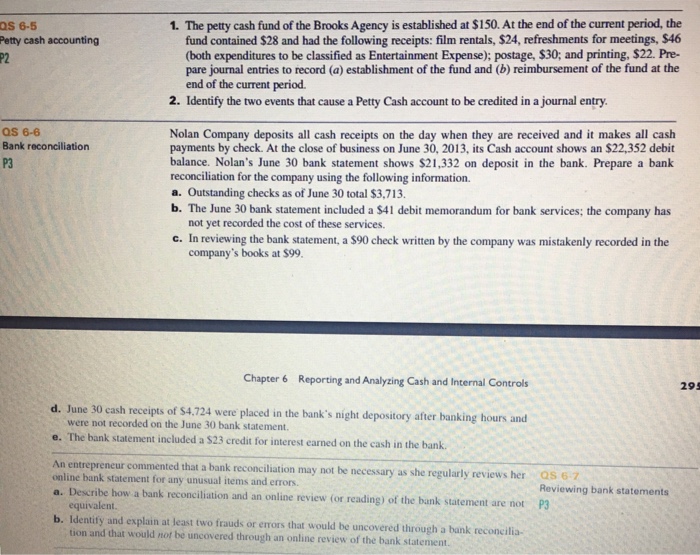

1. The petty cash fund of the Brooks Agency is established at $150. At the end of the current period, the S 6-5 Petty cash accounting P2 fund contained $28 and had the following receipts: film rentals, $24, refreshments for meetings, $46 (both expenditures to be classified as Entertainment Expense); postage, $30; and printing, $22. Pre- pare journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. 2. Identify the two events that cause a Petty Cash account to be credited in a journal entry aS 6-6 Bank reconciliation P3 Nolan Company deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2013, its Cash account shows an $22,352 debit balance. Nolan's June 30 bank statement shows $21,332 on deposit in the bank. Prepare a bank reconciliation for the company using the following information. a. Outstanding checks as of June 30 total $3,713. b. The June 30 bank statement included a $41 debit memorandum for bank services; the company has not yet recorded the cost of these services. c. In reviewing the bank statement, a $90 check written by the company was mistakenly recorded in the company's books at $99. Chapter 6 Reporting and Analyzing Cash and Internal Controls 293 d. June 30 cash receipts of $4,724 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. e. The bank statement included a $23 credit for interest earned on the cash in the bank. An entrepreneur commented that a bank reconciliation may not be necessary as she regularly reviews her online bank statement for any unusual items and errors. a. Desr Qs Reviewing bank statements P3 ribe how a bank reconciliation and an online review for reading) of the bank statement are not equivalent. b. Identify and explain at least two frauds or errors that would be uncovered through a bank reconcilia- tion and that would not be uncovered through an online review of the bank statement