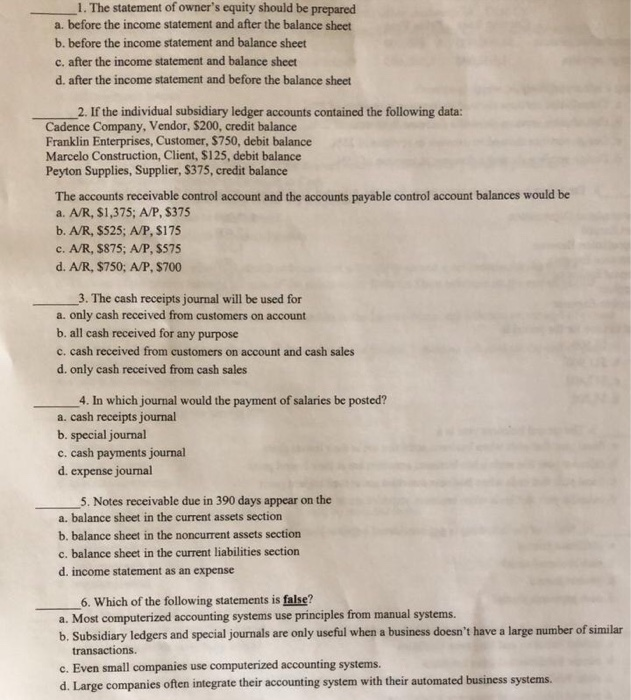

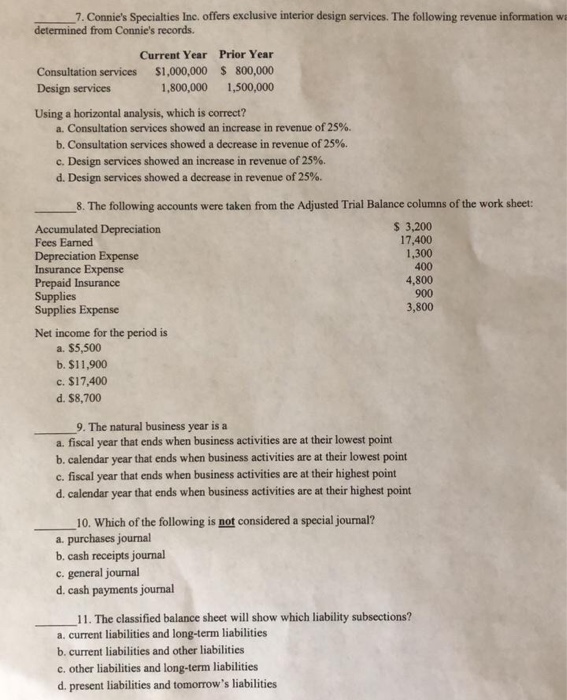

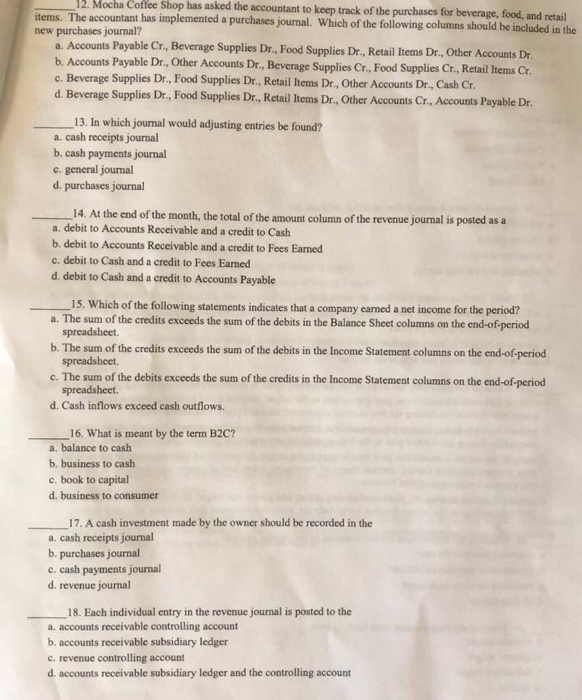

1. The statement of owner's equity should be prepared a. before the income statement and after the balance sheet b. before the income statement and balance sheet c. after the income statement and balance sheet d. after the income statement and before the balance sheet 2. If the individual subsidiary ledger accounts contained the following data: Cadence Company, Vendor, $200, credit balance Franklin Enterprises, Customer, $750, debit balance Marcelo Construction, Client, $125, debit balance Peyton Supplies, Supplier, $375, credit balance The accounts receivable control account and the accounts payable control account balances would be a. A/R, $1,375; A/P, $375 b. A/R, $525; A/P, $175 c. A/R, $875; A/P, $575 d. A/R, $750; A/P, $700 _3. The cash receipts journal will be used for a. only cash received from customers on account b. all cash received for any purpose c. cash received from customers on account and cash sales d. only cash received from cash sales 4. In which journal would the payment of salaries be posted? a. cash receipts journal b. special journal c. cash payments journal d. expense journal 5. Notes receivable due in 390 days appear on the a. balance sheet in the current assets section b. balance sheet in the noncurrent assets section c. balance sheet in the current liabilities section d. income statement as an expense 6. Which of the following statements is false? a. Most computerized accounting systems use principles from manual systems. b. Subsidiary ledgers and special journals are only useful when a business doesn't have a large number of similar transactions. c. Even small companies use computerized accounting systems. d. Large companies often integrate their accounting system with their automated business systems. _7. Connie's Specialties Inc. offers exclusive interior design services. The following revenue information wu determined from Connie's records. Current Year Prior Year Consultation services $1,000,000 $ 800,000 Design services 1,800,000 1,500,000 Using a horizontal analysis, which is correct? a. Consultation services showed an increase in revenue of 25%. b. Consultation services showed a decrease in revenue of 25%. c. Design services showed an increase in revenue of 25%. d. Design services showed a decrease in revenue of 25%. _8. The following accounts were taken from the Adjusted Trial Balance columns of the work sheet: Accumulated Depreciation $ 3,200 Fees Earned 17,400 Depreciation Expense 1,300 Insurance Expense 400 Prepaid Insurance 4,800 Supplies 900 Supplies Expense 3,800 Net income for the period is a. $5,500 b. $11,900 c. $17,400 d. $8,700 9. The natural business year is a a fiscal year that ends when