Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) The monthly depreciation for the office equipment is $1,500. Depreciation has not been recorded since the previous year end procedures which was a

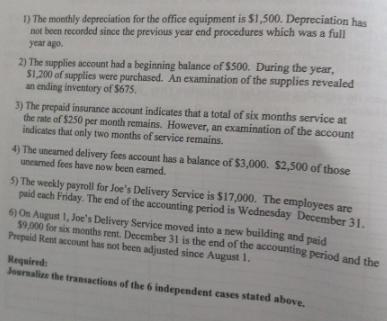

1) The monthly depreciation for the office equipment is $1,500. Depreciation has not been recorded since the previous year end procedures which was a full year ago, 2) The supplies account had a beginning balance of $500. During the year, $1,200 of supplies were purchased. An examination of the supplies revealed an ending inventory of $675. 3) The prepaid insurance account indicates that a total of six months service at the rate of $250 per month remains. However, an examination of the account indicates that only two months of service remains. 4) The unearned delivery fees account has a balance of $3,000. $2,500 of those unearned fees have now been earned. 5) The weekly payroll for Joe's Delivery Service is $17,000. The employees are paid each Friday. The end of the accounting period is Wednesday December 31. 6) On August 1, Joe's Delivery Service moved into a new building and paid $9,000 for six months rent. December 31 is the end of the accounting period and the Prepaid Rent account has not been adjusted since August 1. Required: Journalize the transactions of the 6 independent cases stated above.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Debit Depreciation Expense 1500 Credit Accumulated Depreciation 1500 2 Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started