Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1.) The Taylor Radio Company manufactures and sells ultrasonic radios at P650 each. The variable manufacturing costs per unit are: direct materials = P200,

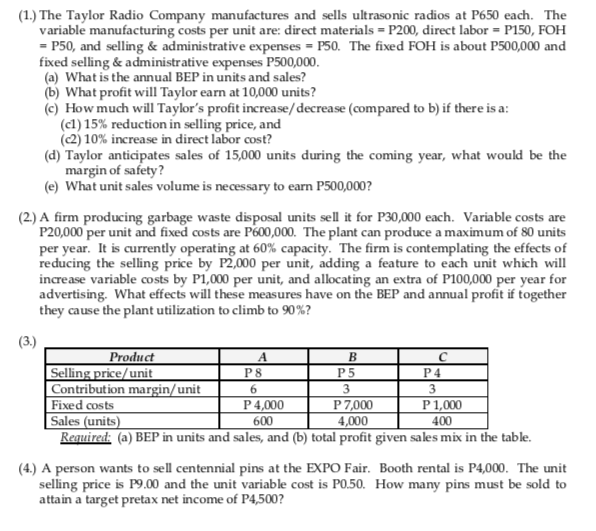

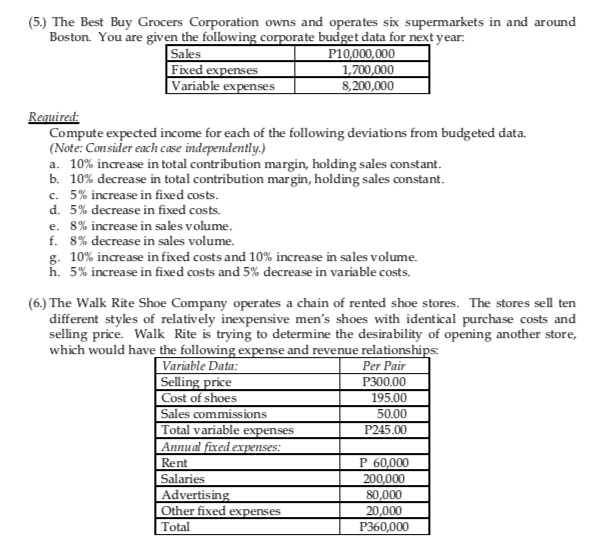

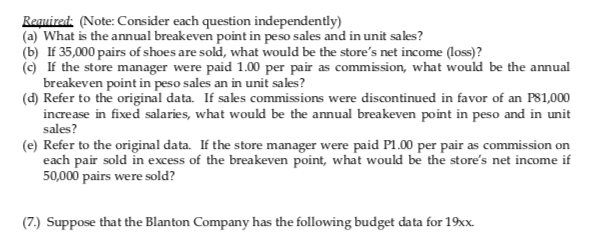

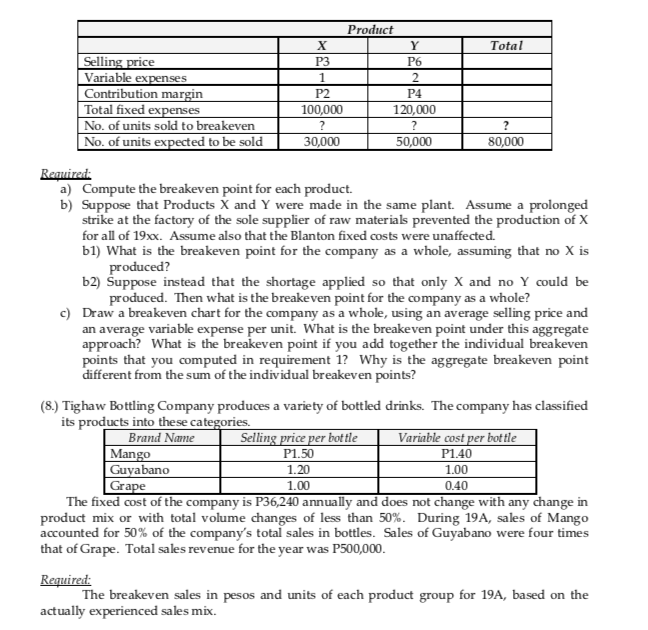

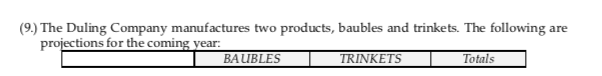

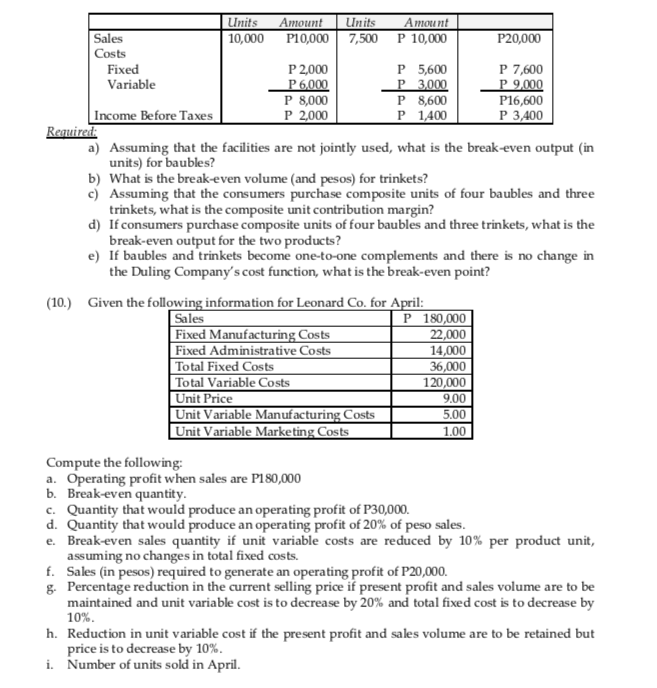

(1.) The Taylor Radio Company manufactures and sells ultrasonic radios at P650 each. The variable manufacturing costs per unit are: direct materials = P200, direct labor = P150, FOH = P50, and selling & administrative expenses P50. The fixed FOH is about P500,000 and fixed selling & administrative expenses P500,000. (a) What is the annual BEP in units and sales? (b) What profit will Taylor earn at 10,000 units? (c) How much will Taylor's profit increase/decrease (compared to b) if there is a: (c1) 15% reduction in selling price, and (c2) 10% increase in direct labor cost? (d) Taylor anticipates sales of 15,000 units during the coming year, what would be the margin of safety? (e) What unit sales volume is necessary to earn P500,000? (2.) A firm producing garbage waste disposal units sell it for P30,000 each. Variable costs are P20,000 per unit and fixed costs are P600,000. The plant can produce a maximum of 80 units per year. It is currently operating at 60% capacity. The firm is contemplating the effects of reducing the selling price by P2,000 per unit, adding a feature to each unit which will increase variable costs by P1,000 per unit, and allocating an extra of P100,000 per year for advertising. What effects will these measures have on the BEP and annual profit if together they cause the plant utilization to climb to 90%? (3.) Product A B C Selling price/unit Fixed costs P8 P5 P4 Contribution margin/unit 6 3 3 P 4,000 P 7,000 P1,000 Sales (units) 600 4,000 400 Required: (a) BEP in units and sales, and (b) total profit given sales mix in the table. (4.) A person wants to sell centennial pins at the EXPO Fair. Booth rental is P4,000. The unit selling price is P9.00 and the unit variable cost is P0.50. How many pins must be sold to attain a target pretax net income of P4,500? (5.) The Best Buy Grocers Corporation owns and operates six supermarkets in and around Boston. You are given the following corporate budget data for next year: Required: Sales Fixed expenses Variable expenses P10,000,000 1,700,000 8,200,000 Compute expected income for each of the following deviations from budgeted data. (Note: Consider each case independently.) a. 10% increase in total contribution margin, holding sales constant. b. 10% decrease in total contribution margin, holding sales constant. c. 5% increase in