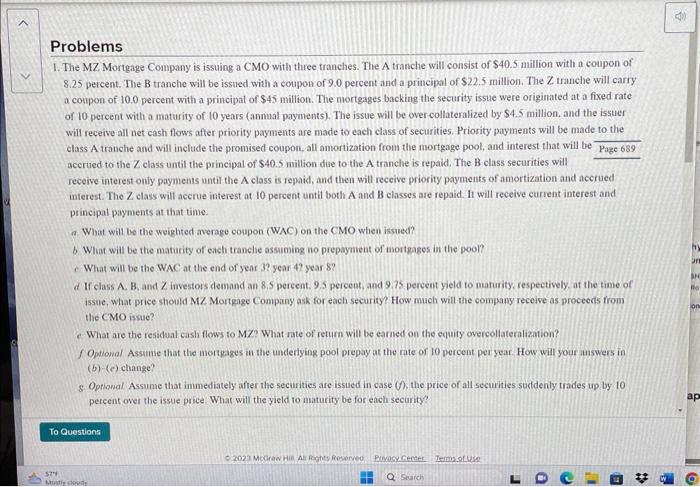

1. The MZ Mortgage Company is issuing a CMO with three tranches. The A tranche will consist of $40.5 million with a coupon of 8.25 percent. The B tranche will be issted with a coupon of 9.0 percent and a principal of $22.5 million. The Z tranche will carry a conpon of 10.0 percent with a principal of $45 million. The mortgages backing the security issue were originated at a fixed rate of 10 percent with a maturity of 10 years (annual payments). The issue will be over-collateralized by $4.5 million, and the issuer will receive all net cash flows after priority payments are made to each class of securities. Priority payments will be made to the class A tranche and will inelude the promised coupon. all amortization from the mortgage pool, and interest that will be Page 689 acerued to the Z class until the principal of $40.5 million due to the A tranche is repaid. The B class securities will receive interest only payments until the A class is repaid, and then will receive priority payments of amortization and accrued interest. The Z class will accrue interest at 10 percent until both A and B classes are repaid. It will receive current interest and principal payments at that time. a. What will to the weighted average coupon (WAC) on the CMO when isued? b. What will be the maturity of each tranche assuming no prepayment of mortgages in the pool? What will be the WAC at the end of year 3 ? year 47 year 8 ? d. If class A,B, and Z investors demand an 8.5 percent. 9.5 percent, and 9.75 percent yield to maturity, respectively, at the time of issue, what price should M Mortgage Company ask for each security? How much will the company receive as proceeds from the CMO issue? What are the residual cash flows to MZ? What rate of return will be earied on the equity overcollateralization? f Optional Assame that the mortgages in the underlying pool prepay at the rate of 10 percent per year. How will your aiswers in (b)-(c) change? 8. Optional Assume that immediately after the securities are issued in case (f), the price of all securities suddenly trades up by 10 pereent over the issue price. What will the yield to maturity be for each security