Question

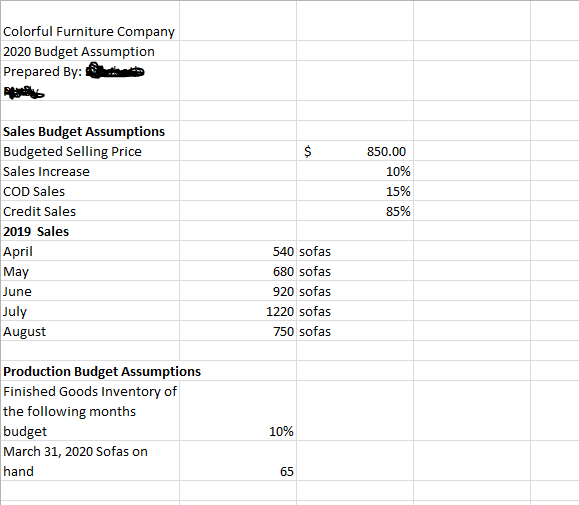

1. The previous year's sales (2019) for the corresponding period were: April - 540 sofas May - 680 sofas June - 920 sofas J uly

1. The previous year's sales (2019) for the corresponding period were:

April - 540 sofas

May - 680 sofas

June - 920 sofas J

uly - 1,220 sofas

August - 750 sofas

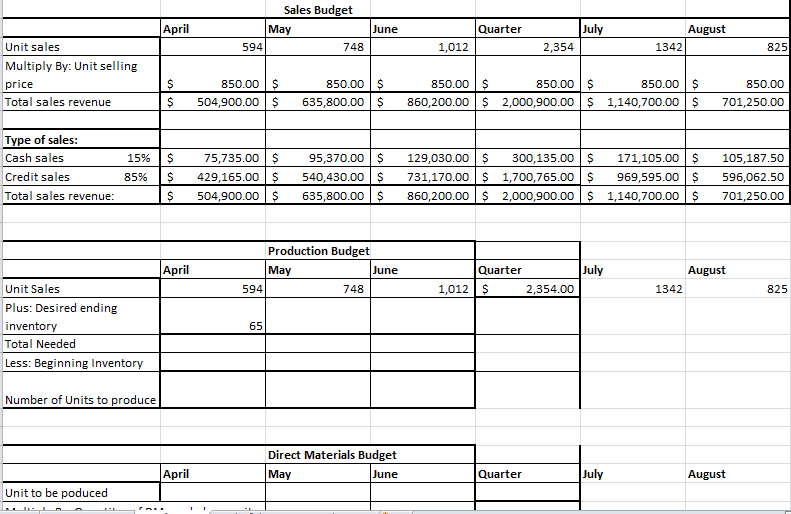

The company expects the above volume of lounge sofa sales to increase by 10% for the period April 2020 - August 2020. The budgeted selling price for 2020 is $850.00 per sofa. The company expects 15% of its sales to be cash (COD) sales. The remaining 85% of sales will be made on credit. How would you prepare a Sales Budget for ColorfulFurniture with this information

2. The company desires to have finished goods inventory on hand at the end of each month equal to 10 percent of the following month's budgeted unit sales. On March 31, 2020, the company expects to have 65 sofas on hand. (Note: an estimate of sales in July is required in order to complete the production budget for June). Use the @ROUNDUP function to round up to the whole number the number of sofas desired in ending inventory. How would you prepare a Production budget with the above information

3. The sofas require two direct materials: oak wood frames and pre-made cushions: Sixteen (16) feet of 4x1 oak wood are required for each sofa produced. Management desires to have materials on hand at the end of each month equal to 18 percent of the following month's sofa production needs. The beginning inventory of wood, April 2020, is expected to be 2,340 feet of wood. Oak wood is expected to cost $8.00 per foot. (Note: budgeted production in July is required in order to complete the direct materials budget for June. Use the @ROUNDUP function to round up to the whole number the number of feet of oak wood to purchase). Pre-made cushions (30*30 inches) are purchased by a set of 10 cushions. Six (6) cushions are required for each sofa. Management desires to have cushions on hand at the end of each month equal to 13 percent of the following month's production needs. Use the @ROUNDUP function to round up to the whole number the number of cushions desired in ending inventory. The beginning inventory, April 2020, is expected to be 630 cushions. The set of 10 cushions is expected to cost $200. (Note: budgeted production in July is required in order to complete the direct materials budget for June. Use the @ROUNDUP function to round up to nearest 10 the number of cushions to purchase). How would you prepare a Direct Materials budget with the above information. Also, because two direct materials are required for production - oak wood and cushions - you will need a separate schedule for each direct material.

4. Each sofa requires 10 hours of direct labor. ColorfulFurniture uses a series of table saws, table routers and sanders set up for specialized operations to achieve production efficiencies. Direct labor costs the company $20 per hour. How would you prepare a Direct Labor budget with the above information

5. ColorfulFurniture budgets indirect materials (e.g., wood legs, screws, hinges, sand paper, stain, and packaging) at $35.50 per sofa. ColorfulFurniture treats indirect labor and utilities as mixed costs. The variable components are $20.60 per sofa for indirect labor and $7.50 per sofa for utilities. The following fixed costs per month are budgeted for indirect labor, $55,000, utilities, $3,000, and other, $20,000. How would you Prepare a Manufacturing Overhead budget with the above information

6. Variable selling and administrative expenses are $50.50 per sofa sold. Fixed selling and administrative expenses are $85,000 per month. These costs are not itemized, i.e., the budget has only two line items - variable operating expenses and fixed operating expenses. How would you prepare an Operating Expenses budget with the above information

7. How would you prepare a Budgeted Manufacturing Cost per unit budget with the above information. To calculate FMOH/unit calculate total FMOH for the year and divide this by budgeted production for the year. The total production volume for the year is budgeted at 10,000 sofas.

8. How would you prepare a Budgeted Income Statement for the quarter for ColorfulFurniture with the given information Assume interest expense of $0, and income tax expense of 21% of income before taxes.

*****Please provide step-by-step explanations along with the formulas and math you used to get to the answers. snapshots of excel would be extremely helpful in this problem. I am attaching a photo of what I have gotten so far, I am unsure if it is correct and I am now stuck and not sure on how to continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started