fixed costs. d. 5% decrease in fixed costs. e. 8% increase in sales volume. f. 8% decrease in sales volume. g. 10% increase in fixed costs and 10% increase in sales volume. h. 5% increase in fixed costs and 5% decrease in variable costs. (6.) The Walk Rite Shoe Company operates a chain of rented shoe stores. The stores sell ten different styles of relatively inexpensive men's shoes with identical purchase costs and selling price. Walk Rite is trying to determine the desirability of opening another store, which would have the following expense and revenue relationships: Variable Data: Selling price Cost of shoes Sales commissions Total variable expenses Per Pair P300.00 195.00 50.00 P245.00 Rent P 60,000 Salaries 200,000 Advertising 80,000 Other fixed expenses 20,000 Total P360,000 Annual fixed expenses: Required: (Note: Consider each question independently) (a) What is the annual breakeven point in peso sales and in unit sales? (b) If 35,000 pairs of shoes are sold, what would be the store's net income (loss)? (c) If the store manager were paid 1.00 per pair as commission, what would be the annual breakeven point in peso sales an in unit sales? (d) Refer to the original data. If sales commissions were discontinued in favor of an P81,000 increase in fixed salaries, what would be the annual breakeven point in peso and in unit sales? (e) Refer to the original data. If the store manager were paid P1.00 per pair as commission on each pair sold in excess of the breakeven point, what would be the store's net income if 50,000 pairs were sold? (7.) Suppose that the Blanton Company has the following budget data for 19xx. Product X Y Total Selling price Variable expenses Contribution margin Total fixed expenses P3 P6 1 2 P2 P4 100,000 120,000 No. of units sold to breakeven ? ? ? No. of units expected to be sold 30,000 50,000 80,000 Required: a) Compute the breakeven point for each product. b) Suppose that Products X and Y were made in the same plant. Assume a prolonged strike at the factory of the sole supplier of raw materials prevented the production of X for all of 19xx. Assume also that the Blanton fixed costs were unaffected. b1) What is the breakeven point for the company as a whole, assuming that no X is produced? b2) Suppose instead that the shortage applied so that only X and no Y could be produced. Then what is the breakeven point for the company as a whole? c) Draw a breakeven chart for the company as a whole, using an average selling price and an average variable expense per unit. What is the breakeven point under this aggregate approach? What is the breakeven point if you add together the individual breakeven points that you computed in requirement 1? Why is the aggregate breakeven point different from the sum of the individual breakeven