Question

1) The revenue recognition principle a.is not in conflict with the cash method of accounting b.determines when revenue is credited to a revenue account c.states

1) The revenue recognition principle

a.is not in conflict with the cash method of accounting

b.determines when revenue is credited to a revenue account

c.states that revenue is not recorded until the cash is received

d.controls all revenue reporting for the cash basis of accounting

2) The supplies account had a balance of $4,056 at the beginning of the year and was debited during the year for $2,565, representing the total of supplies purchased during the year. If $266 of supplies are on hand at the end of the year, the supplies expense to be reported on the income statement for the year is

a.$6,355

b.$266

c.$6,621

d.$2,831

3) The account type and normal balance of Prepaid Expense are

a.asset, debit

b.expense, debit

c.liability, credit

d.revenue, credit

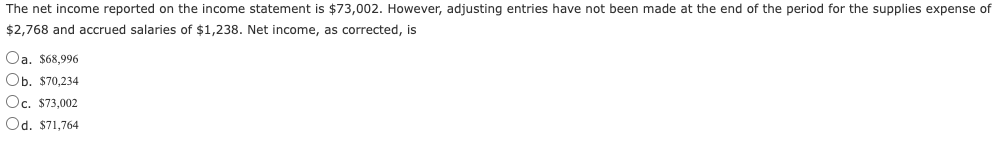

4) The net income reported on the income statement is $73,002. However, adjusting entries have not been made at the end of the period for the supplies expense of $2,768 and accrued salaries of $1,238. Net income, as corrected, is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started