Answered step by step

Verified Expert Solution

Question

1 Approved Answer

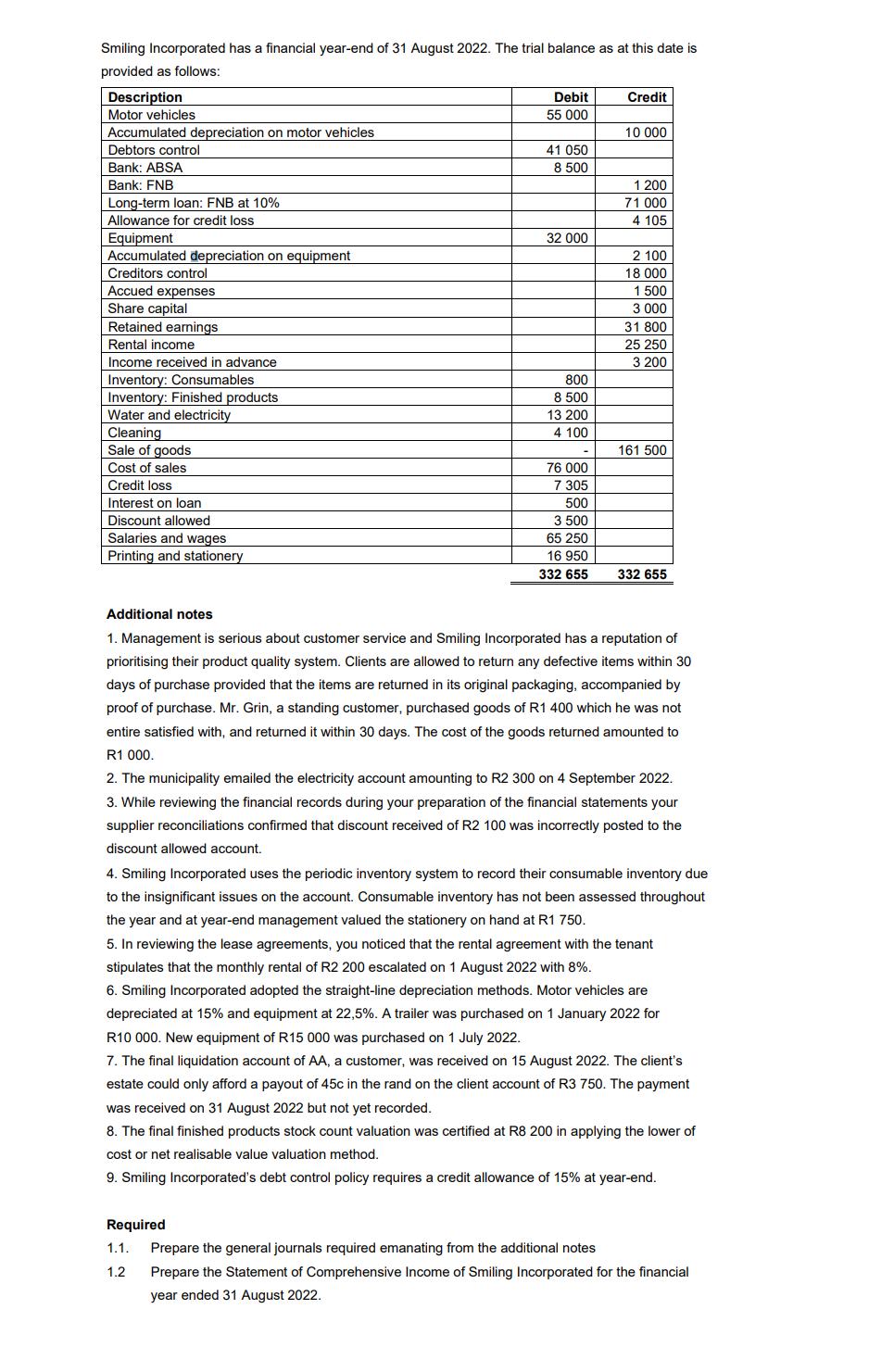

Smiling Incorporated has a financial year-end of 31 August 2022. The trial balance as at this date is provided as follows: Description Motor vehicles

Smiling Incorporated has a financial year-end of 31 August 2022. The trial balance as at this date is provided as follows: Description Motor vehicles Accumulated depreciation on motor vehicles Debtors control Bank: ABSA Bank: FNB Long-term loan: FNB at 10% Allowance for credit loss Equipment Accumulated depreciation on equipment Creditors control Accued expenses Share capital Retained earnings Rental income Income received in advance Inventory: Consumables Inventory: Finished products Water and electricity Cleaning Sale of goods Cost of sales Credit loss Interest on loan Discount allowed Salaries and wages Printing and stationery Debit 55 000 41 050 8 500 32 000 800 8 500 13 200 4 100 76 000 7 305 500 3 500 65 250 16 950 332 655 Credit 10 000 1 200 71 000 4 105 2 100 18 000 1500 3 000 31 800 25 250 3 200 161 500 332 655 Additional notes 1. Management is serious about customer service and Smiling Incorporated has a reputation of prioritising their product quality system. Clients are allowed to return any defective items within 30 days of purchase provided that the items are returned in its original packaging, accompanied by proof of purchase. Mr. Grin, a standing customer, purchased goods of R1 400 which he was not entire satisfied with, and returned it within 30 days. The cost of the goods returned amounted to R1 000. 2. The municipality emailed the electricity account amounting to R2 300 on 4 September 2022. 3. While reviewing the financial records during your preparation of the financial statements your supplier reconciliations confirmed that discount received of R2 100 was incorrectly posted to the discount allowed account. 4. Smiling Incorporated uses the periodic inventory system to record their consumable inventory due to the insignificant issues on the account. Consumable inventory has not been assessed throughout the year and at year-end management valued the stationery on hand at R1 750. 5. In reviewing the lease agreements, you noticed that the rental agreement with the tenant stipulates that the monthly rental of R2 200 escalated on 1 August 2022 with 8%. 6. Smiling Incorporated adopted the straight-line depreciation methods. Motor vehicles are depreciated at 15% and equipment at 22,5%. A trailer was purchased on 1 January 2022 for R10 000. New equipment of R15 000 was purchased on 1 July 2022. 7. The final liquidation account of AA, a customer, was received on 15 August 2022. The client's estate could only afford a payout of 45c in the rand on the client account of R3 750. The payment was received on 31 August 2022 but not yet recorded. 8. The final finished products stock count valuation was certified at R8 200 in applying the lower of cost or net realisable value valuation method. 9. Smiling Incorporated's debt control policy requires a credit allowance of 15% at year-end. Required 1.1. Prepare the general journals required emanating from the additional notes 1.2 Prepare the Statement of Comprehensive Income of Smiling Incorporated for the financial year ended 31 August 2022.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started