Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The riskless interest rate is 2%. You hold a portfolio consisting of short-term safe assets and the market portfolio of risky assets, which

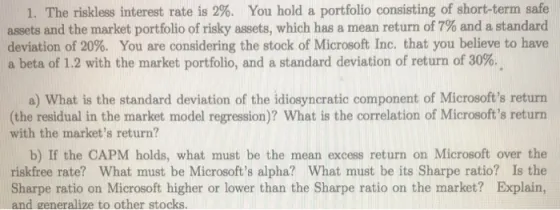

1. The riskless interest rate is 2%. You hold a portfolio consisting of short-term safe assets and the market portfolio of risky assets, which has a mean return of 7% and a standard deviation of 20%. You are considering the stock of Microsoft Inc. that you believe to have a beta of 1.2 with the market portfolio, and a standard deviation of return of 30%. a) What is the standard deviation of the idiosyncratic component of Microsoft's return (the residual in the market model regression)? What is the correlation of Microsoft's return with the market's return? b) If the CAPM holds, what must be the mean excess return on Microsoft over the riskfree rate? What must be Microsoft's alpha? What must be its Sharpe ratio? Is the Sharpe ratio on Microsoft higher or lower than the Sharpe ratio on the market? Explain, and generalize to other stocks.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the standard deviation of the idiosyncratic component of Microsofts return we can use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started