Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The scope of IFRS 6 Exploration for and Evaluation of Mineral Resources is limited to the recognition, measurement and disclosure of expenditure incurred

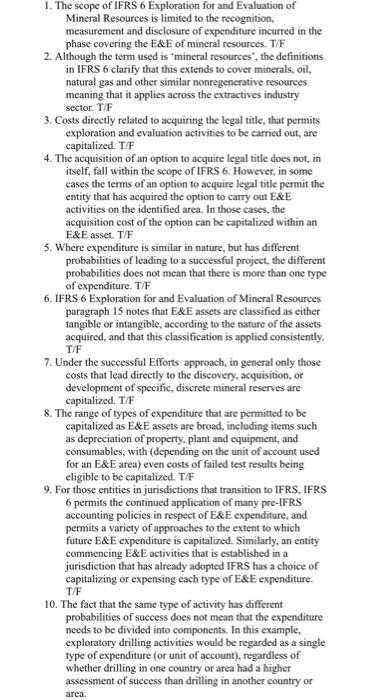

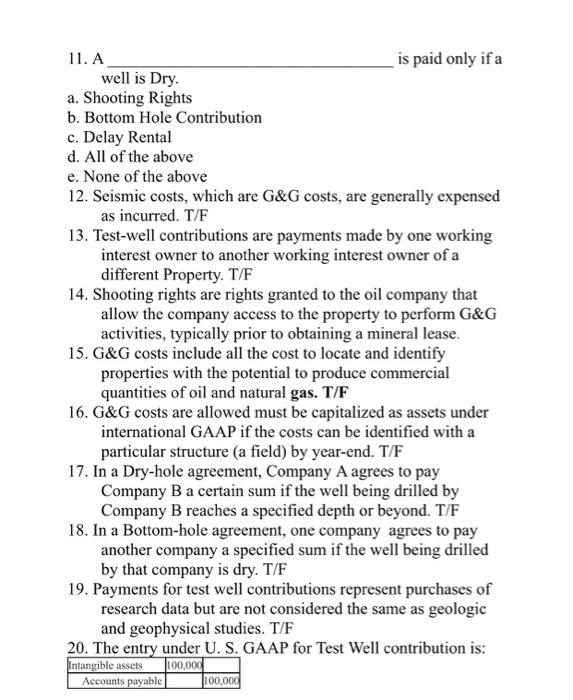

1. The scope of IFRS 6 Exploration for and Evaluation of Mineral Resources is limited to the recognition, measurement and disclosure of expenditure incurred in the phase covering the E&E of mineral resources. T/F 2. Although the term used is "mineral resources, the definitions in IFRS 6 clarify that this extends to cover minerals, oil, natural gas and other similar nonregenerative resources meaning that it applies across the extractives industry sector. T/F 3. Costs directly related to acquiring the legal title, that permits exploration and evaluation activities to be carried out, are capitalized. T/F 4. The acquisition of an option to acquire legal title does not, in itself, fall within the scope of IFRS 6. However, in some cases the terms of an option to acquire legal title permit the entity that has acquired the option to carry out E&E activities on the identified area. In those cases, the acquisition cost of the option can be capitalized within an E&E asset. T/F 5. Where expenditure is similar in nature, but has different probabilities of leading to a successful project, the different probabilities does not mean that there is more than one type of expenditure. T/F 6. IFRS 6 Exploration for and Evaluation of Mineral Resources paragraph 15 notes that E&E assets are classified as either tangible or intangible, according to the nature of the assets acquired, and that this classification is applied consistently. T/F 7. Under the successful Efforts approach, in general only those costs that lead directly to the discovery, acquisition, or development of specific, discrete mineral reserves are capitalized. T/F 8. The range of types of expenditure that are permitted to be capitalized as E&E assets are broad, including items such as depreciation of property, plant and equipment, and consumables, with (depending on the unit of account used for an E&E area) even costs of failed test results being eligible to be capitalized. T/F 9. For those entities in jurisdictions that transition to IFRS, IFRS 6 permits the continued application of many pre-IFRS accounting policies in respect of E&E expenditure, and permits a variety of approaches to the extent to which future E&E expenditure is capitalized. Similarly, an entity commencing E&E activities that is established in a jurisdiction that has already adopted IFRS has a choice of capitalizing or expensing each type of E&E expenditure. T/F 10. The fact that the same type of activity has different probabilities of success does not mean that the expenditure needs to be divided into components. In this example, exploratory drilling activities would be regarded as a single type of expenditure (or unit of account), regardless of whether drilling in one country or area had a higher assessment of success than drilling in another country or area. 11. A well is Dry. a. Shooting Rights b. Bottom Hole Contribution is paid only if a c. Delay Rental d. All of the above e. None of the above 12. Seismic costs, which are G&G costs, are generally expensed as incurred. T/F 13. Test-well contributions are payments made by one working interest owner to another working interest owner of a different Property. T/F 14. Shooting rights are rights granted to the oil company that allow the company access to the property to perform G&G activities, typically prior to obtaining a mineral lease. 15. G&G costs include all the cost to locate and identify properties with the potential to produce commercial quantities of oil and natural gas. T/F 16. G&G costs are allowed must be capitalized as assets under international GAAP if the costs can be identified with a particular structure (a field) by year-end. T/F 17. In a Dry-hole agreement, Company A agrees to pay Company B a certain sum if the well being drilled by Company B reaches a specified depth or beyond. T/F 18. In a Bottom-hole agreement, one company agrees to pay another company a specified sum if the well being drilled by that company is dry. T/F 19. Payments for test well contributions represent purchases of research data but are not considered the same as geologic and geophysical studies. T/F 20. The entry under U. S. GAAP for Test Well contribution is: Intangible assets 100,000 Accounts payable 100,000

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER True IFRS 6 focuses on the recognition measurement and disclosure of expenditures related to the exploration and evaluation EE phase of mineral resources True The term mineral resources in IFRS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started