Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1- The student must use his/ her own words (any copy is considered as a cheating and will be marked 0 ). 2- Plagiarism Check

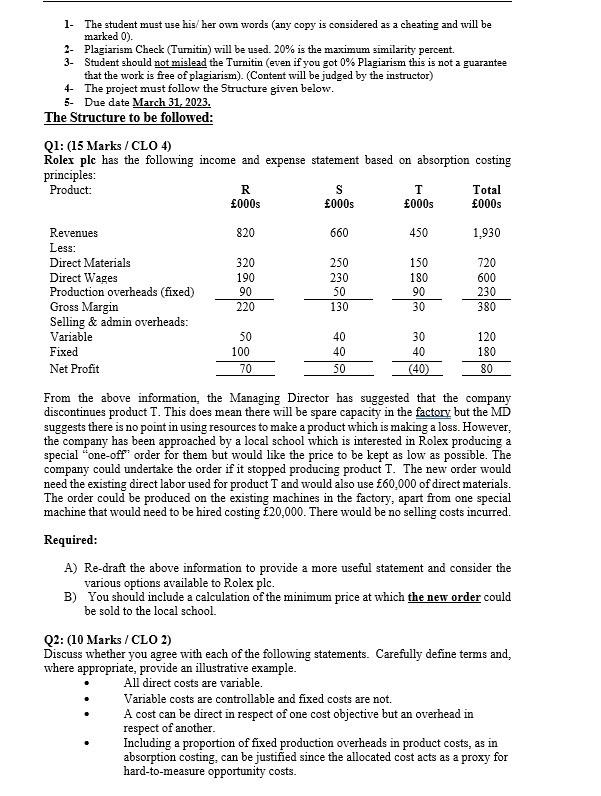

1- The student must use his/ her own words (any copy is considered as a cheating and will be marked 0 ). 2- Plagiarism Check (Turnitin) will be uged. 20% is the maximum similarity percent. 3- Student should not mislead the Turnitin (even if you got 0% Plagiarism this is not a guarantee that the work is free of plagiarism). (Content will be judged by the instructor) 4- The project must follow the Structure given below. 5- Due date March 31, 2023. The Structure to be followed: Q1: (15 Marks / CLO 4) Rolex plc has the following income and expense statement based on absorption costing nrincinles. From the above information, the Managing Director has suggested that the company discontinues product T. This does mean there will be spare capacity in the factory but the MD suggests there is no point in using resources to make a product which is making a loss. However, the company has been approached by a local school which is interested in Rolex producing a special "one-off" order for them but would like the price to be kept as low as possible. The company could undertake the order if it stopped producing product T. The new order would need the existing direct labor used for product T and would also use {60,000 of direct materials. The order could be produced on the existing machines in the factory, apart from one special machine that would need to be hired costing f20,000. There would be no selling costs incurred. Required: A) Re-draft the above information to provide a more useful statement and consider the various options available to Rolex plc. B) You should include a calculation of the minimum price at which the new order could be sold to the local school. Q2: (10 Marks / CLO 2) Discuss whether you agree with each of the following statements. Carefully define terms and, where appropriate, provide an illustrative example. All direct costs are variable. Variable costs are controllable and fixed costs are not. A cost can be direct in respect of one cost objective but an overhead in respect of another. Including a proportion of fixed production overheads in product costs, as in absorption costing, can be justified since the allocated cost acts as a proxy for hard-to-measure opportunity costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started