Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The office supplies were counted on December 31,2013 witha cost value of $1,000.00. During 2014 , the business purchased $3,250.00 of office supplies. The

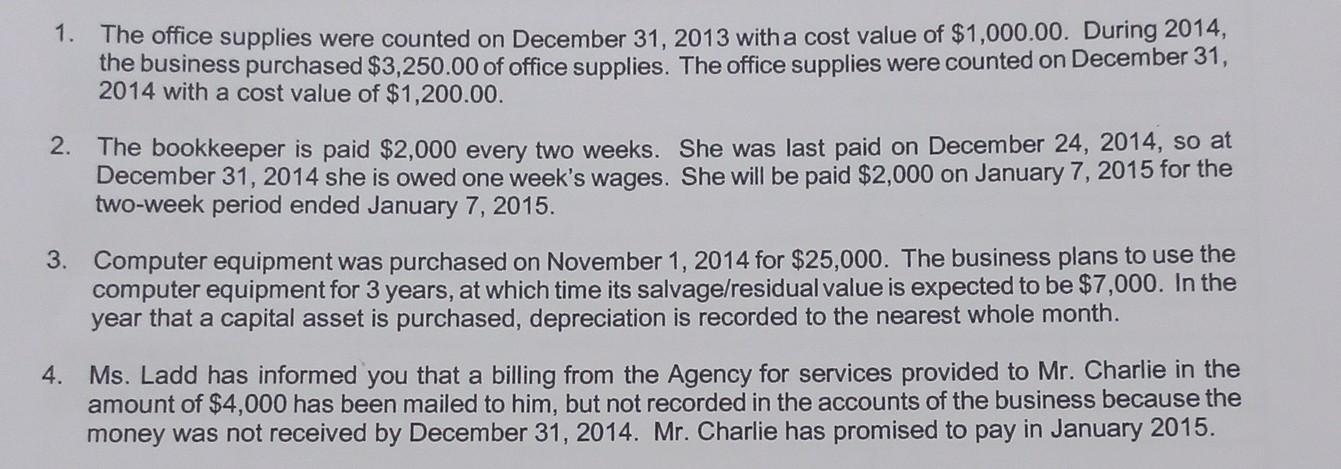

1. The office supplies were counted on December 31,2013 witha cost value of $1,000.00. During 2014 , the business purchased $3,250.00 of office supplies. The office supplies were counted on December 31 , 2014 with a cost value of $1,200.00. 2. The bookkeeper is paid $2,000 every two weeks. She was last paid on December 24,2014 , so at December 31,2014 she is owed one week's wages. She will be paid $2,000 on January 7,2015 for the two-week period ended January 7, 2015. 3. Computer equipment was purchased on November 1,2014 for $25,000. The business plans to use the computer equipment for 3 years, at which time its salvage/residual value is expected to be $7,000. In the year that a capital asset is purchased, depreciation is recorded to the nearest whole month. 4. Ms. Ladd has informed you that a billing from the Agency for services provided to Mr. Charlie in the amount of $4,000 has been mailed to him, but not recorded in the accounts of the business because the money was not received by December 31, 2014. Mr. Charlie has promised to pay in January 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started