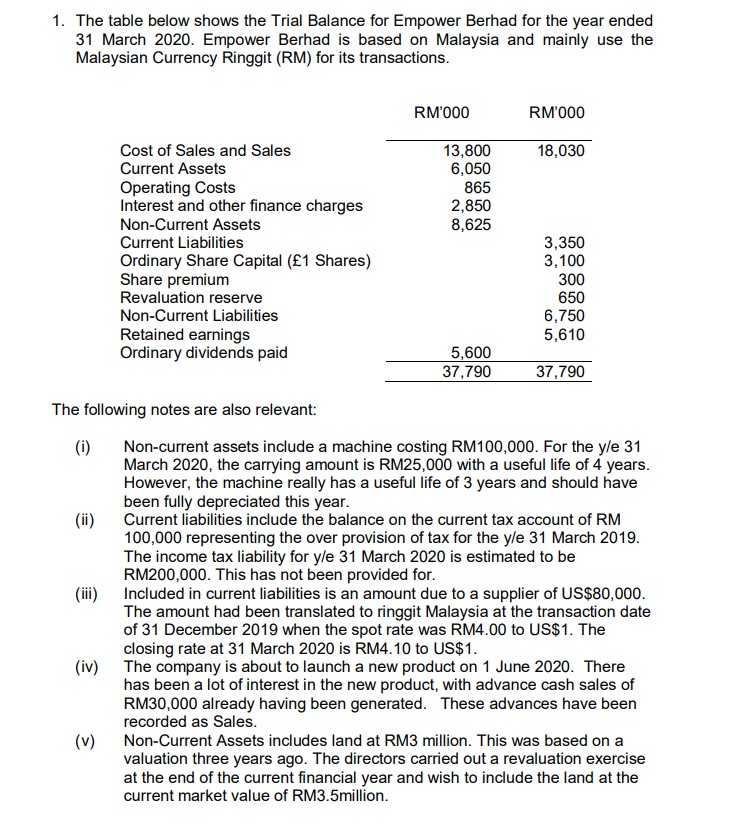

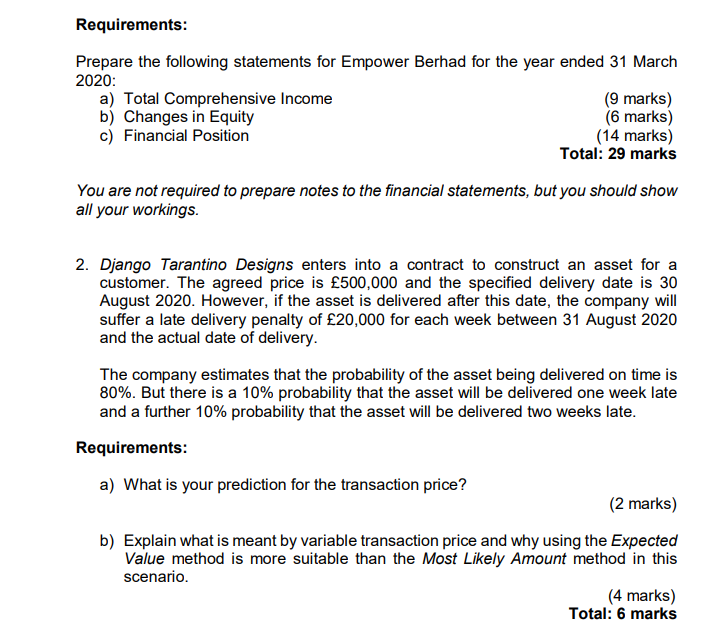

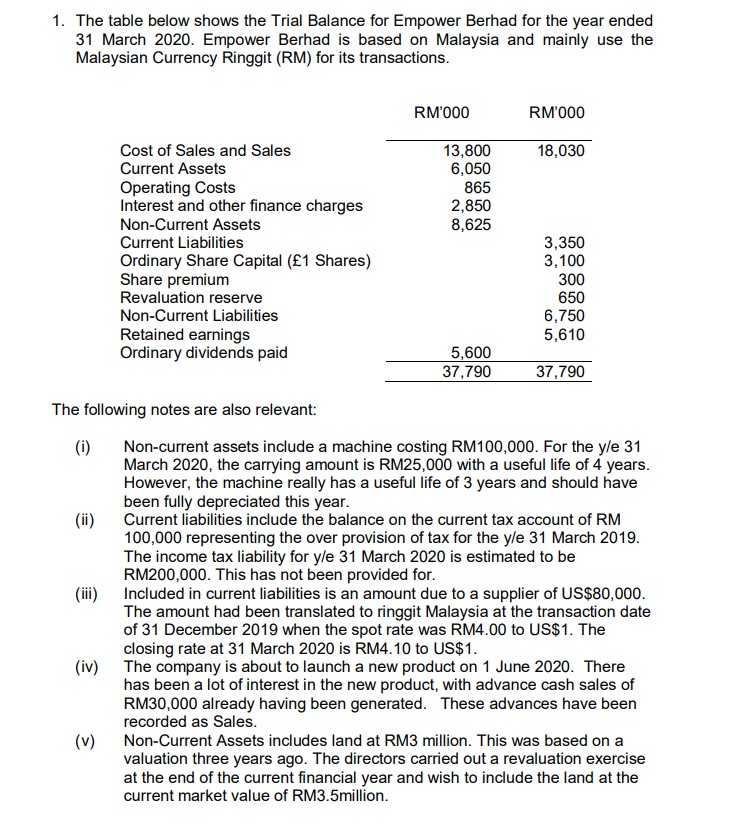

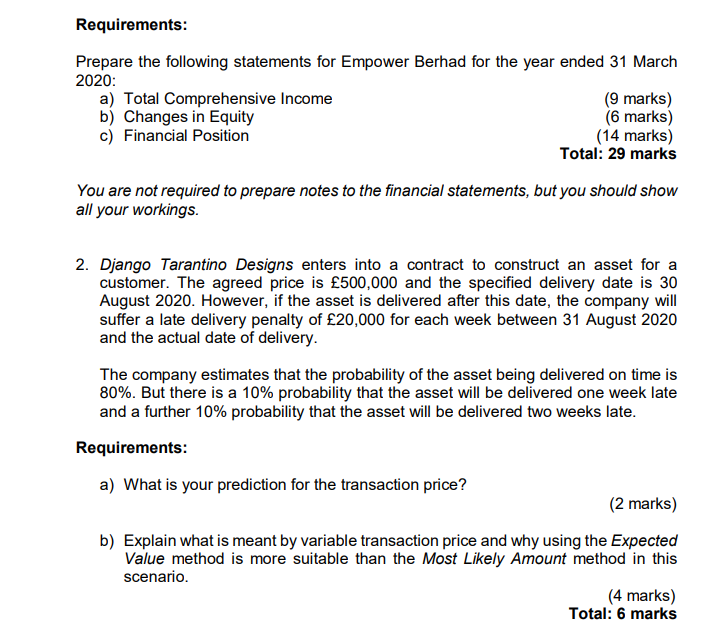

1. The table below shows the Trial Balance for Empower Berhad for the year ended 31 March 2020. Empower Berhad is based on Malaysia and mainly use the Malaysian Currency Ringgit (RM) for its transactions. RM'000 RM'000 18,030 13,800 6,050 865 2,850 8,625 Cost of Sales and Sales Current Assets Operating costs Interest and other finance charges Non-Current Assets Current Liabilities Ordinary Share Capital (1 Shares) Share premium Revaluation reserve Non-Current Liabilities Retained earnings Ordinary dividends paid 3,350 3,100 300 650 6,750 5,610 5,600 37,790 37,790 The following notes are also relevant: (i) Non-current assets include a machine costing RM100,000. For the yle 31 March 2020, the carrying amount is RM25,000 with a useful life of 4 years. However, the machine really has a useful life of 3 years and should have been fully depreciated this year. Current liabilities include the balance on the current tax account of RM 100,000 representing the over provision of tax for the yle 31 March 2019. The income tax liability for yle 31 March 2020 is estimated to be RM200,000. This has not been provided for. (ii) Included in current liabilities is an amount due to a supplier of US$80,000. The amount had been translated to ringgit Malaysia at the transaction date of 31 December 2019 when the spot rate was RM4.00 to US$1. The closing rate at 31 March 2020 is RM4.10 to US$1. (iv) The company is about to launch a new product on 1 June 2020. There has been a lot of interest in the new product, with advance cash sales of RM30,000 already having been generated. These advances have been recorded as Sales (v) Non-Current Assets includes land at RM3 million. This was based on a valuation three years ago. The directors carried out a revaluation exercise at the end of the current financial year and wish to include the land at the current market value of RM3.5million. Requirements: Prepare the following statements for Empower Berhad for the year ended 31 March 2020: a) Total Comprehensive Income (9 marks) b) Changes in Equity (6 marks) c) Financial Position (14 marks) Total: 29 marks You are not required to prepare notes to the financial statements, but you should show all your workings. 2. Django Tarantino Designs enters into a contract to construct an asset for a customer. The agreed price is 500,000 and the specified delivery date is 30 August 2020. However, if the asset is delivered after this date, the company will suffer a late delivery penalty of 20,000 for each week between 31 August 2020 and the actual date of delivery. The company estimates that the probability of the asset being delivered on time is 80%. But there is a 10% probability that the asset will be delivered one week late and a further 10% probability that the asset will be delivered two weeks late. Requirements: a) What is your prediction for the transaction price? (2 marks) b) Explain what is meant by variable transaction price and why using the Expected Value method is more suitable than the Most Likely Amount method in this scenario. (4 marks) Total: 6 marks