Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The table below shows hypothetical demand and supply schedules for the Canadian dollar in terms of the US dollar. Assume the US dollar

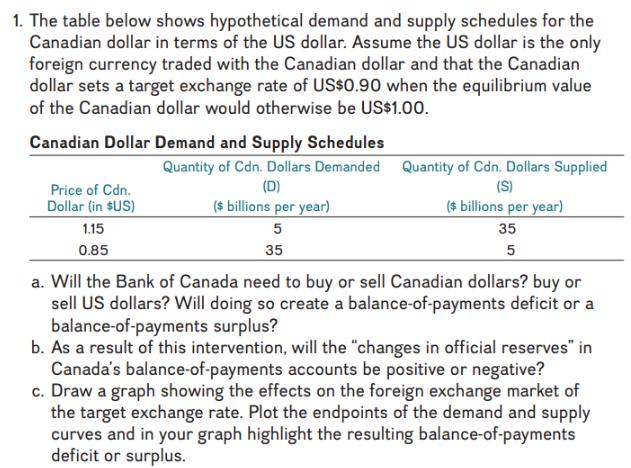

1. The table below shows hypothetical demand and supply schedules for the Canadian dollar in terms of the US dollar. Assume the US dollar is the only foreign currency traded with the Canadian dollar and that the Canadian dollar sets a target exchange rate of US$0.90 when the equilibrium value of the Canadian dollar would otherwise be US$1.00. Canadian Dollar Demand and Supply Schedules Price of Cdn. Dollar (in $US) 1.15 0.85 Quantity of Cdn. Dollars Demanded Quantity of Cdn. Dollars Supplied (D) (S) ($ billions per year) ($ billions per year) 5 35 35 5 a. Will the Bank of Canada need to buy or sell Canadian dollars? buy or sell US dollars? Will doing so create a balance-of-payments deficit or a balance-of-payments surplus? b. As a result of this intervention, will the "changes in official reserves" in Canada's balance-of-payments accounts be positive or negative? c. Draw a graph showing the effects on the foreign exchange market of the target exchange rate. Plot the endpoints of the demand and supply curves and in your graph highlight the resulting balance-of-payments deficit or surplus.

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Based on the given information the equilibrium exchange rate for the Canadian dollar would be US10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started