Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The Mental Health program for the Community Center has just completed its fiscal year end The program director determines that his program has revenue

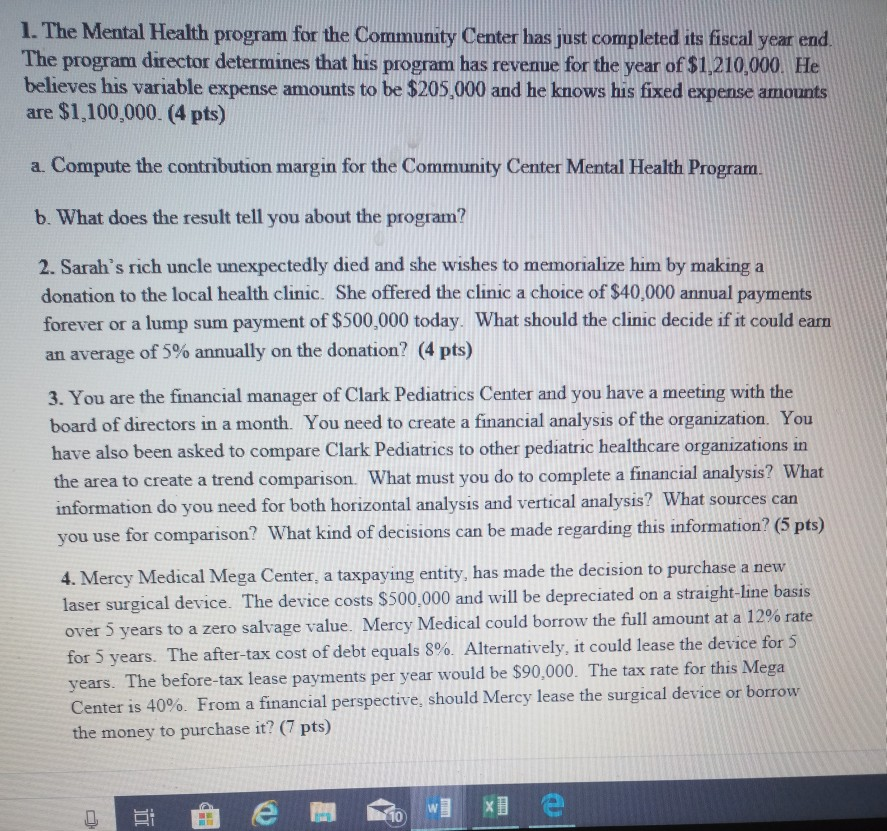

1. The Mental Health program for the Community Center has just completed its fiscal year end The program director determines that his program has revenue for the year of $1.210,000. He believes his variable expense amounts to be $205,000 and he knows his fixed expense amounts are $1,100,000. (4 pts) a. Compute the contribution margin for the Community Center Mental Health Program b. What does the result tell you about the program? 2. Sarah's rich uncle unexpectedly died and she wishes to memorialize him by making a forever or a lump sum payment of $500,000 today. What should the clinic decide if it could earn donation to the local health clinic. She offered the clinic a choice of $40,000 annual payments an average of 5% annually on the donation? (4 pts) 3. You are the financial manager of Clark Pediatrics Center and you have a meeting with the board of directors in a month. You need to create a financial analysis of the organization. You have also been asked to compare Clark Pediatrics to other pediatric healthcare organizations in the area to create a trend comparison. What must you do to complete a financial analysis? What information do you need for both horizontal analysis and vertical analysis? What sources can 4. Mercy Medical Mega Center, a taxpaying entity, has made the decision to purchase a new over 5 years to a zero salvage value. Mercy Medical could borrow the full amount at a 12% rat years. The before-tax lease payments per year would be $90,000. The tax rate for this Mega ou use for comparison? What kind of decisions can be made regarding this information? (5 pts) laser surgical device. The device costs S500,000 and will be depreciated on a straight-line basis for 5 years. The after-tax cost of debt t equals 8%. Alternatively, it could lease the device for 5 Center is 40%. From a financial perspective, should Mercy lease the surgical device or borrow the money to purchase it? (7 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started