Answered step by step

Verified Expert Solution

Question

1 Approved Answer

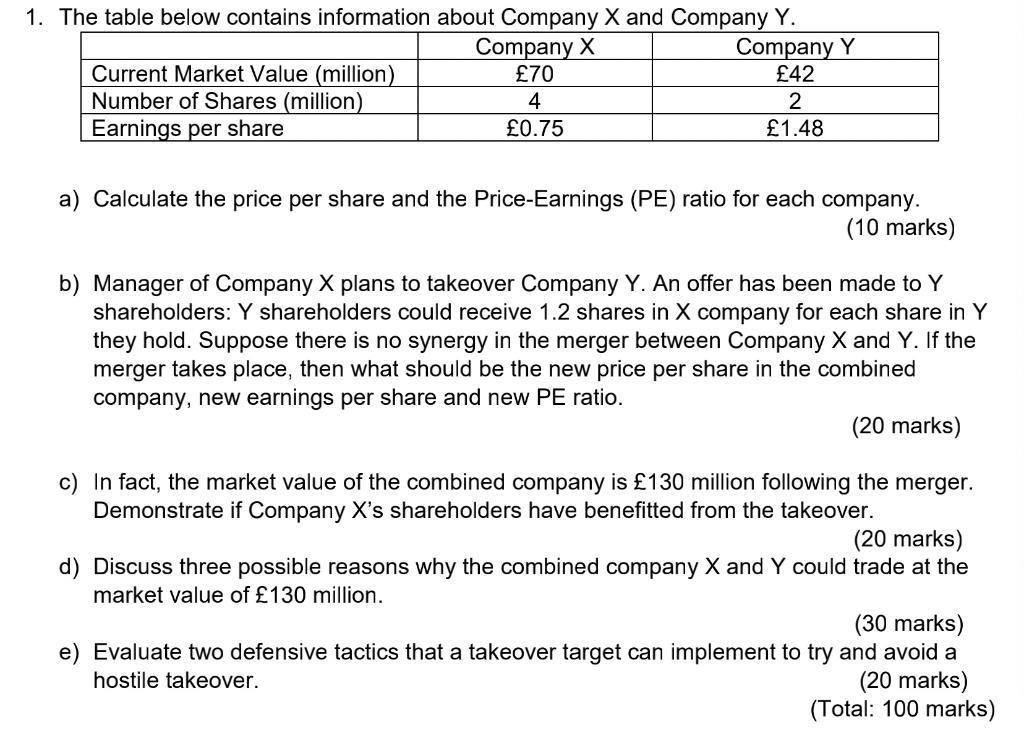

1. The table below contains information about Company X and Company Y. Company Y 42 2 1.48 Current Market Value (million) Number of Shares

1. The table below contains information about Company X and Company Y. Company Y 42 2 1.48 Current Market Value (million) Number of Shares (million) Earnings per share Company X 70 4 0.75 a) Calculate the price per share and the Price-Earnings (PE) ratio for each company. (10 marks) b) Manager of Company X plans to takeover Company Y. An offer has been made to Y shareholders: Y shareholders could receive 1.2 shares in X company for each share in Y they hold. Suppose there is no synergy in the merger between Company X and Y. If the merger takes place, then what should be the new price per share in the combined company, new earnings per share and new PE ratio. (20 marks) c) In fact, the market value of the combined company is 130 million following the merger. Demonstrate if Company X's shareholders have benefitted from the takeover. (20 marks) d) Discuss three possible reasons why the combined company X and Y could trade at the market value of 130 million. (30 marks) e) Evaluate two defensive tactics that a takeover target can implement to try and avoid a hostile takeover. (20 marks) (Total: 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Calculating price per share and PriceEarnings PE ratio for each company Company X Price per share Market Value Number of Shares Price per sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started