Question: 1) The Sixteenth Amendment to the U.S. Constitution permits the passage of a federal income tax law. 2) Taxable income for an individual is

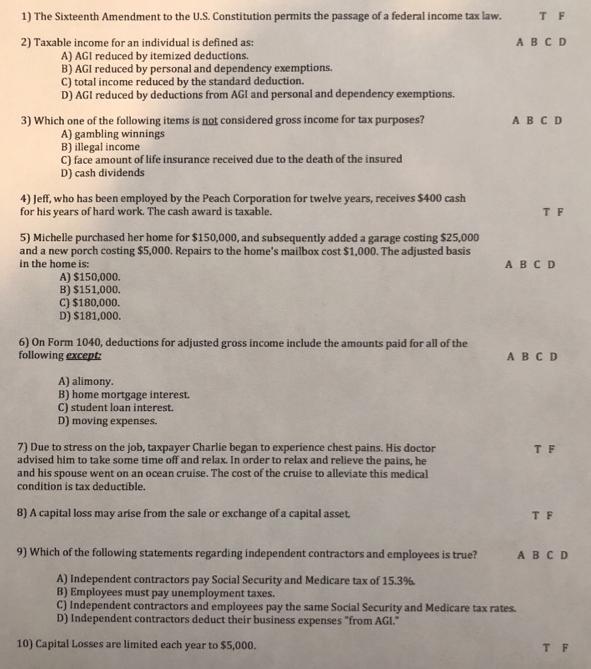

1) The Sixteenth Amendment to the U.S. Constitution permits the passage of a federal income tax law. 2) Taxable income for an individual is defined as: A) AGI reduced by itemized deductions. B) AGI reduced by personal and dependency exemptions. C) total income reduced by the standard deduction. D) AGI reduced by deductions from AGI and personal and dependency exemptions. 3) Which one of the following items is not considered gross income for tax purposes? A) gambling winnings B) illegal income C) face amount of life insurance received due to the death of the insured D) cash dividends 4) Jeff, who has been employed by the Peach Corporation for twelve years, receives $400 cash for his years of hard work. The cash award is taxable. 5) Michelle purchased her home for $150,000, and subsequently added a garage costing $25,000 and a new porch costing $5,000. Repairs to the home's mailbox cost $1,000. The adjusted basis in the home is: A) $150,000. B) $151,000. C) $180,000. D) $181,000. 6) On Form 1040, deductions for adjusted gross income include the amounts paid for all of the following except: A) alimony. B) home mortgage interest. C) student loan interest. D) moving expenses. 7) Due to stress on the job, taxpayer Charlie began to experience chest pains. His doctor advised him to take some time off and relax. In order to relax and relieve the pains, he and his spouse went on an ocean cruise. The cost of the cruise to alleviate this medical condition is tax deductible. 8) A capital loss may arise from the sale or exchange of a capital asset. TF A B C D ABCD TF A B C D ABCD 9) Which of the following statements regarding independent contractors and employees is true? A) Independent contractors pay Social Security and Medicare tax of 15.3% B) Employees must pay unemployment taxes. C) Independent contractors and employees pay the same Social Security and Medicare tax rates. D) Independent contractors deduct their business expenses "from AGI." 10) Capital Losses are limited each year to $5,000. TF ABCD TF

Step by Step Solution

3.56 Rating (146 Votes )

There are 3 Steps involved in it

True The Sixteenth Amendment allows for the federal income tax A AGI reduc... View full answer

Get step-by-step solutions from verified subject matter experts