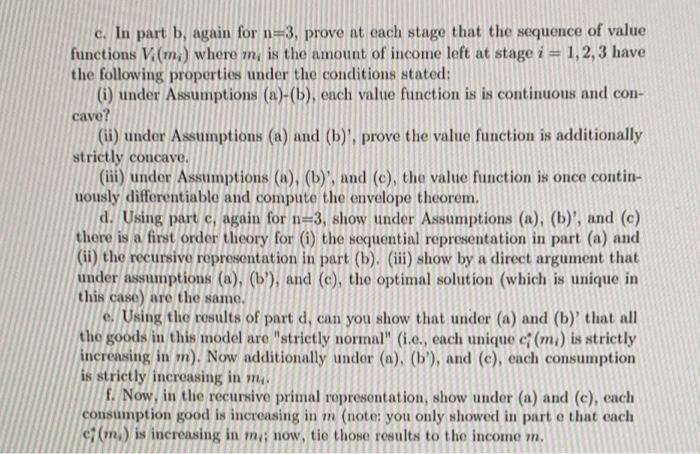

1* The Marshallian version of the consumer's problem is the following: V(m, p) max U(c) ce B( mp) where B(m, 2) = {c|p c5 m, c, 20} In lecture, we formulated this problem as a "cake-cnting" problem. For simplic- ity, fix the price vector p = (1, P2, P3, ....,P.) to be the unit vector (i.e., all the relative prices =1 so you do not need to carry the notation). As in my lecture, imagine you have a "cake" of size m > 0, and you have decide how much of the cake to eat at each "stage" by deciding how much income to consume "one good at a time" Also, assume preferences are additively separable and given by U (c) = u' (q) + u(c) + .... + u" (en) where for each u'(c) i = {1,2,..., n} we consider imposing the following as- sumptions: (a) C (hence continuous), increasing, (b) concave, (b)' strictly concave (c) '(c) satisfies the following Inada condition: lim (c) - C0 where u(ci) is the derivative of utility function u' (). a. For these prices, develop a sequential optimization primal problem that represents the consumer's Marshallian choice problem (i.e., develop a collection of sequential budget constraints as in a macro consumption-savings problem where the HH has some income level m, in period j = 1, 2, 3,..., 1 - 1). b. Now, n=3, using the idea of modeling the consumers problem as a "cake- eating" problem. develop a recursive primal optimization approach to the prob- lem to this sequential problem starting at the "terminal" period, stage n == 3. c. In part b, again for n=3, prove at each stage that the sequence of value functions V. (m) where m, is the amount of income left at stage i = 1, 2, 3 have the following properties under the conditions stated: (i) under Assumptions (a)-(b), ench value function is is continuous and con- cave? (ii) under Assumptions (a) and (b)', prove the value function is additionally strictly concave. (iii) under Assumptions (a), (b)', and (c), the value function is once contin- uously differentiable and compute the envelope theorem. d. Using part e, again for n=3, show under Assumptions (a), (b)', and (e) there is a first order theory for (i) the sequential representation in part (a) and (ii) the recursive representation in part (b). (iii) show by a direct argument that under assumptions (a), (b), and (c), the optimal solution (which is unique in this case) are the same. e. Using the results of part d, can you show that under (a) and (b) that all the goods in this model are "strictly normal" (i.c., each unique c'(m) is strictly increasing in m). Now additionally under (a), (b), and (c), each consumption is strictly increasing in my f. Now, in the recursive primal representation, show under (a) and (c), each consumption good is increasing in m (note: you only showed in part e that cach ef(m) is increasing in my; now, tio those results to the income m. 1* The Marshallian version of the consumer's problem is the following: V(m, p) max U(c) ce B( mp) where B(m, 2) = {c|p c5 m, c, 20} In lecture, we formulated this problem as a "cake-cnting" problem. For simplic- ity, fix the price vector p = (1, P2, P3, ....,P.) to be the unit vector (i.e., all the relative prices =1 so you do not need to carry the notation). As in my lecture, imagine you have a "cake" of size m > 0, and you have decide how much of the cake to eat at each "stage" by deciding how much income to consume "one good at a time" Also, assume preferences are additively separable and given by U (c) = u' (q) + u(c) + .... + u" (en) where for each u'(c) i = {1,2,..., n} we consider imposing the following as- sumptions: (a) C (hence continuous), increasing, (b) concave, (b)' strictly concave (c) '(c) satisfies the following Inada condition: lim (c) - C0 where u(ci) is the derivative of utility function u' (). a. For these prices, develop a sequential optimization primal problem that represents the consumer's Marshallian choice problem (i.e., develop a collection of sequential budget constraints as in a macro consumption-savings problem where the HH has some income level m, in period j = 1, 2, 3,..., 1 - 1). b. Now, n=3, using the idea of modeling the consumers problem as a "cake- eating" problem. develop a recursive primal optimization approach to the prob- lem to this sequential problem starting at the "terminal" period, stage n == 3. c. In part b, again for n=3, prove at each stage that the sequence of value functions V. (m) where m, is the amount of income left at stage i = 1, 2, 3 have the following properties under the conditions stated: (i) under Assumptions (a)-(b), ench value function is is continuous and con- cave? (ii) under Assumptions (a) and (b)', prove the value function is additionally strictly concave. (iii) under Assumptions (a), (b)', and (c), the value function is once contin- uously differentiable and compute the envelope theorem. d. Using part e, again for n=3, show under Assumptions (a), (b)', and (e) there is a first order theory for (i) the sequential representation in part (a) and (ii) the recursive representation in part (b). (iii) show by a direct argument that under assumptions (a), (b), and (c), the optimal solution (which is unique in this case) are the same. e. Using the results of part d, can you show that under (a) and (b) that all the goods in this model are "strictly normal" (i.c., each unique c'(m) is strictly increasing in m). Now additionally under (a), (b), and (c), each consumption is strictly increasing in my f. Now, in the recursive primal representation, show under (a) and (c), each consumption good is increasing in m (note: you only showed in part e that cach ef(m) is increasing in my; now, tio those results to the income m