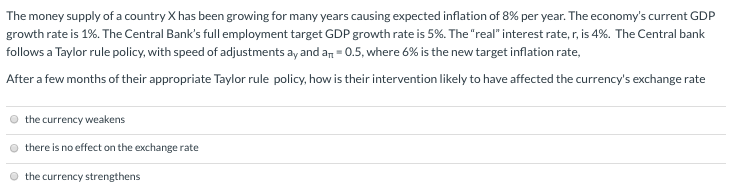

1.

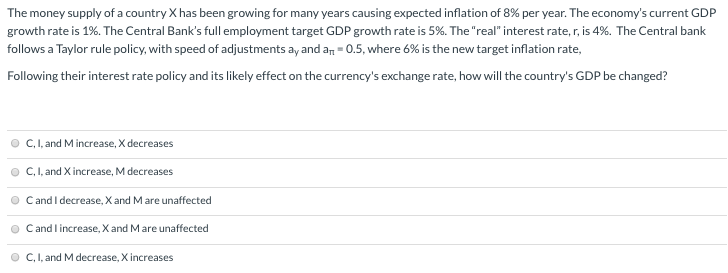

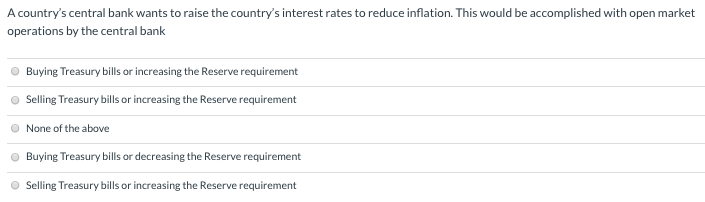

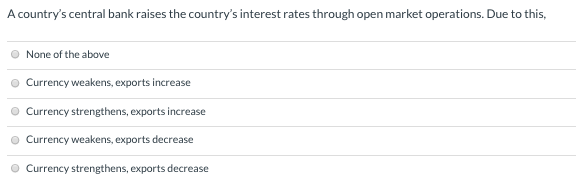

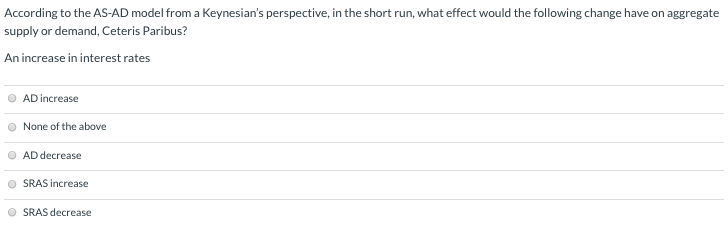

The money supply of a country X has been growing for many years causing expected inflation of 8% per year. The economy's current GDP growth rate is 1%. The Central Bank's full employment target GDP growth rate is 5%. The "real" interest rate, r, is 4%. The Central bank follows a Taylor rule policy, with speed of adjustments ay and an = 0.5, where 6% is the new target inflation rate, After a few months of their appropriate Taylor rule policy, how is their intervention likely to have affected the currency's exchange rate O the currency weakens O there is no effect on the exchange rate O the currency strengthensThe money supply of a country X has been growing for many years causing expected inflation of 8% per year. The economy's current GDP growth rate is 1%. The Central Bank's full employment target GDP growth rate is 5%. The "real" interest rate, r, is 4%. The Central bank follows a Taylor rule policy, with speed of adjustments ay and an = 0.5, where 6% is the new target inflation rate, Following their interest rate policy and its likely effect on the currency's exchange rate, how will the country's GDP be changed? O C, I, and M increase, X decreases O C, I, and X increase, M decreases O C and I decrease, X and M are unaffected O C and I increase, X and M are unaffected O C, I, and M decrease, X increasesA country's central bank wants to raise the country's interest rates to reduce inflation. This would be accomplished with open market operations by the central bank O Buying Treasury bills or increasing the Reserve requirement O Selling Treasury bills or increasing the Reserve requirement O None of the above O Buying Treasury bills or decreasing the Reserve requirement O Selling Treasury bills or increasing the Reserve requirementA country's central bank raises the country's interest rates through open market operations. Due to this, O None of the above O Currency weakens, exports increase O Currency strengthens, exports increase O Currency weakens, exports decrease O Currency strengthens, exports decreaseAccording to the AS-AD model from a Keynesian's perspective, in the short run, what effect would the following change have on aggregate supply or demand, Ceteris Paribus? An increase in interest rates O AD increase None of the above O AD decrease O SRAS increase SRAS decrease