Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The most recent bank statement reports a balance of $48,770. Included with the bank statement was a $2,100 check from Iggy Smarts, a

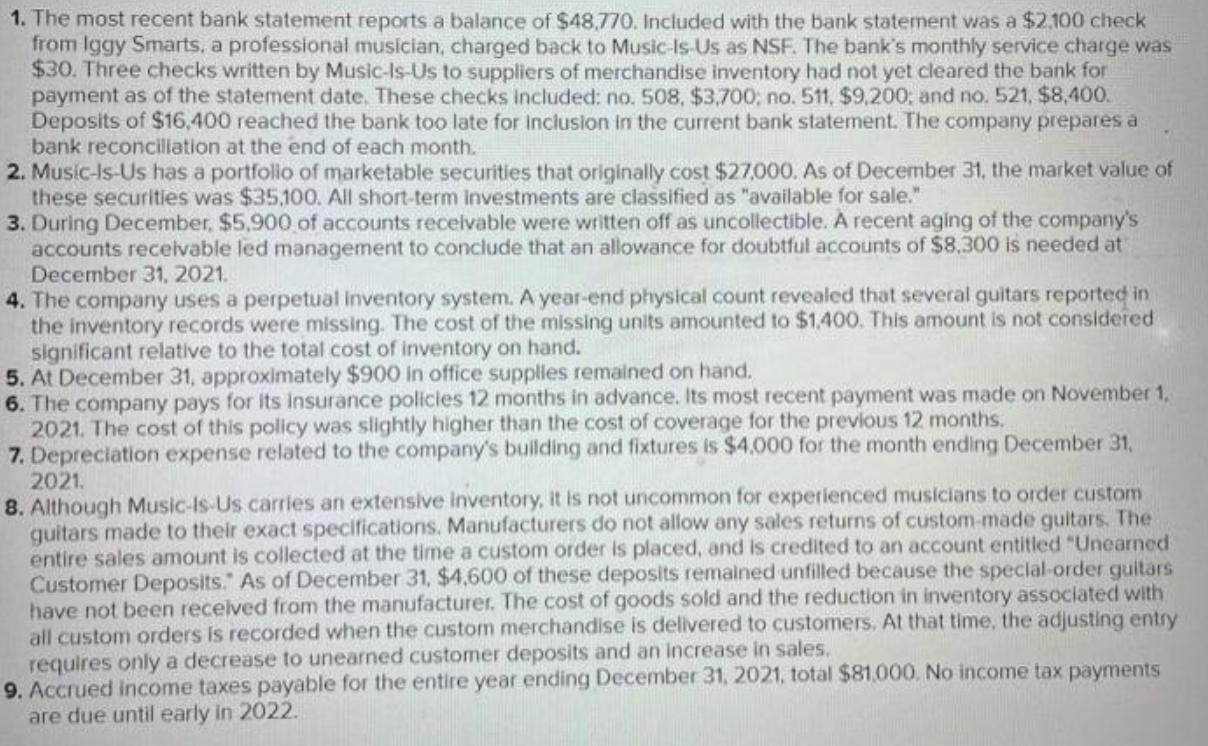

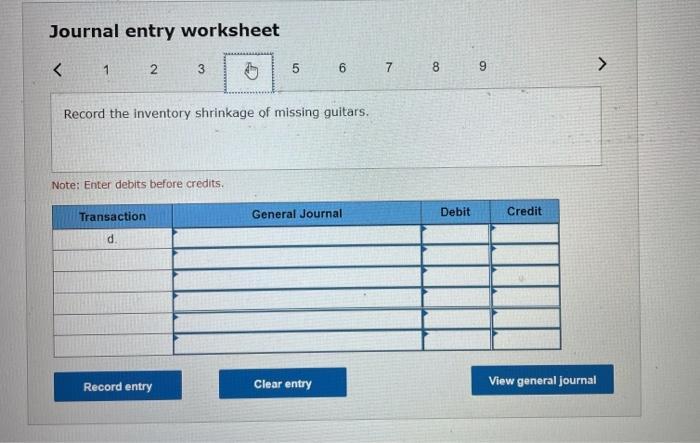

1. The most recent bank statement reports a balance of $48,770. Included with the bank statement was a $2,100 check from Iggy Smarts, a professional musician, charged back to Music-Is-Us as NSF. The bank's monthly service charge was $30. Three checks written by Music-Is-Us to suppliers of merchandise inventory had not yet cleared the bank for payment as of the statement date. These checks included: no. 508, $3,700, no. 511, $9,200; and no. 521, $8,400. Deposits of $16,400 reached the bank too late for inclusion in the current bank statement. The company prepares a bank reconciliation at the end of each month. 2. Music-Is-Us has a portfolio of marketable securities that originally cost $27,000. As of December 31, the market value of these securities was $35,100. All short-term investments are classified as "available for sale." 3. During December, $5,900 of accounts receivable were written off as uncollectible. A recent aging of the company's accounts receivable led management to conclude that an allowance for doubtful accounts of $8,300 is needed at December 31, 2021. 4. The company uses a perpetual inventory system. A year-end physical count revealed that several guitars reported in the inventory records were missing. The cost of the missing units amounted to $1,400. This amount is not considered significant relative to the total cost of inventory on hand. 5. At December 31, approximately $900 in office supplies remained on hand. 6. The company pays for its insurance policies 12 months in advance. Its most recent payment was made on November 1, 2021. The cost of this policy was slightly higher than the cost of coverage for the previous 12 months. 7. Depreciation expense related to the company's building and fixtures is $4,000 for the month ending December 31, 2021. 8. Although Music-Is-Us carries an extensive inventory, it is not uncommon for experienced musicians to order custom guitars made to their exact specifications. Manufacturers do not allow any sales returns of custom-made guitars. The entire sales amount is collected at the time a custom order is placed, and is credited to an account entitled "Unearned Customer Deposits." As of December 31, $4,600 of these deposits remained unfilled because the special-order guitars have not been received from the manufacturer. The cost of goods sold and the reduction in inventory associated with all custom orders is recorded when the custom merchandise is delivered to customers. At that time, the adjusting entry requires only a decrease to unearned customer deposits and an increase in sales, 9. Accrued income taxes payable for the entire year ending December 31, 2021, total $81,000. No income tax payments are due until early in 2022. Journal entry worksheet < 1 2 Transaction d. 3 Note: Enter debits before credits. Record the inventory shrinkage of missing guitars. Record entry 5 6 7 8 General Journal Clear entry Debit 9 Credit View general journal

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Debit Credit NSF Check 2100 Bank Service Charge 30 Total 2130 2 Debit Credit Marketable Sec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started