business activities are at their lowest point b. calendar year that ends when business activities are at their lowest point c. fiscal year that ends when business activities are at their highest point d. calendar year that ends when business activities are at their highest point 10. Which of the following is not considered a special journal? a. purchases journal b. cash receipts journal c. general journal d. cash payments journal _11. The classified balance sheet will show which liability subsections? a. current liabilities and long-term liabilities b. current liabilities and other liabilities c. other liabilities and long-term liabilities d. present liabilities and tomorrow's liabilities 12 Mocha Coffee Shop has asked the accountant to keep track of the purchases for beverage, food, and retail items. The accountant has implemented a purchases journal. Which of the following columns should be included in the new purchases journal? Accounts Payable Cr., Beverage Supplies Dr., Food Supplies Dr. Retail Items Dr., Other Accounts Dr. b. Accounts Payable Dr., Other Accounts Dr., Beverage Supplies Cr.. Food Supplies Cr. Retail Items Cr. c. Beverage Supplies Dr., Food Supplies Dr., Retail Items Dr. Other Accounts Dr., Cash Cr. d. Beverage Supplies Dr., Food Supplies Dr., Retail Items Dr., Other Accounts Cr., Accounts Payable Dr. _13. In which journal would adjusting entries be found? a. cash receipts journal b. cash payments journal c. general journal d. purchases journal 14. At the end of the month, the total of the amount column of the revenue journal is posted as a a. debit to Accounts Receivable and a credit to Cash b. debit to Accounts Receivable and a credit to Fees Eamed c. debit to Cash and a credit to Fees Earned d. debit to Cash and a credit to Accounts Payable 15. Which of the following statements indicates that a company earned a net income for the period? a. The sum of the credits exceeds the sum of the debits in the Balance Sheet columns on the end of period spreadsheet b. The sum of the credits exceeds the sum of the debits in the Income Statement columns on the end-of-period spreadsheet c. The sum of the debits exceeds the sum of the credits in the Income Statement columns on the end-of-period spreadsheet. d. Cash inflows exceed cash outflows. _16. What is meant by the term B2C? a. balance to cash b. business to cash c. book to capital d. business to consumer 17. A cash investment made by the owner should be recorded in the a. cash receipts journal b. purchases journal c. cash payments journal d. revenue journal 18. Each individual entry in the revenue journal is posted to the a. accounts receivable controlling account b. accounts receivable subsidiary ledger c. revenue controlling account d. accounts receivable subsidiary ledger and the controlling account