Question

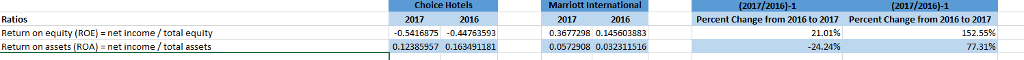

1. The return on assets ratio tells us the profit generated by each dollar in assets. You will want to compare this ratio to Choice

1. The return on assets ratio tells us the profit generated by each dollar in assets. You will want to compare this ratio to Choice Hotels' historical performance and to Marriott International to understand if it is an acceptable ratio. Is the return on assets ratio acceptable? Why or why not?

2. Which of the above ratios would you use to determine which company, Choice Hotels or Marriott International, is more attractive for an acquisition? Why?

3. Based on the financial statement analysis, earnings per share analysis, budgeting ratios, and the above profitability ratios, which company would you invest in and why?

Choice Hot 2017 Marriott I (2017/2016)-1 Ratios Retun on equity (ROE net income/total equity Return on assets (ROA)net income/total assets (2017/2016)-1 2017 0.3677298 0.145603333 0.0572908 0.032311516 2016 Percent Change from 2016 to 2017 21.01% 24.24% Percent Change from 2016 to 2017 152.55% 77.31% 0.5416875 0.44763593Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started