Answered step by step

Verified Expert Solution

Question

1 Approved Answer

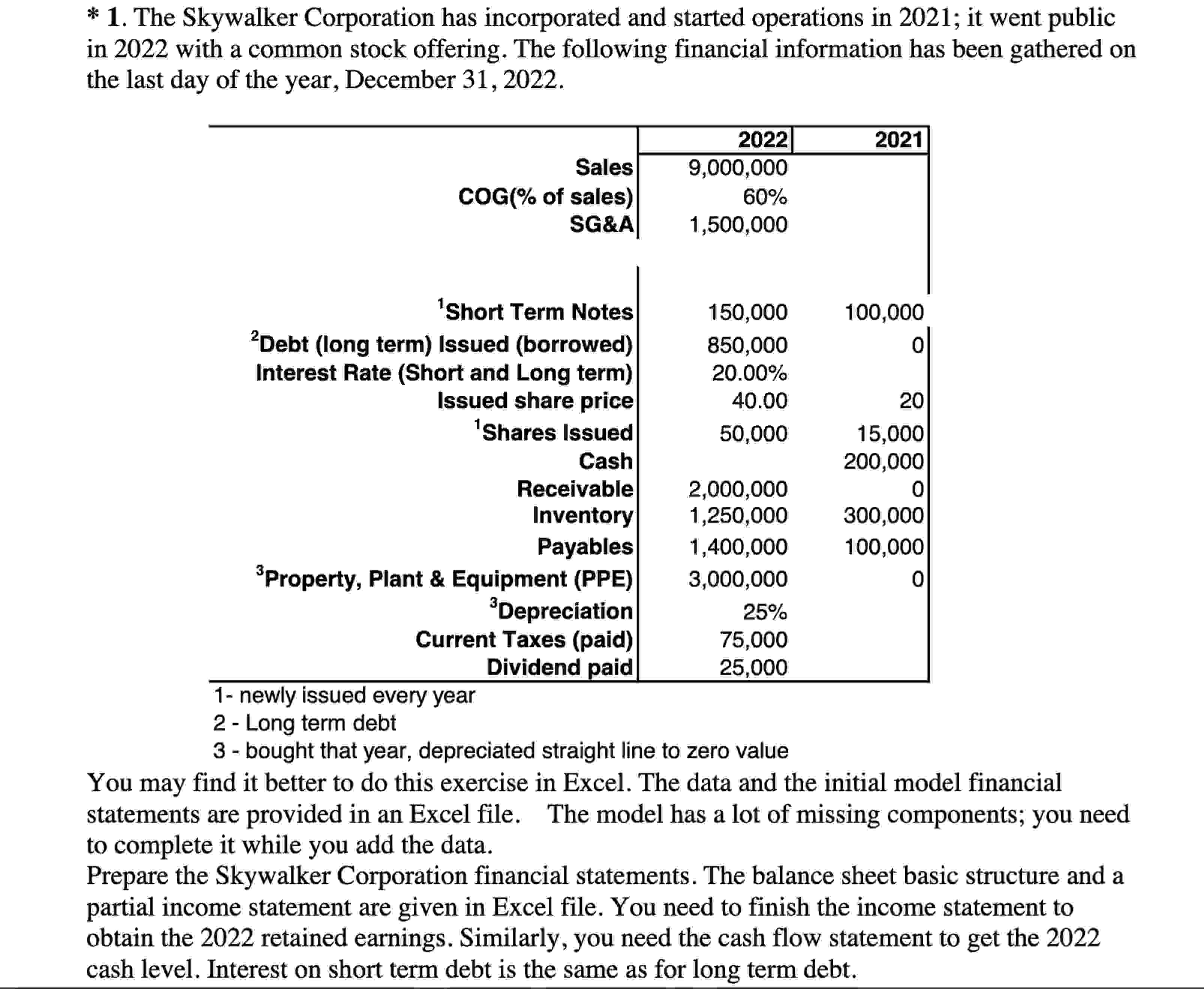

* 1. The Skywalker Corporation has incorporated and started operations in 2021; it went public in 2022 with a common stock offering. The following

* 1. The Skywalker Corporation has incorporated and started operations in 2021; it went public in 2022 with a common stock offering. The following financial information has been gathered on the last day of the year, December 31, 2022. Sales 2022 9,000,000 2021 COG(% of sales) 60% SG&A 1,500,000 1Short Term Notes 150,000 100,000 2Debt (long term) Issued (borrowed) 850,000 ol Interest Rate (Short and Long term) 20.00% Issued share price 40.00 20 1Shares Issued 50,000 15,000 Cash 200,000 Receivable 2,000,000 0 Inventory 1,250,000 300,000 Payables 1,400,000 100,000 Property, Plant & Equipment (PPE) 3,000,000 0 Depreciation 25% Current Taxes (paid) 75,000 Dividend paid 25,000 1- newly issued every year 2 - Long term debt 3 - bought that year, depreciated straight line to zero value You may find it better to do this exercise in Excel. The data and the initial model financial statements are provided in an Excel file. The model has a lot of missing components; you need to complete it while you add the data. Prepare the Skywalker Corporation financial statements. The balance sheet basic structure and a partial income statement are given in Excel file. You need to finish the income statement to obtain the 2022 retained earnings. Similarly, you need the cash flow statement to get the 2022 cash level. Interest on short term debt is the same as for long term debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started