points? (8.) Tighaw Bottling Company produces a variety of bottled drinks. The company has classified its products into these categories. Brand Name Mango Guyabano Grape Selling price per bottle P1.50 1.20 1.00 Variable cost per bottle P1.40 1.00 0.40 The fixed cost of the company is P36,240 annually and does not change with any change in product mix or with total volume changes of less than 50%. During 19A, sales of Mango accounted for 50% of the company's total sales in bottles. Sales of Guyabano were four times that of Grape. Total sales revenue for the year was P500,000. Required: The breakeven sales in pesos and units of each product group for 19A, based on the actually experienced sales mix. (9.) The Duling Company manufactures two products, baubles and trinkets. The following are projections for the coming year: BAUBLES TRINKETS Totals Sales Costs Fixed Variable Income Before Taxes Required: Units Amount Units Amount 10,000 P10,000 7,500 P 10,000 P20,000 P 2,000 P 5,600 P 7,600 P 6,000 P 3,000 P 8,000 P 8,600 P 9,000 P16,600 P 2,000 P 1,400 P 3,400 a) Assuming that the facilities are not jointly used, what is the break-even output (in units) for baubles? b) What is the break-even volume (and pesos) for trinkets? c) Assuming that the consumers purchase composite units of four baubles and three trinkets, what is the composite unit contribution margin? d) If consumers purchase composite units of four baubles and three trinkets, what is the break-even output for the two products? e) If baubles and trinkets become one-to-one complements and there is no change in the Duling Company's cost function, what is the break-even point? (10.) Given the following information for Leonard Co. for April: Sales P 180,000 Fixed Manufacturing Costs 22,000 Fixed Administrative Costs 14,000 Total Fixed Costs 36,000 Total Variable Costs 120,000 Unit Price 9.00 Unit Variable Manufacturing Costs 5.00 | Unit Variable Marketing Costs 1.00 Compute the following: a. Operating profit when sales are P180,000 b. Break-even quantity. c. Quantity that would produce an operating profit of P30,000. d. Quantity that would produce an operating profit of 20% of peso sales. e. Break-even sales quantity if unit variable costs are reduced by 10% per product unit, assuming no changes in total fixed costs. f. Sales (in pesos) required to generate an operating profit of P20,000. g. Percentage reduction in the current selling price if present profit and sales volume are to be maintained and unit variable cost is to decrease by 20% and total fixed cost is to decrease by 10%. h. Reduction in unit variable cost if the present profit and sales volume are to be retained but price is to decrease by 10%. i. Number of units sold in April.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started