Question

1. The National Football Association (NFA) has granted Tike an exclusive license to sell NFA replica jerseys. Tike outsources the jersey cutting and sewing operations

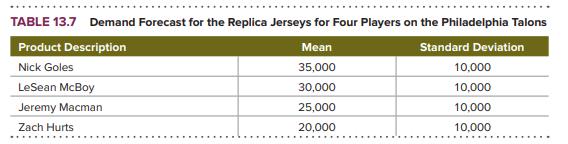

1. The National Football Association (NFA) has granted Tike an exclusive license to sell NFA replica jerseys. Tike outsources the jersey cutting and sewing operations to an offshore manufacturer. The jerseys are then delivered to Tike’s distribution center (DC). Because of the long production and shipment lead times, Tike must decide in advance how much inventory to hold at the DC in anticipation of retailers’ orders for the coming season. Table 13.7 displays Tike’s demand forecasts for four of the players on the Philadelphia Talons for the upcoming season, assuming independent normal demand distributions

Tike sells the NFA jerseys to retailers at a wholesale price of $24 per jersey. Tike buys each jersey from the offshore manufacturer for $11. Tike does not have the opportunity to make a midseason replenishment. At the end of the season, Tike sells its unsold jerseys at a discount price of $7 per jersey.

(a) What is the probability that demand for the Nick Goles jersey is fewer than 25,000?

(b) What is the probability that demand for the Nick Goles jersey is between 25,000 and 45,000?

(c) What is the overage cost for the Nick Goles jersey?

(d) What is the underage cost for the Nick Goles jersey?

(e) What is the critical ratio for the Nick Goles jerseys?

(f) How many Nick Goles jerseys should Tike order to maximize expected profit?

(g) If Tike orders 38,000 LeSean McBoy jerseys, how many of these jerseys can Tike expect to sell at the discount price of $7?

(h) If Tike orders 38,000 LeSean McBoy jerseys, how many of these jerseys can Tike expect to sell at the regular wholesale price of $24?

(i) If Tike orders 38,000 LeSean McBoy jerseys, what is its expected profit from selling this jersey?

(j) If Tike orders 30,000 Jeremy Macman jerseys, what is the probability that it has enough inventory to satisfy all regular-priced demand?

(k) If Tike orders 37,000 Jeremy Macman jerseys, what is the probability that Tike does not satisfy all demand for this jersey?

(l) If Tike wants to ensure that there is a 90 percent in-stock probability for the Jeremy Macman jersey, then how many units should it order?

(m) What is the maximum profit for the Zach Hurts jersey?

TABLE 13.7 Demand Forecast for the Replica Jerseys for Four Players on the Philadelphia Talons Product Description Mean Standard Deviation Nick Goles 35,000 30,000 25,000 20,000 LeSean McBoy Jeremy Macman Zach Hurts 10,000 10,000 10,000 10,000

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a What is the probability that demand for the Nick Goles jersey is fewer than 25000 ANSWER The probability that demand for the Nick Goles jersey is fewer than 25000 is 01587 WORKING P demand for the N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started